As the 2025 voting season gets underway, dual-class stocks could once again become a common target for proxy rating firms and activist investors. These reflexive critics overlook the reality that dual-class shares are often important guardians of shareholder value and enable important structural benefits, such as:

• More efficient capital allocation: Unlike nearly all of its peers, Warren Buffett's Berkshire Hathaway has never paid a dividend, and Berkshire's dual-class stock structure allows Buffett to virtually ignore occasional sniping from speculators. It's done. Over time, we found that reinvesting retained earnings was 30 times more profitable for shareholders than if Berkshire paid regular dividends like its peers.

• Insulation from short-term opportunistic hostile takeovers: Hershey was almost sold at a quarter of its current market value during the cyclical recession, but the sale was wisely halted only because of its dual-class stock structure.

• Encourage innovative risk-taking. Despite his non-traditional background, Comcast CEO Brian Roberts successfully recruited former JPMorgan superstar banker Mike Kavanagh to become CFO and then president. While this move worked very well for everyone involved, it might not have been possible without the protection of dual class shares. Insulation from activist investors/short-term profit pressure: Dual-class stock allowed Dillard's to resist activist demands to sell profitable real estate.

• Navigating structural changes: of new york times Thanks to the Sulzberger family's control through dual-class stock, the company was able to invest heavily in emerging digital businesses in the early 2000s, allowing it to move from print to digital faster than many of its newspaper peers. I was able to navigate the transition much better. Similarly, Ralph Lauren's early investments in Gen Z and Millennial customers have paid off, adapting to changing generational tastes much better than its luxury fashion peers.

Among the Russell 3000 companies, many of the historically stable and successful companies include Berkshire Hathaway, Visa, Nike, Hyatt, Hyco, Regeneron, McCormick & Company, and Blackstone. It is a multi-class corporation, representing virtually every sector of the economy.

Of course, dual-class shares aren't always the right answer for every company. As critics are quick to point out, there are even situations in which dual-class stock has gotten downright ugly. For example, former Hollinger International CEO Conrad Black was charged with fraud for misusing dual-class stock and diverting company assets and resources into his own hands to facilitate self-enrichment. was indicted for.

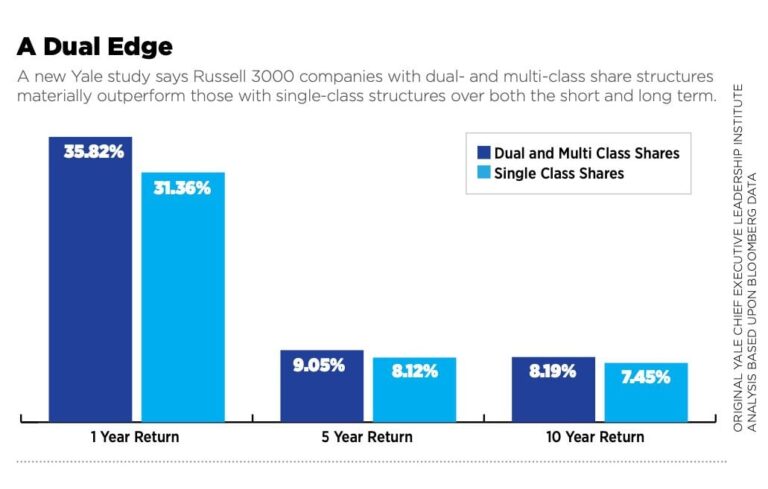

But overall, there is strong evidence that companies with dual-class stock outperform their peers financially. In fact, a groundbreaking study published at Harvard University found that the 244 companies in the Russell 3000 with dual-class or multi-class stock structures outperformed companies with single-class stock over five-year and 10-year spans. significantly higher on average. Law School Forum on Corporate Governance.

It's not just long-term outperformance. When we ran the numbers through November 15, 2024 for corporate directors only, we found that companies with dual-class shares outperformed by a similarly large margin in 2024.

It is also reassuring to know that some of the most notorious corporate bankruptcies and scandals did not occur in companies with dual class stock. Prior to their failures due to governance failures, Enron, WorldCom, Tyco, Arthur Andersen, Bear Stearns, Lehman Brothers, Wirecard, Silicon Valley Bank, and First Republic Bank had their share of stocks rather than dual-class stock. It had a single class share structure.

Clearly, universal activist investors' criticisms of dual-class stock ownership per voting season are often false and miss the actual shareholder value that these dual-tier structures create.