Chase offers the Chase Sapphire Preferred® Card and Chase Sapphire Reserve®However, Chase cards have even stricter application rules, known as the “5/24 rule.”

Here's how it works: If you've opened 5 or more credit cards from any bank in the last 24 months, you can't get a Chase credit card. It's tough, but there are ways around it. For example, business credit cards from most other banks don't show up on your personal credit report and therefore don't count toward your 5/24 count. The exceptions are Discover and Capital One, whose business credit cards do count toward your 5/24 count.

Chase's small business cards are a bit different. These cards don't increase your 5/24 count, but they do limit it. For example, if you've applied for 4 cards in the last 24 months, your count will be 4/24. If you then apply for the Chase IHG One Rewards Premier credit card, your count will be 5/24 and you won't qualify for any of the valuable Chase Ink business credit cards.

However, if you apply for a Chase business card first, your 5/24 count will not increase because the Chase business card will not show up on your personal credit report, so even if you are approved for the Ink Business Preferred® credit card, you may still be approved for another Chase credit card, which is why it's important to include your business card as part of your miles and points strategy.

Who qualifies for a Chase Business Card?

Applying for a Chase business card is very similar to applying for a Chase personal card, but there are a few differences. The biggest difference is that you need to operate a business that generates revenue. This is easier to accomplish than you might think. You don't need to run a full-time business or make a six-figure income from your business activities to get approved for a small business card.

If you run a business, having a business card is not only a good way to earn extra perks, but it's also essential for keeping business and personal expenses separate. For example, you could qualify for a business card if you're a part-time freelance writer, designer, consultant, or artist. Also, non-employee gigs like Uber, Lyft, some food delivery apps, and dog walking apps (Rover or Wag) are eligible businesses.

How to Apply for a Chase Business Card

Let’s take a look at Chase’s business card application and see what information is most likely to confuse you.

All Chase business credit card applications follow the same format, but if you're applying for a co-branded business card, such as the Southwest Rapid Rewards® Performance Business Credit Card or the United Business Card, you have the option to add your loyalty program number. If you don't add a number, one will be assigned and a new loyalty account will be created in your name. If you already have a loyalty account, you'll have to merge the two accounts, which can be a bit of a hassle.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers and get the latest news, in-depth guides, and exclusive deals from TPG experts

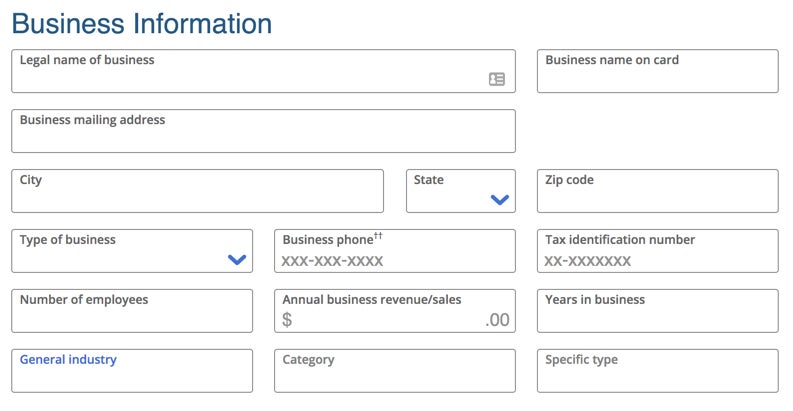

Step 1: Business Information

Let's take a look at the initial online Chase business credit card application screen.

Here's the information you need to add for each part of your application:

- Company full name: If you are a sole proprietor, meaning your business is operating under your own name, you can use your name as the “Legal Business Name”. However, if you have applied for a DBA (doing business as) name with your local or state government, enter that name here. Also, if you have set up a legal business structure such as an LLC, your “Legal Business Name” would be the name of your LLC or other entity. There is one very important note here: do not have If you don't have a DBA, create one. Chase may require company verification. If you don't have a DBA under the company name you enter in this field (other than your personal name), your card may be denied.

- Company Name on Card: This does not have to be your official company name, as it is the company name that will be engraved on the card (just below the cardholder's name). You may need to abbreviate the name you enter here, as long names may not fit.

