Interest rates are on hold, but what are the other important metrics for the year ahead? Let's break it down.

From interest rates to inflation and business confidence, this month we take a look at the key numbers impacting Australian businesses.

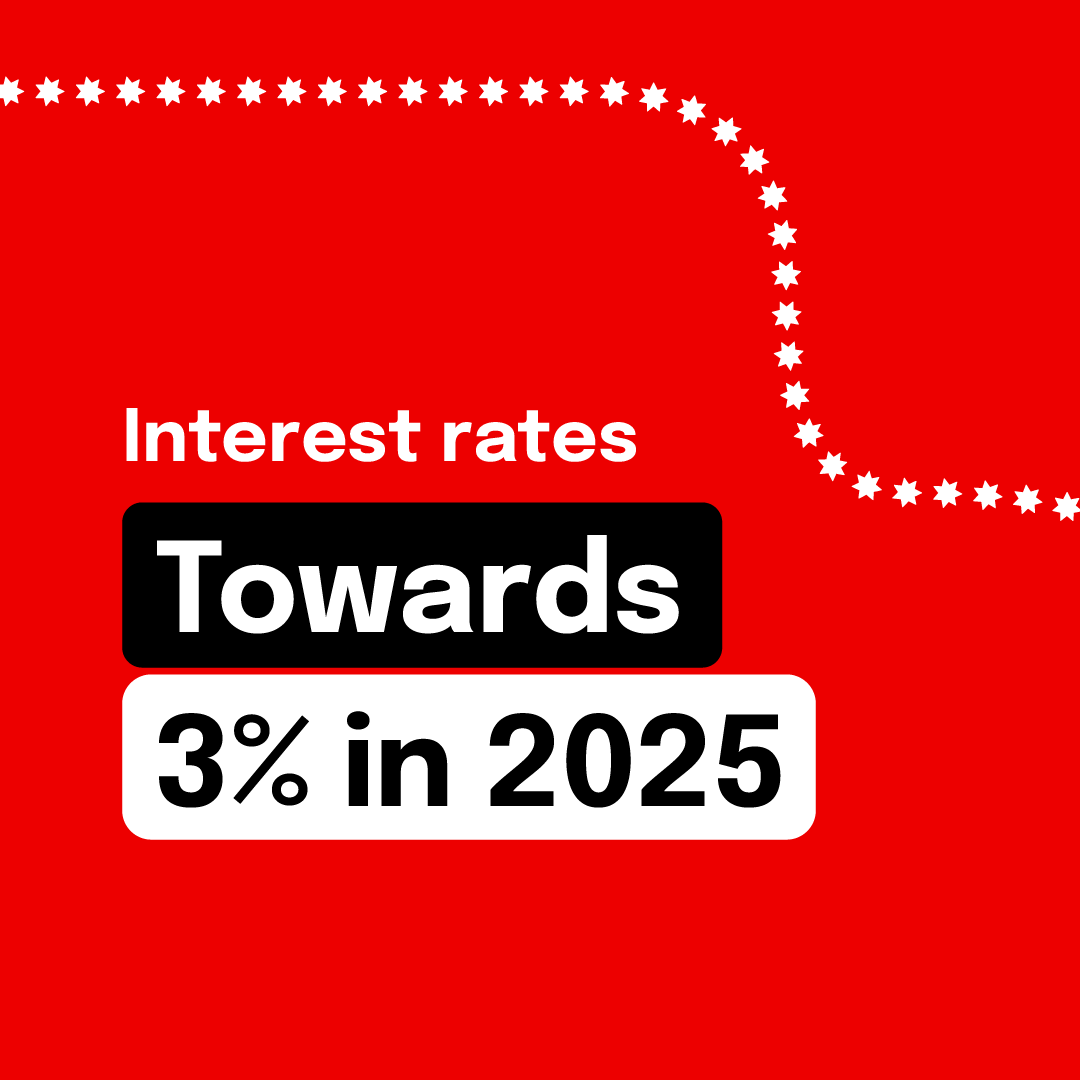

interest rate deferred

NAB Economics forecasts interest rates to peak at 4.35%. However, it is unlikely to decrease any time soon. Our team expects the Reserve Bank to take action in November, after which we expect the cash rate to decline gradually to around 3% by the end of 2025.

Inflation continues to ease

Inflation slowed significantly in 2023, falling to 4.2% year-on-year. This began to resolve global supply issues and significantly eased pressure on commodity prices. It is unclear how long this situation will last, but NAB Economics expects inflation to return to above 3% by the end of 2024.

not so slow growth

NAB Economics expects further growth in 2024, forecasting GDP growth of 1.7%. While prudent household spending remains the main driver here, with consumers mostly focusing on needs over wants, lackluster business investment will also take a toll. However, as the team points out, the situation could have been much worse had interest rates risen rapidly. Additionally, consumer spending should improve as inflation eases further.

Deterioration of business conditions

Our latest monthly business survey shows that business confidence remains very weak, despite enjoying a slight uptick in January. As our Group Chief Economist Alan Oster points out, this is not surprising given the economic slowdown and continued cost pressures (although cost growth is expected to ease somewhat into the second half of 2023). ). Meanwhile, business conditions are below long-term averages, with recreation and personal services seeing the biggest declines. The advantage is that capacity utilization remains high.

Unemployment rate rises

The unemployment rate rose to 4.1% in January, but as NAB Economics points out, this number should be viewed with caution due to seasonal factors. Nevertheless, the labor market has indeed softened since mid-2023, reflecting a recovery in Australia's population and a slowdown in labor demand. NAB Economics expects further gradual easing throughout the year, with the unemployment rate reaching 4.5% by the end of 2024. It should be noted that this rate is still below pre-pandemic rates.