The world is moving at a fierce speed, Corporate Board Members EY Americas Center for Board Matters also reveals how this pace of change is reshaping corporate governance.

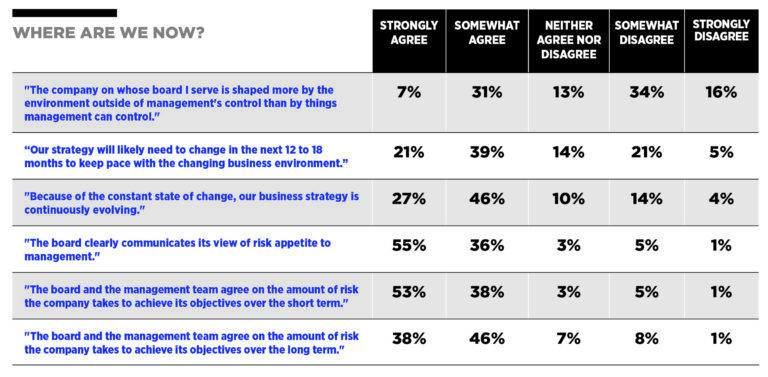

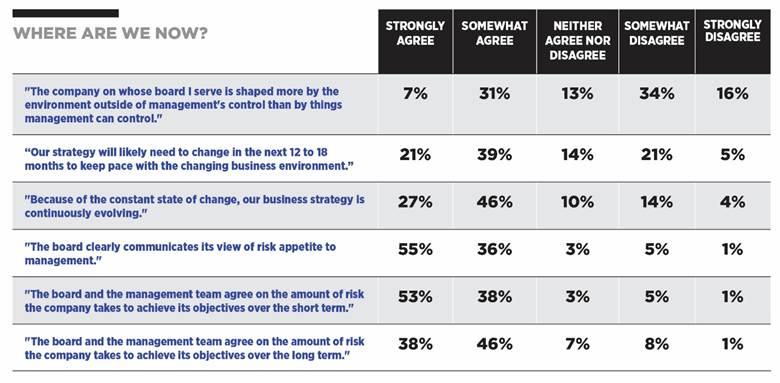

A new study conducted earlier this year among board members of nearly 200 public company members has found that almost three-quarters of directors say their corporate strategy is constantly fluid, with six out of ten expecting a carefully prepared plan to require a complete overhaul within just 12-18 months.

This finding illustrates a fundamental shift in the way boards must approach strategic oversight, with continued strategic vigilance and adaptive governance. Take a closer look at what's changing.

New strategic reality

This study reveals changes in dynamics in boardroom decision making. The board and management team report strong consistency on current risks, but 87% of directors who think they are looking at management and making eye contact with risk assessments may be that this consensus is hiding more troubling issues.

“In today's dynamic global market, the board cannot afford to be satisfied with its organizational strategy,” said Jamie Smith, director of EY Board Matters and partner in the study. “This environment requires the board to use experience and a long-term perspective to help raise management perspectives and identify opportunities for action.”

The meaning is profound. If the strategy has to evolve constantly, the board cannot afford to wait for a formal strategy session that occurs once or twice a year. Instead, strategic thinking must be incorporated into every board conversation and woven into a structure of continuous surveillance rather than compartmentalised into a dedicated planned retreat.

Action gap

Another obvious finding from this study focuses on risk preferences and implementation. 91% of directors say they clearly communicate their risk appetite to management, with 80% saying they report that the management understands it, while the third says they actually want the management to take it. more Risks act more positively in line with the stated risk appetite of the board.

This study suggests that this careful approach from management stems from several barriers. Beyond the industry's external disruption (cited by 50% of directors) and wider economic disruption (45%), management's focus on short-term financial performance creates a major challenge to build long-term resilience.

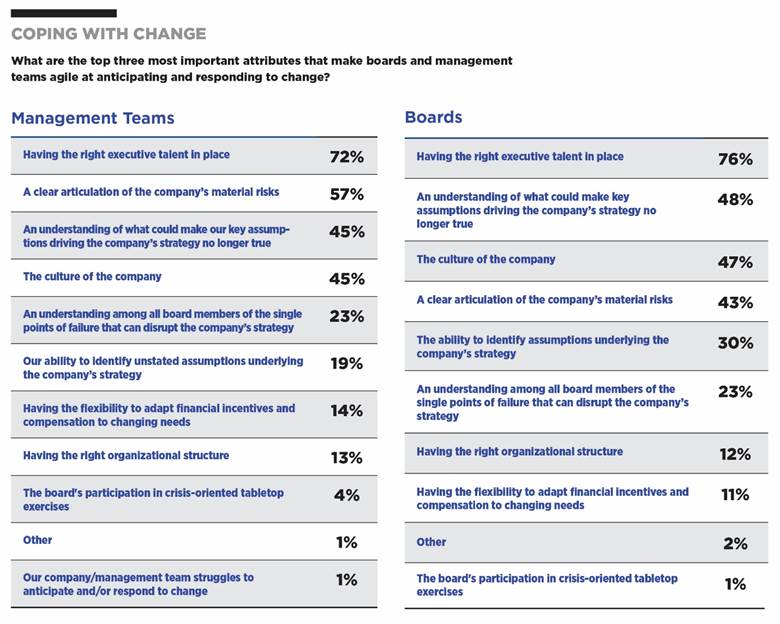

So how does the main board fill this action gap? The study points out several important factors at 72% where director skills and background expertise are on the list.

However, experience alone is not enough. The most effective committees create what research identifies as a “culture of the boardroom of constructive disagreement.” This culture appears in the four key conversations that the main board engages throughout the year rather than waiting for a formal strategy session.

- Building a genuine consensus About strategic resilience by ensuring that all directors share a common understanding of the current state and preparation of the company. This is not about achieving an agreement, but about clarifying what resilience means for a particular organization.

- Evaluating Strategic Discussions Regularly Instead of every year, the board of directors will support management to identify appropriate opportunities for action and assess the cost of omission.

- Identifies a single point of failure It will then clearly define each risk tolerance and help management prioritize where resources are allocated to both resilience and growth.

- Understanding important assumptions Organize the underlying strategies and preparations to change these assumptions, and create early warning systems and response strategies.

For more information about the findings and how the board is harming these conversations, and how practical frameworks for improving strategic oversight, see Download the report.