The instability in Washington is also reflected in corporate finance.

CFO Leadership's Q1 CFO Confidence Index, conducted among 195 U.S. CFOs from January 19 to 21, comes as President Trump threatens to increase tariffs on the European Union and then announces a framework agreement with NATO allies.

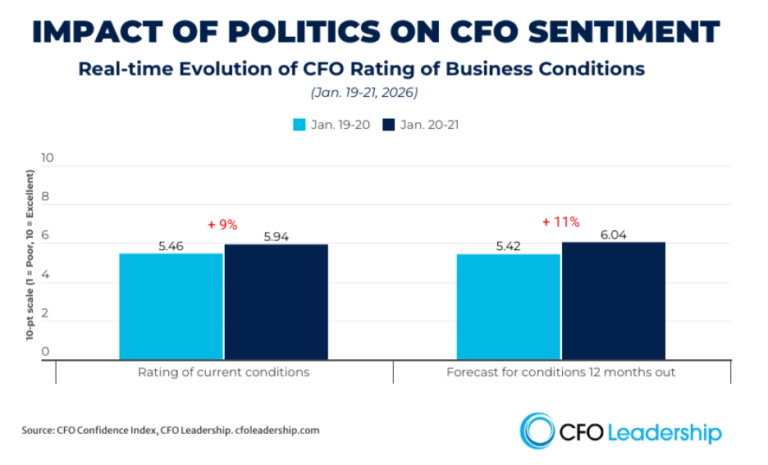

Emotions changed rapidly in real time. Survey of 130 CFOs in front In the acquisition announcement, the current business condition was rated at 5.5 out of 10, a 9% decrease from the 6.0 rating given by the CFO in the fourth quarter. 60 CFOs surveyed rear However, the announcement reported a positive outlook, with the condition rated 5.9 out of 10 and a 9% profit within 24 hours, recouping almost all of the previous losses.

Asked to predict the situation in the year ahead, the first group expressed pessimism about the possibility of improvement, predicting that business conditions would worsen slightly in 2026, reaching a rating of 5.4 by the end of the year. Instead, the second group expressed cautious optimism, predicting that the situation would improve to 6 out of 10, an 11% difference in ratings compared to the first group.

The second group brought some gains to the overall index in Q1 2026, but not enough to completely reverse course.

Overall, CFOs' rating of current business conditions is 5.6 /10, still down from Q4 (-7%). CFOs' expectations for the economy by this time next year were also 5.6, down 10% from 6.3 in the previous quarter. This indicates that despite the increase at the end of the voting period, CFOs still do not expect the economy to play out significantly differently in 2026 than in 2025.

political influence

The political (and geopolitical) environment plays a key role in how CFOs and executive teams approach growth and risk, and, as a result, investment and employment. CFOs shared how policy shifts originating in Washington, from tariffs to regulations to what has been dubbed “Greenland Madness,” are impacting their plans and creating challenges for their businesses.

“Economic fundamentals look good,” said one of the most positive CFOs in the survey, adding, “but geopolitics are very turbulent.”

Another official said, “There are limits to what the market can do to fight back.''

Another official expressed the same opinion, saying, “The inconsistent, unstable, and unpredictable actions of the U.S. government and president are making it difficult for businesses to operate.''

As one CFO explained, “Tariff uncertainty, including the upcoming Supreme Court ruling on IEPA tariffs. The Trump administration's uncertainties are around tariffs, foreign policy, and the historic government structure — the Federal Reserve's turmoil. All of these things impact the economic outlook, investment, employment, and consumer spending.”

That uncertainty is reflected in CFOs' 2026 forecasts for their respective organizations.

- 73% expect revenue growth in 2026 (down from 76% in Q4)

- 56% expect profits to increase this year (down from 69% in Q4)

- 38% plan to increase capital spending this year (down from 45% in Q4)

This finding is in contrast to what CEOs are saying. chief executiveour sister publication, says that this year's top priority is improving profitability.

CFOs surveyed reported that one of the factors impacting their bottom line is rising healthcare costs. 90% of respondents said their healthcare costs will increase in 2026, and one-third said their healthcare costs will increase by 10% to 20% compared to the previous year.

There is one silver lining. 44% of CFOs say they plan to increase headcount in 2026, up from 41% in Q4.