Editor's note: Glenn Hopper, a regular contributor to the FATE eNewsletter, is one of the nation's top experts on the intersection of finance and technology (check out Glenn's articles) deep finance dispatch). He will be hosting our upcoming events AI in Finance Forum on November 12th the night before Financial Accounting Technology Exhibition (New York). Why not join us >

If you lead a financial industry, you're going to get whiplash. Get more magical AI demos right in your inbox. Your team is addicted to the “quick fix” of AI. The audit partner asked how they manage prompts. Somewhere between the keynote and the end of the quarter, enthusiasm turned to giddyness.

We have officially slipped from the peak of inflated expectations to the valley of disappointment. Not because technology failed, but because expectations failed. The headline tells the story:

- Massachusetts Institute of Technology (2025) reported that 95% of generative AI pilots fail to reach productioncited inadequate data preparation, lack of governance, and unclear ROI as the main barriers (MIT Sloan Management Review2025).

- Deloitte’s AI Failure (2025) The company made global news when it issued refunds to customers after the AI-generated report contained fabricated legal citations and fictitious research papers (financial timesOctober 2025).

- Air Canada chatbot incident (2024)The story of an airline customer service bot inventing a non-existent refund policy became an instant analogy for out-of-control AI automation and corporate responsibility (CBC News, February 2024).

Each failure reinforced the same lesson. The problem isn't that AI can't deliver value, it's that organizations don't yet know how to manage it. CFOs are now facing questions about trust, governance, and whether it's safer to wait and see what happens.

our place in the cycle

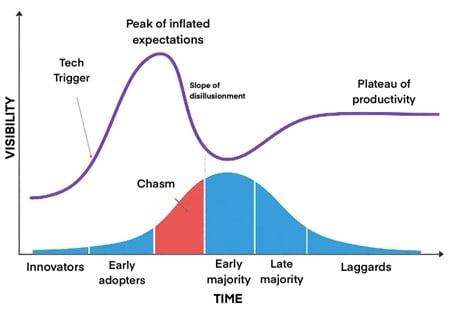

Gartner's hype cycle and Technology adoption curve Please share with us the tensions that financial leaders are feeling today. The Hype Cycle shows how enthusiasm for a new technology reaches a peak of unrealistic expectations, then falls into disillusionment, and eventually levels off as its true value emerges.

There is an added human element to the adoption curve. Innovators and early adopters rush ahead, while the early majority waits for evidence, structure, and predictable outcomes. When the waning of hype meets the hesitation of the early majority, leaders feel a shift beneath their feet. That's exactly where most CFOs find themselves today.

There is also a human side to this confusion. The emotional strain of repetitive processes and the pressure to deliver accuracy can make it easy to lose sight of what change within the finance function should feel like. Conversations about technology often ignore the people who live inside these systems. Before finance leaders can transform their workflows, they must confront the emotional weight of the work itself.

Sisyphus moment in finance

This metaphor captures the challenges of traditional finance operations, but also reflects the early stages of AI adoption. Teams work tirelessly, repeating the same actions without realizing that automation can take over. This connection shows that technology not only provides a release from everyday life, but also provides an opportunity to redefine what progress looks like.

Closing at the end of the month. Account Adjustments. A report that repeats quarterly. It's Sisyphus. Same weight, same movement.

Camus told us to imagine Sisyphus happy, because meaning lives in struggle.

Generative AI raises other questions. What would happen if the rock actually went over the top?

Imagine the moment when the impossible happens. The rock that has been pushed out day after day finally reaches the top of the hill and begins to roll down on its own. Tension eases, momentum takes over, and the world beneath your feet changes. That moment of release is both relief and anxiety, a pause until you realize that everything you were once resisting is now pushing you forward.

The real risk is not noticing that gravity has changed. At that moment, leadership becomes less about power and more about awareness: the recognition that the shape of the challenge has changed. Many teams continue to press out of habit despite the stones leaning over the ridge. They do not understand that what once required struggle now requires guidance to stabilize momentum.

Why fear feels real

It's not just the accuracy of the model. Anxiety stems from gaps in operating models, not gaps in technology.

- The economics of use cases are murky. Benchmarks are not useful for financial results. Unit economics are required for each adjustment, variance explanation, and policy review.

- Management and responsibility are blurred. Who approves when the model drafts disclosures or posts accruals? Ownership is unknown.

- Poor workflow suitability. Rather than machines and humans working together to redesign processes, off-the-shelf tools are bolted onto traditional steps.

- The measurement is shallow. The team counts clicks and delays. Finance requires cycle time, exception rates, and quality versus cost.

