2025 has been a very volatile year for U.S. businesses, hit by geopolitical instability, legal confusion, and headwinds from Trump-era tariffs. While these stressors have had a negative impact on the CFO outlook quarter after quarter, recent developments appear to be creating renewed optimism about the future.

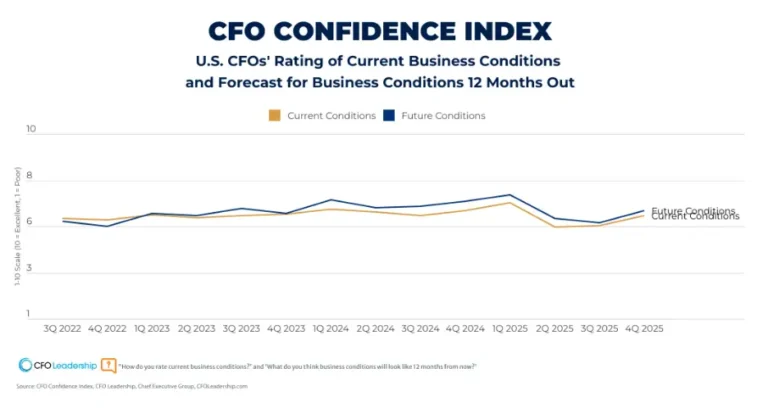

New data from CFO Leadership's Q4 CFO Confidence Index (conducted Nov. 6-12 among 106 U.S. CFOs) shows current business conditions are rated 6.0 out of 10, with 1 being “poor” and 10 being “excellent.” This is up 9 percent from the previous quarter and almost reverses the plunge in confidence observed in March.

Many CFOs polled attributed this recovery to a clearer sense of what's coming next. It's a sentiment shared by CEOs in our sister publication, the November CEO Confidence Index. One CFO says his optimism is rooted in new “financial stability” and a strong “customer forward-looking voice.” Others agreed, citing “a more favorable regulatory environment, access to capital, and increased business activity.”

Predictions about how this situation will play out into next year show further upward momentum. CFOs expect the situation to rise to 6.3 out of 10 by this time next year. This would be a 4% improvement over the current situation.

Still, the CFO community is polarized. While some believe the current administration's approach to the economy, from tax cuts to salt credits, has led to business optimism for the year ahead, others argue that the lack or unreliability of key economic indicators calls for renewed vigilance.

Some companies report sector-specific issues, especially those with a focus on events and construction.

41% of CFOs surveyed plan to improve their business performance a year from now, down from 43% last quarter. However, this has been offset by a significant increase in the proportion of finance executives who expect no change next year, from 24% in August to 34% now. Overall economic conditions are improving this month, with fewer CFOs expecting conditions to worsen.

Looking at data by company size, mid-sized companies are the most cautious about their forecasts for 2026. It is important to note that businesses with sales of $250 million to $500 million expect their situation to be 5.3 by this time next year, compared to 7.2 for small and medium-sized businesses, a difference of 26 percentage points.

According to CFOs surveyed, the strength of this smaller market is primarily a result of increased financial transparency and year-over-year growth for small businesses. One CFO of a company ranging in size from $25 million to $49.9 million reported that “clear visibility and understanding of market trends across all divisions” is essential to a bullish forecast.

There are also large deltas between sectors, with significant polarization depending on the industry. Healthcare CFOs report the highest future expectations at 8.0 out of 10, while real estate and restaurant CFOs are far more hesitant (ranging from 2.0 to 3.0).

The coming year

When asked how they expected the situation to affect their companies, CFOs were particularly optimistic this quarter, although setbacks were evident in employment and cash-to-debt ratios.

- 76% of CFOs expect revenue to increase next year, up from 70% last quarter.

- 69% expect profits to increase, up from 57% in the third quarter.

- 41% expect their headcount to increase, down 15% from the previous quarter.

- 45% intend to deploy more capital over the next year, up from 38% last quarter.

- 58% expect to increase their cash position and 25% are looking to increase their debt levels (both increased from last quarter).

For more 2026 forecasts and insights broken down by company size, ownership, sector, and other dimensions, see CEO Group's Financial Benchmarking Report for U.S. Companies and see how you compare to your competitors.

About the CFO Confidence Index

Each quarter, CFO Leadership surveys hundreds of CFOs from organizations of all types and sizes across the United States to provide the CFO Confidence Index, a real-time, forward-looking tracker of CFO confidence in the current and future business environment, as well as forecasts of a company's revenue, earnings, capital expenditures, and cash/debt ratios for the year ahead. For more information, please visit CFOLeadership.com/cfo-confidence-index/.