There is no doubt that you can make money by owning shares of unprofitable companies. For example, biotechnology companies and mining exploration companies often lose money for years before achieving success with a new treatment or mineral discovery. That being said, there are risks involved, as unprofitable companies can burn through all their cash and go into distress.

Considering this risk, I decided to consider the following. samsara (NYSE:IOT) shareholders should be concerned about its cash burn. This report examines the company's negative free cash flow for the year. We will refer to this as “cash burn” from now on. First, compare its cash burn to its cash reserves to determine its cash runway.

Check out our latest analysis for Samsara.

How long is Samsara's cash runway?

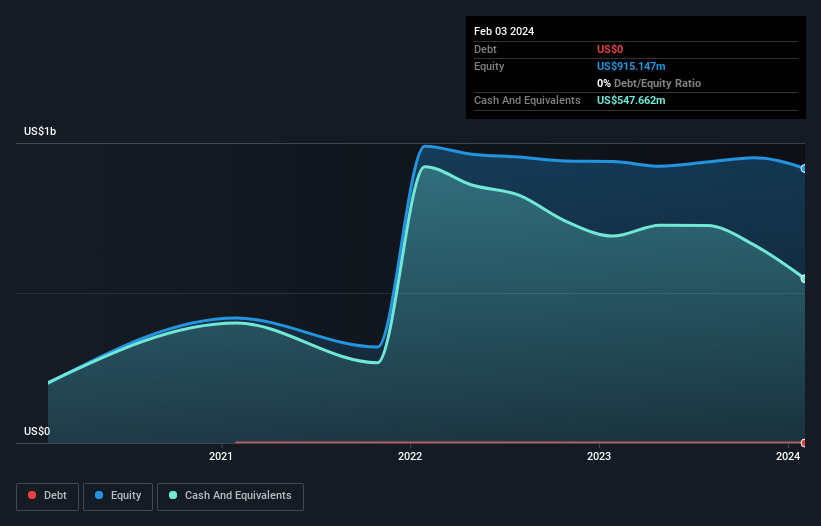

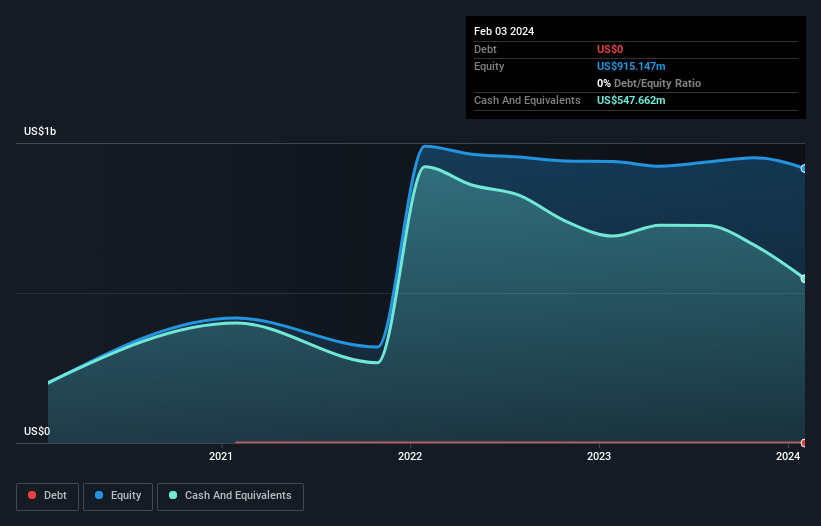

A company's cash runway is calculated by dividing its cash holdings by its cash burn. As of February 2024, Samsara had US$548 million in cash and no debt. Last year's cash burn was US$23m. Therefore, a very long funding period was required, starting from February 2024 and extending over many years. Notably, however, analysts believe Samsara will break even (at a free cash flow level) by then. In that case, you may never reach the end of your financial runway. The image below shows how its cash balance has changed over the past few years.

How much is Samsara growing?

Fortunately, Samsara is on the right track when it comes to its cash burn, which is down 83% over the last year. Happily, this was achieved through a 44% increase in revenue. Considering these factors, we're pretty impressed with its growth trajectory. The past is always worth studying, but it is the future that matters most. That's why it makes so much sense to see what analysts are predicting for the company.

How easily can Samsara raise cash?

While we're certainly impressed with the progress Samsara has made in the last year, it's also worth considering how much it will cost if it wants to raise even more capital to fund faster growth. there is. Generally, listed companies can raise new cash by issuing stock or taking on debt. One of the main advantages of publicly traded companies is that they can sell stock to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalization, we can roughly estimate how many shares it would need to issue to run the company for another year (at the same burn rate).

Samsara's cash burn of $23 million is equivalent to about 0.1% of its $19 billion market capitalization. As such, it will almost certainly be able to easily raise cash by borrowing a small amount or issuing a few shares to fund growth next year.

So should you be worried about Samsara's cash burn?

As you can probably tell, we're not too worried about Samsara's cash burn. In particular, we think the company's ability to raise funds stands out as evidence that it is spending well. However, it is no exaggeration to say that revenue growth was also very encouraging. Shareholders will no doubt take great comfort in the fact that analysts expect the company to reach breakeven before long. Considering all the factors in this report, we think the business has plenty of capital to spend if needed, so we're not worried about cash burn at all.A detailed investigation of the risks revealed 3 warning signs to reincarnation Here's what readers should consider before investing money in this stock.

If you want to check out another company with better fundamentals, don't miss this free A list of interesting companies with a high return on equity, low debt, or a list of growing stocks.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.