Business budgeting software helps ensure your business is on track to meet its financial goals. Some business owners use spreadsheets as their main budgeting tool; however, the downsides are manual data entry and the risk of human error. If you prefer a more automated approach to the process, business budgeting software could be a better alternative. The best tools let you create account budgets, run budget variance reports, forecast cash flow and, in some cases, choose between different projection methods or plan for worst-case scenarios.

250+ small-business products reviewed and rated by our team of experts.

95+ years of combined experience covering small-business and personal finance.

75+ categories of best business software selections.

Here are our top picks for business budgeting software tools and what makes them stand out.

In-depth forecasting

PlanGuru

Cash flow management

Float

NerdWallet’s picks for the best business budgeting software

Best for all-in-one budgeting software

-

$30 per month for the Simple Start plan.

-

$60 per month for the Essentials plan.

-

$90 per month for the Plus plan.

-

$200 per month for the Advanced plan.

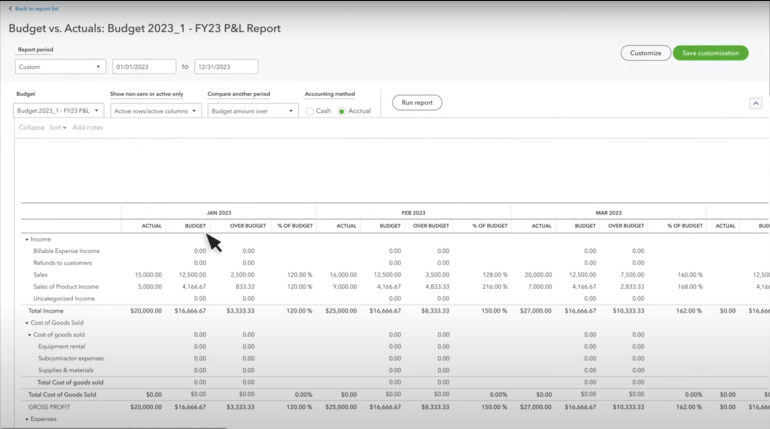

Once you’ve created your budget, the budgets vs. actuals report will compare your actual account balances with projected balances, side by side.

Best for all-in-one budgeting software

-

$15 per month for the Early plan.

-

$42 per month for the Growing plan.

-

$78 per month for the Established plan.

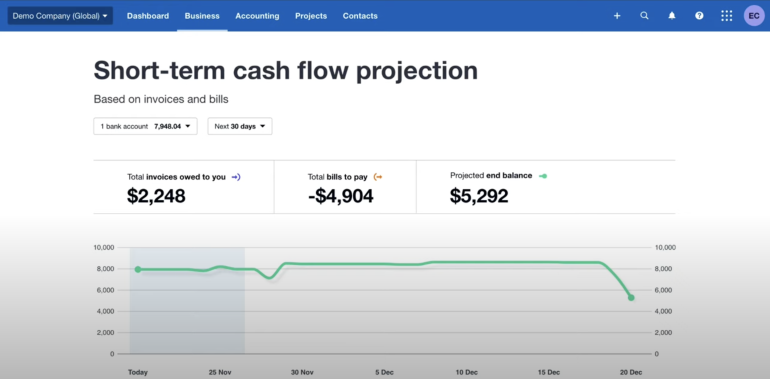

Xero Analytics gives you access to basic, short-term cash flow and future predictions reporting. Note that long-term cash flow predictions (up to 90 days) require a subscription to the highest-tier Established plan.

Best for all-in-one budgeting software

-

$0 per month for the Free plan.

-

$20 per month for the Standard plan.

-

$50 per month for the Professional plan.

-

$70 per month for the Premium plan.

-

$150 per month for the Elite plan.

-

$275 per month for the Ultimate plan.

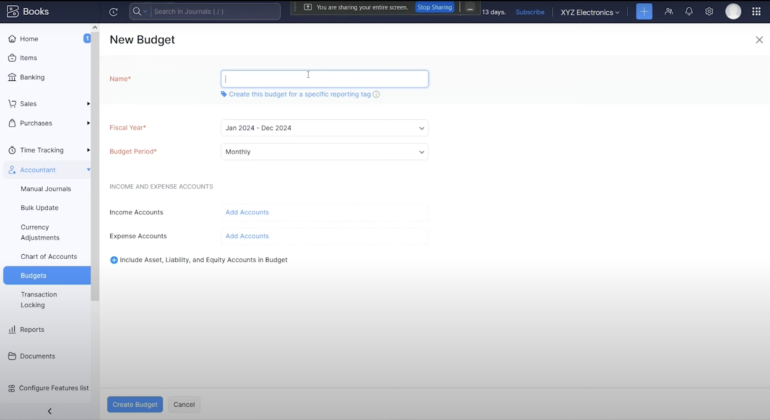

When you’re creating a new budget in Zoho Books, you can associate the budget with a particular reporting tag and even factor asset, liability and equity accounts into the budget.