- Company Mailing Address: If you work from home or don't have a work address, it's okay to enter your home address.

- Industry: If you are the sole owner, select “Sole Proprietor.” If your company has two or more owners, select “Partnership.” If your company is registered as one of the other options (LLC, Corporation, Non-Profit), select the appropriate option.

- Business Phones: This can be at home or on your mobile phone.

- Tax Identification Number: If you're self-employed, you can use your Social Security number as your tax ID number. Otherwise, you'll need a federal EIN (Employer Identification Number), which is easy to apply for with the IRS.

- Number of employees: Enter the number of all additional employees except yourself. If you are the only employee, enter “0”.

- Annual business revenue/sales: This is the total annual income of your business before expenses and taxes. This doesn't have to be a big number. Some new businesses get approved with little or no income, but having business income will definitely increase your chances of being approved.

- Years in business: If you have been in business for less than one year, enter 0.

- General Industry/Category/Specific Type: Choose the option that best describes your business.

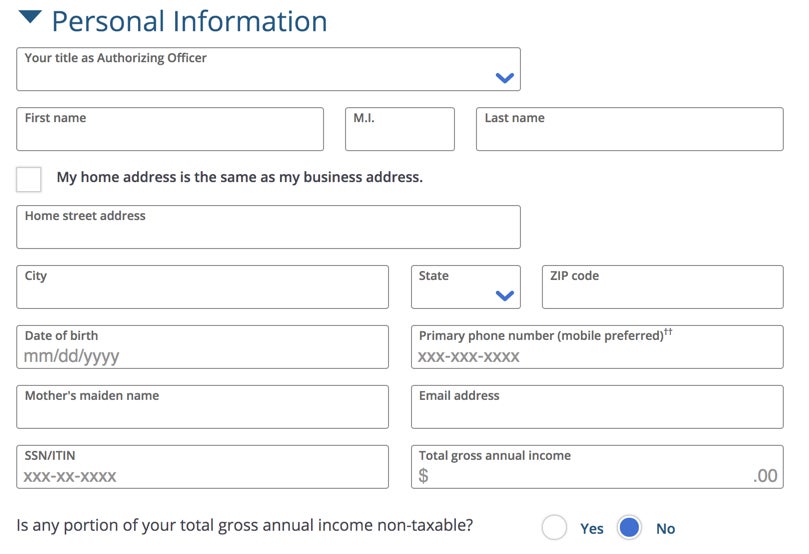

Step 2: Personal Information

Next, you’ll be taken to the second application screen for the Chase Business Credit Card.

Most of the personal information you have to fill out is easy. If your home address is the same as your work address, just check that box and you won't have to fill it in again. For “Total Annual Income,” you need to make sure you include all of your qualifying income. According to Chase, qualifying income includes:

- Full-time or part-time work.

- internship.

- Seasonal work.

- interest.

- Dividends.

- Social security benefits.

- Public assistance.

You can also include “money that other people regularly deposit into your account.” You can also include income from other people that you regularly use to pay bills, as long as you're over 21. So if you have a partner or spouse with whom you split bills, it's okay to include their annual salary along with your own.

Once you've filled out your personal details, you can add an employee card (optional) and review the terms and conditions before submitting.[送信]Just above the button is a box that you must check to indicate that you have read and agree to the terms and conditions.

Conclusion

Applying for a Chase business credit card is relatively easy. As with any credit card application, Chase may ask you to submit documentation to verify your input, so be sure to answer your questions honestly. Getting a business credit card isn't as hard as you might think, as many freelance or independent contractor jobs and side hustles qualify as businesses.

A business credit card can also simplify your bookkeeping by keeping business and personal expenses separate, while earning you valuable travel rewards at the same time. Most business credit cards don't show up on your personal credit report (including Chase business cards) and therefore don't count toward your Chase 5/24 count.

Finally, a business credit card is an important part of an overall points and miles strategy, so if you're on the fence about getting a business credit card, take another look at where you earn income outside of your regular job and see if you qualify.

Official application link: Chase Ink Business Preferred

Official application link: Chase Ink Business Cash

Official application link: Chase Ink Business Unlimited

Additional reporting by Ryan Wilcox.