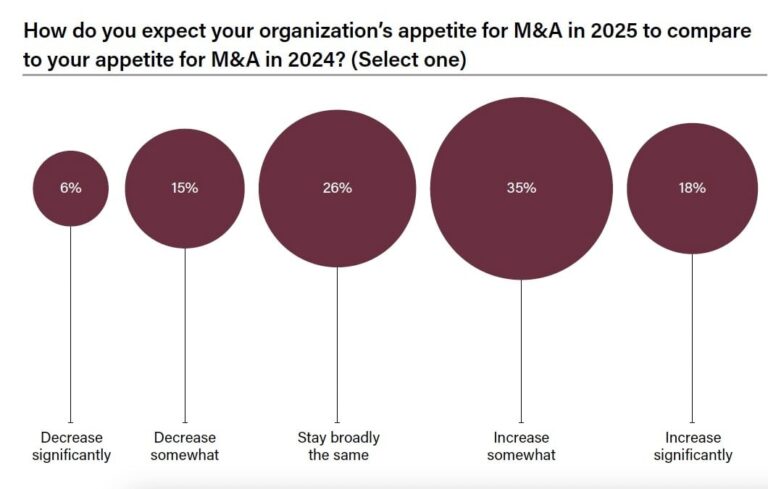

Following a promising start to 2025, hopes for a revival of M&A activities this year saw the US administration suddenly unveiling a wide range of tariffs early in the second quarter, marking a major escalation in global trade tensions. However, Norton Rose Fulbright and Melger Market's latest global M&A trends and risk reports show that despite uncertainty, nearly a third of respondents say that M&A appetites are the same or somewhat increasing.

The report highlights signs of careful optimism that private equity is ready to make the dry powder work and that this challenging environment can reduce competition for attractive targets and potentially low ratings. Certain regions in North America are less attractive in market volatility, and stronger M&A activities are expected in Europe, East Asia and Australia, highlighting regional fluctuations in market sentiment.

While the outlook for M&A remains uncertain, the investigation shows that traders respond with prudence, pragmatism and patience as they prepare to seize opportunities ahead of time. The mid-term outlook for deal-making looks positive as challenging dynamics require companies to adapt, some of which include lively M&A strategies.

The M&A market is facing a setback as tariffs cause strategic revaluation and delays

The widespread mutual tariffs announced by the US administration have had a calm impact on M&A worldwide. This move has surprised the market, with many M&A transactions being postponed, creating more clarity in the trading environment. While ongoing transactions have stagnated, other transactions have halted altogether as parties reassess the implications of tariffs on the transactions.

The initial survey conducted prior to the April 2nd tariff announcement reflects bullish sentiment, with 53% of respondents hoping for an increase in M&A appetite in 2025. After the announcement, 67% of respondents responded to a follow-up query on the same topic, saying that tariff-related turbulence and trade tensions caused M&A appeals. In the US, survey participants responded that tariffs, new products/services, private equity (PE) dry powder, and supply chain disruption will be the four most important drivers of M&A in 2025.

Among those still pursuing new M&A transactions, there is a significant shift in low-risk acquisitions towards domestic transactions instead of cross-border transactions and industries that are less vulnerable to tariff uncertainty, such as technology and healthcare transactions. Others see the confusion as an opportunity to tie into bargains and grab a glaring target with a lower rating, as competitors are retreating from dealing. Ultimately, tariffs present short-term challenges, but many deal makers focus on long-term value creation and have a positive outlook for M&A activities.

Private Equity is ready to make the dry powder work

The survey shows that respondents believe PE dry powder will become the second most important driver of M&A activities as a global baseline in 2025. In all regions except South and Southeast Asia, Africa and Latin America, respondents rank PE dry powder in the top four most important drivers of M&A activities in 2025.

Furthermore, survey participants expect domestic PE buyers to become one of the most active types of acquirers in the trading market in 2025 (44% cited to acquire a global baseline). According to our respondents, their presence is felt in all markets, with a particular emphasis on South Asia and Southeast Asia (49%). Meanwhile, their international PE peers are expected to be particularly active in Europe (41%), Australia and New Zealand (43%), as well as in neighbouring East Asia (41%).

Deal makers move quickly to integrate AI

AI has rapidly evolved into the transformational power within the M&A landscape, while simultaneously creating extremely popular acquisition targets and equips the in-house trading team with increasingly witty tools. In 2025, technology companies began offering some of the most attractive trading opportunities, including the following subsectors: cybersecurity, data analytics, and AI in particular. Over half (51%) of survey participants acquired AI businesses, and respondents applied technology to various parts of the M&A process, from procuring transactions to due diligence. Additionally, 46% report that they are about to acquire an AI business in the near future. Both of these numbers speak of the rapid adoption of this transformative technology in a short period of time. In a previous 2024 survey, only 33% of respondents said they were trying to win an AI business.

In addition to acquiring AI goals, companies are deploying AI to enhance their own internal trading processes. Approximately 77% of respondents said they have recently partnered with AI vendors or procured services from AI providers. AI technology has become an important tool for many companies to support M&A processes. This technology is currently used in M&A documents as well as in financial analysis and valuation modeling. Also, approximately 63% of respondents use AI to improve M&A due diligence.

Contract insurance is becoming more popular

Representations and guaranteed insurance (RWI), also known as guarantee and indemnification insurance, continue to accelerate as companies offset risks in an increasingly uncertain trading environment. RWI is expected to increase in 2024 compared to 2024, as almost two-thirds of respondents expect RWI to increase in all regions this year. In particular, respondents expect RWIs to be used more in transactions that include industrial assets, life sciences and healthcare, and technology. With the maturation of the RWI market, M&A traders can expect a global increase in careers that could make rates and terms more competitive.

Read the complete M&A trends and risk reports.