Best for in-depth forecasting

-

$99 per month for the single-entity solution.

-

$299 per month for the multidepartment/multilocation solution.

-

$29 per month for each additional user.

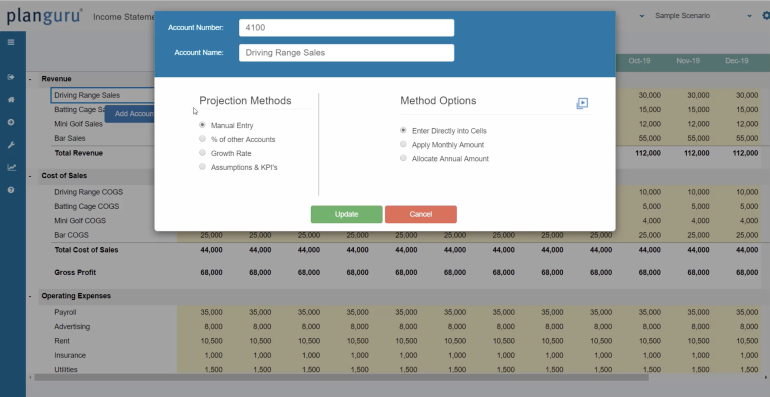

PlanGuru’s forecasting tools enable you to look at assumptions and key performance indicators, percentage of other accounts and growth rates.

Best for cash flow management

Why we like it: Float’s functionality doesn’t get quite as granular as PlanGuru’s does, but for business owners who want a more user-friendly experience, that’s not necessarily a bad thing. The software has a clean user interface and analyzes historical accounting data to suggest budget values for you if you’re not sure where to start. This is a plus for business owners who need more features than their accounting software offers but are still relatively new to budgeting. Float’s business budgeting software forecasts cash flow for up to three years and automatically syncs with Xero to give you a real-time view of your cash flow and forecasting. The app also helps businesses plan for worst-case scenarios with a dedicated tool that shows how certain events, like losing a valuable client, would affect cash flow.

-

$69 per month for the Essential plan.

-

$119 per month for the Premium plan.

-

$249 per month for the Enterprise plan.

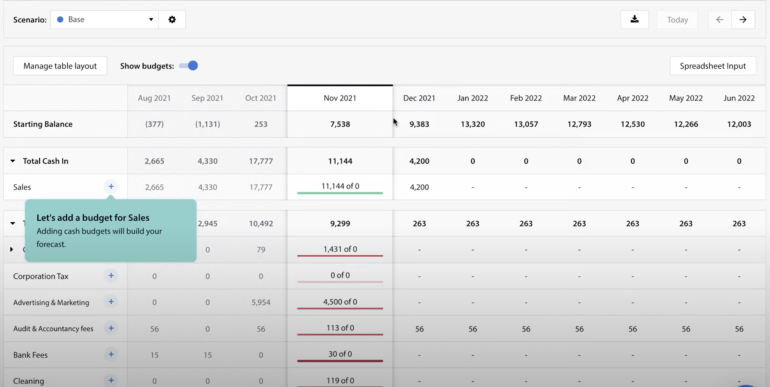

Float uses cash budgets (rather than profit and loss budgets), which are inclusive of taxes and based on dates you pay bills and receive cash. This gives you a more accurate view of your cash flow on any given date.

Best for financial planning and analysis

Why we like it: Centage Planning Maestro’s dashboard visualizes top-line data for a number of criteria, along with yearly financial comparisons and monthly trends. The amount of information can be overwhelming at first, but business owners who take a more in-depth approach to financial planning and analysis will appreciate it. Advanced financial planning and analysis (FP&A) tools can accommodate medium-size businesses with dedicated finance teams, too.

Best for software integrations

-

$35 per month for the Single plan.

-

$200 per month for the Starter plan.

-

$375 per month for the Professional plan.

-

$500 per month for the Practice plan.

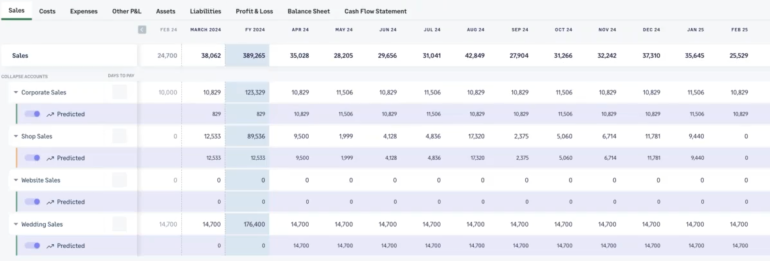

Futrli’s predictions tool comes with a useful color-coding feature to indicate the software’s confidence in the predictions it’s making, based on the current data flow.

