A structured annual evaluation of external auditors helps audit committees maintain audit quality, protect market confidence, and strengthen communication between the parties.

The audit committee strengthens important safeguards by conducting a disciplined evaluation of the independence, technical proficiency, and overall performance of external auditors. High quality auditing is a shared responsibility that relies on strong and constructive dialogue between external auditors and audit committees.

“Evaluating and appointing external auditors is one of the key responsibilities of audit committees, and it is important to follow a consistent process from year to year,” said Sara Grootwasink Lewis, director of Weyerhaeuser, Freeport-McMoRan, PwC, Healthpeak Properties, and Center for Audit Quality (CAQ) Audit Committee Councilor, during a November 2025 webinar on the subject. Therefore, conducting a formal evaluation is an effective way to foster important conversations and is an important tool for establishing a consistent review process.

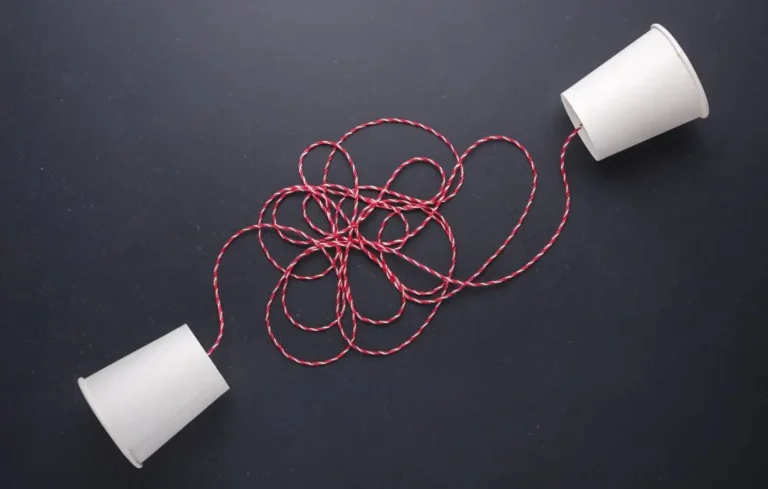

have a constructive dialogue

Appraisals are a powerful source of constructive feedback and should cover four areas to ensure they are comprehensive and address the core drivers of audit quality:

- engagement team. Evaluate the expertise, depth, and efficiency of a specific audit team.

- This is an auditing corporation. Assess the firm's approach to promoting and monitoring overall audit quality.

- communication and interaction. Review the effectiveness, timeliness, and transparency of communications with the audit committee.

- Independence and professional skepticism. Ensuring that external auditors maintain a strong position of independence is critical to investor confidence.

partnership key

Audit quality is directly related to the strength of the relationship between the external auditor and the audit committee. While annual reviews are important, an effective auditor-audit committee relationship relies on communication that goes well beyond the annual cycle. One of the most important elements is having a proactive audit partner, someone who reaches out when issues arise rather than waiting for the next scheduled touchpoint.

“As long as it's not rough, I can accept it. But the audit committee needs to know if it wasn't in the middle of the fairway. They need to talk about things that might kick them into the rough. As audit partners, we need to have the courage to have a perspective. And we shouldn't surprise management with that perspective,” Stephen Parker, assurance partner in PwC's Center for Governance Insights, said in the webinar.

It's also important to maintain connections with the company's broader leadership, not just the core audit team. This broader effort provides visibility into emerging and evolving issues, supports stronger judgment, and strengthens a culture of openness. Ultimately, these relationships work best when built on a foundation of transparency and consistent, honest communication.

Key operating practices that help strengthen this important partnership include:

- Beyond meetings. Communication needs to extend beyond the audit committee's quarterly meetings.

- Start succession planning for your engagement partner early. It is important to start the partner selection process well in advance of the required five-year rotation. As Karen Goltz, Audit Committee Chair at Analog Devices and iRobot, said in a CAQ webinar, this process should begin “approximately 18 to 20 months before the lead engagement partner needs to rotate engagements,” and audit committees should seek “at least three qualified candidates.” It is also important that “the audit committee chooses the partners, rather than the company choosing the partners,” he said.

- Address sensitive topics. When faced with complex or sensitive issues, audit committees can expect candor from their audit partners.

Ultimately, audit committees should view external auditors as strategic partners. The real value of this effort comes from the quality of insight auditors provide and the benefit of an independent perspective that helps committees make more informed decisions and improve overall efficiency.

By fully adopting a structured, continuous and constructive evaluation process, audit committees can strengthen their governance role, fulfill their fiduciary duties and ensure the highest level of audit quality, thereby increasing confidence in the capital markets. This work is more important than ever, especially as the technology landscape continues to change the way organizations operate.

As Mike Seelig, former director of the Federal Home Mortgage Association, stated in a CAQ webinar, “An annual evaluation by an external auditor is a cornerstone of good corporate governance.” This is a process that experienced audit committees take seriously, understanding that auditor independence and performance are key components of investor confidence and the strength of capital markets.

For more information on how to evaluate external auditor performance, use CAQ's External Auditor Evaluation Tool. Watch the full replay of the webinar.

This article was first published NACD Directorship® online.