American corporate directors ended 2025 on an unexpectedly optimistic note.

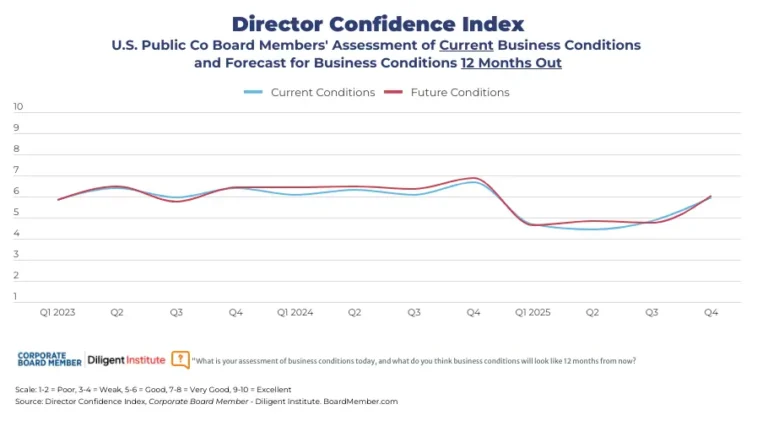

The Director Confidence Index is a quarterly poll that comes after three consecutive quarters of slump to five-year lows. corporate director In a survey of U.S. public company board members' business confidence, the Diligent Institute rose 23% in December, rising from 4.9 out of 10 to 6.0, finally entering “good” territory.

A better understanding of how tariffs are impacting businesses and the economy, lower interest rates and increased capital spending are the most common factors directors share to explain this recovery.

“[There’s] There is an expectation that companies will be able to cope with the impact of tariffs without significantly increasing prices,” explained one director who took part in the study.

This is a surprising turnaround in a year that tested the board's resolve.

However, despite the late-game increase, the average confidence rating for 2025 remained at just 5 out of 10, well below the 6.2 average for 2024 and well below the 6.9 that directors predicted this time last year.

A survey of 105 board members conducted between December 6 and 11 found that tariffs were overwhelmingly cited as one of the issues that had slowed this year's performance.

Three-quarters cited this as the biggest factor in the weaker-than-expected business performance, far more than any other factor, and noted that standard strategies no longer work as the environment continues to change.

“No matter how much you try to prepare for the unexpected, you can never truly assess all the consequences,” said one director on the board of a publicly traded technology company. “We did not believe that the ever-changing rate environment, much of which is likely unconstitutional, would significantly impact customers' capital investment plans.”

“I've been around for over 30 years and have never experienced what's happening in our industry,” said one director of a Nasdaq-listed life sciences company. “Pharma/Biotech has always been recession-proof and was not affected by which political party was in power at the time.”

Looking to the future

Despite the rapid growth in December, directors are not expecting the same momentum into the new year. The economic outlook for this point in 2026 is 6.0, about flat from today's levels.

This is an interesting difference when compared to CEO sentiment. During a questionnaire survey conducted by a sister magazine chief executive In the first week of December, CEOs predicted that the economy would improve by 6% in 2026 and reach a score of 6.4 out of 10 next December.

Overall, 44% of CEOs are optimistic that the situation will improve, compared to 32% of board members.

Among optimistic directors, we observe a strong focus on AI for answers, far outweighing macro concerns, which are at the top of the list of concerns for directors who expect conditions to worsen in 2026. When it comes to neutral directors, the uncertainty expected to persist over the next year rivals inflation as a key theme.

To successfully navigate 2026, directors are prioritizing adaptability, deeper engagement, and faster learning, recognizing that compounding risks will require boards to connect the dots faster than ever before. “Work hard and smart, keep your expenses down and survive until the rebound comes,” one director advised.

Another concluded: “Defend and survive.”

Director Confidence Index after 5 years

To celebrate the fifth year of implementing the Director Confidence Index, this quarter we asked respondents to reflect on how their roles have changed since we first conducted the survey at the end of 2020. Directors say they are spending far more time on risk in a “more complex and faster-changing” environment. This means cybersecurity, AI, geopolitical shocks, supply chain integrity, and policy instability are now routine boardroom topics rather than edge cases.

Many describe a shift from 'managing the present' to 'understanding and planning for the future', with scenario planning and strategic resilience now core to the role. Others point to heightened scrutiny from a growing base of activists and investors, whose mandate has expanded from overseeing financial performance to managing culture, human capital and corporate character.

Directors repeatedly warn about the steep learning curve that comes with this. In their open-ended comments, they highlighted the need to become more technologically savvy around AI and cyber, more familiar with geopolitics and regulation, and more intentional about continuing education in order to remain effective on the board. The committee is “very busy” and has a wide range of topics, with some directors pointing to a clear shift from informal business development to disciplined governance, succession planning and risk oversight.

Although a minority will argue that the formal role has not changed, the weight of a written response is undeniable. Being on a board today is more time-consuming, strategically demanding, and consequential than it was in 2020, and perhaps ever before.