- Change fatigue is real. People know how to push rocks. When I let go, I feel dizzy. We often fear success because it requires new ways of working.

- Data preparation is delayed. Document sprawl, misaligned policies, and messy master data destroy ROI faster than illusions.

Why is this future important?

This financial vision is important because it shows what happens when human potential and technology match. AI removes the friction that has long defined financial operations. This shift is not about replacing accountants and analysts, but returning the focus to strategy, insight, and forward thinking. The act of closing a book becomes an act of thinking about what is possible next.

It redefines the purpose of finance leaders. When reporting mechanisms run on their own, CFOs have the space to interpret patterns, model new futures, and lead change instead of managing throughput. It's the difference between keeping the engine running and steering the ship toward new horizons.

what does the other side look like

Imagine stepping into a different landscape of finance, where daily struggles are replaced by continuous flow and foresight. The rock that once required constant effort now rolls forward under its own momentum, and your role changes from pushing to steering. This is not just a vision of efficiency, but a vision of purpose. This represents a fundamental shift in the raison d'être of finance. This means creating clarity from complexity and shaping outcomes before they unfold.

This change involves not only structure but also motivation. This gives financial professionals a new sense of agency and creativity. Time spent coordinating and reporting becomes time for exploration, insight, and influence. As work becomes continuous and intelligent, finance evolves from a reactive function to a decision-making operating system.

- Consecutive closures. Reconciliations and subledger checks occur in real time, and each transaction is validated as it occurs. The reports are automatically updated and the books are always up to date, so they are never actually closed.

- Narratives of Live Difference. Explanations emerge automatically from streaming data and evolving policies, allowing analysts to refine rather than rewrite.

- Surrounding Compliance. Built into every process, silently controls the hum in the background. Evidence appears where you need it, turning audit preparation into a confirmation exercise rather than a contest.

- positive attitude. Finance teams are on the cutting edge of what happens next, designing scenarios and guiding strategic decisions rather than explaining what went wrong last quarter.

What you need is Sherpa, not another demo

Guides do not sell models. A guide will be in charge of the climb. This is leadership that combines method, empathy, and discipline. The right Sherpa brings context, structure, and endurance to climbing that others only speak of from the base.

CFOs need more than proof-of-concept slides to reach the top. They need people who can translate ambition into architecture and excitement into measurable results.

- Process first, then tools. Start with a ledger-to-report map. Identify decision points, controls, and evidence. Select technology after design.

- Governance by design. Define who approves what, which artifacts are saved, and escalation rules and rollback steps before a single prompt goes live.

- Humans are involved in important situations. Specify when personnel need to review, when thresholds trigger interventions, and how feedback retrains the system.

- Valuable instrumentation. We connect every use case to save time, reduce errors, improve caching, and reduce risk, and see your score weekly.

- Vendor-independent assembly. Treat LLM, RPA, and workflows as interchangeable parts behind standards owned by financial institutions.

With a Sherpa, you don't have to travel alone. It's the difference between watching others attempt a climb and knowing your own route to the top. Consultants who succeed here bring focus, stamina, and evidence of traction every step of the way, not hype.

CFO Monday Actions

Start your climb today by finding a guide to help you evaluate your initial process and take the first steps toward transformation.

- Name your guide. Appoint a financial AI Sherpa to own one 90-day climb.

- Choose a rock. Choose a single process that is highly repetitive and easy to manage risk. Before you start automation, publish a baseline by documenting and sharing the performance of your current processes. Track key metrics like cycle time, exceptions, and error rates to measure progress and align your team based on a clear starting point.

- Set your destination. Define what success looks like in clear and measurable terms, and decide in advance how you will know when the work is done. These “deeply cleared” metrics may include faster closures, fewer exceptions, and improved data reliability. When they appear, allow yourself and your team to relieve pressure, recognize progress, and prepare for the next climb.

CFOs have good reason to be cautious. The noise surrounding AI is deafening and the stakes are high. But fear and hesitation are signals, not stop signs. They are like standing on a narrow ridge and feeling the height of what comes next. It's a reminder to move carefully, keep your footing, and trust your guides who know the terrain. They point out that the most important thing is to have the right guidance, structure, and trust before climbing the face of your next mountain.

You don't have to conquer that mountain overnight. Climbing requires the right map and the right companions. Meet your technology as it is and take your team with you as it matures. Each intentional step builds muscle memory that your organization will rely on for the next 10 years.

There's a better world on the other side. Finance never loses rigor or control. It gains time, context, and creative ability. What once felt like a never-ending climb can turn into progress. Mythology gave Sisyphus no choice. you have it. The question is not whether the stone can be crossed. It's just a matter of recognizing it when it's already happening.