Why we like it: At its core, LivePlan is software designed to guide you through the business planning and startup process. It takes the guesswork out of drafting a complete business plan, creating a business pitch deck and refining your business strategy. Most notably, though, LivePlan helps you build and check your business financials — answer some straightforward questions and prompts, and the software will construct a visualized forecast. LivePlan integrates with QuickBooks and Xero, so it can keep up with your business budgeting needs as they evolve. To get access to LivePlan’s ongoing budgeting tools, including analytics dashboards and accounting integrations, you’ll need the Premium plan.

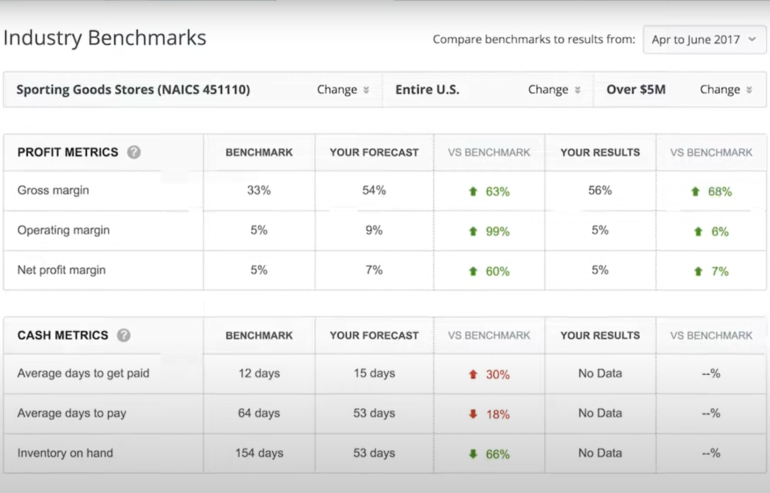

Once you’ve completed the forecasting step in LivePlan, you can use the software’s benchmarking tool to check your forecast in comparison with other similar businesses.

Best for easy to use business budgeting software

Why we like it: Budgeto’s business budgeting software stands out for its simple interface and intuitive user experience. Before you begin using the software, you’re prompted to enter some basic information about your business, including the country in which it’s based and the currency in which it operates. This ensures the financial budgets, forecasting and reports conform to the specific needs of your business. Budgeto also makes it easy to share your budgets with your business collaborators and import your accounting data from QuickBooks Online or Xero (provided you choose the respective upgrade option).

-

$25 per month for the Basic plan.

-

$5 per month, in addition to the Basic plan, for each of the following options: collaborate with unlimited users and create an unlimited number of budgeting scenarios.

-

$10 per month, in addition to the Basic plan, to import accounting data from Quickbooks Online or Xero.

-

$45 per month is the total price of a Budgeto subscription including the basic plan and all optional add-ons.

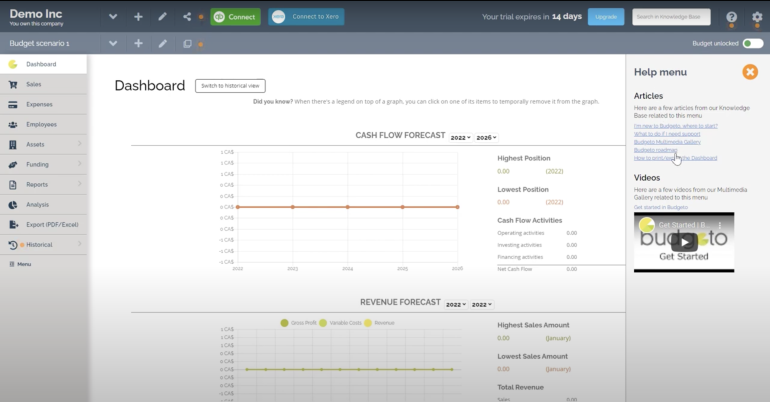

From the software’s clean financial dashboard, you can easily navigate to tabs related to your assets, employees, expenses, reports and more, as well as quickly access Budgeto’s library of articles and videos to help you learn the software and troubleshoot challenges.

What is business budgeting software?

While some accounting software products have budgeting tools, there are distinct solutions that dig a little deeper if you want to predict how a particular business decision could affect your cash flow. Before you dive into your options, consider how pricing, user experience, accounting tools and more will play into your decision-making process.