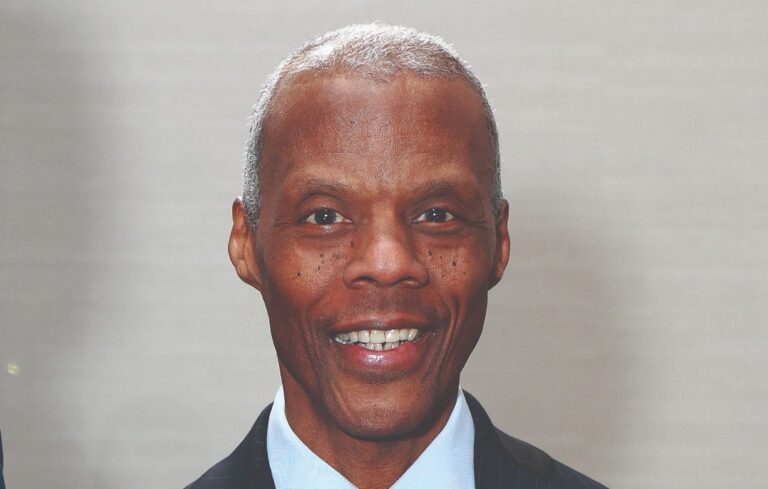

For J.C. Watts, success in the boardroom does not begin with strategic or financial insight. It starts with the characters. At a recent board forum in Dallas, Watts offered a deep, personal and very practical reflection on what makes the supervision effective and what the board can consistently provide excellent results.

Why listen to Watts? Former MPs, championship quarterbacks and veteran corporate directors who served on boards of companies such as CSX, Paycom, Dillard, and Terrax have been recognized as the top value creation directors of the past 20 years. Corporate Board Members And Alixpartners for driving shareholders will return 15.3% above industry peers for 20 years.

“If you have to compromise on strategy or integrity, you have to compromise on strategy. Don't compromise on integrity,” he said, citing General Norman Schwarzkop in a room full of seasoned supervisors. “When a leader or board loses integrity, when you lose trust. And if you lose trust… you lose your leadership.” Some tips:

Build the right team.

Watts emphasized that the successful boards were constructed in the same way as the successful teams he played. Not all players have the same role, but each one needs to understand the game. “We need someone who can bring that institutional knowledge, its chemistry, that knowledge to the management team.

Integrity is not just a virtue, it is the need for governance.

For Watts, integrity earns the right to lead the director and the influential trust. A loss of credibility, he said, inevitably undermines the board's role as the custodian of capital and culture. “That's true in everything I've done… in football, politics, missionary, business,” he said.

Great directors do their job.

“High-performance boards throw themselves into the mix and learn everything you need to know about the business,” he said. “We don't need to know that at the grassroots level, but we need to understand the dynamics. How do we make money?” This means studying industry reports, understanding competitive positioning, and being prepared to ask difficult questions that drive real insights into business performance.

Management, and retain yourself.

“The CEO worth his or her salt is honest [about performance]. When you're not going to be honest with yourself and say, 'I haven't done it,' it's when you're about to smash some heads,” Watts said. He said accountability flows in both ways.

The effectiveness of the boardroom depends on humility, not on ego.

He encouraged supervisors to model humility by asking questions, postpone them when appropriate, and prioritizing businesses over personal reputations. “No one owe me the opportunity to be a member of Congress. No one owe me the opportunity to do business with me… you block and work on everything else like you.” This idea creates an environment where the best ideas will surface, regardless of source, and the director will continue to focus on value creation rather than personal positioning.

Rethinking Dei as a “intentional opportunity.”'

“When I was in high school, we didn't have any black people working in courts, banks, or grocery stores, but someone crossed the railroad tracks and offered me a job,” Watts recalled. “If anyone was willing to draw outside the line, I wouldn't have had the opportunity.” He reframed Day as a “deliberate opportunity,” challenging the supervisor to think beyond the traditional employment pipeline. “In many cases, we can hire from the network, so you have to be intentional about expanding it.”