- In recent years, production from the world's uranium mines has supplied 90% of the power company's demand.

- Primary production from the mines is complemented by secondary supplies, which previously consisted mostly of former military supplies but now consist of recycled products and stockpiles accumulated when demand fell.

All mineral commodity markets tend to be cyclical (In other words Uranium prices have risen and fallen significantly over the years, but these fluctuations tend to coincide with a long-term downward trend in real prices as technological improvements reduce production costs at mines. However, the uranium market saw high prices in the late 1970s give way to price stagnation in the 1980s and 1990s, when spot prices fell below production costs at all but the lowest-cost mines. Spot prices recovered from 2003 to 2009, but have slumped since then.

Until around 2007, spot prices only applied to daily marginal transactions and represented a small portion of supply, but since 2008, that share has almost doubled to about a quarter over the past decade. Most transactions are made under contracts of 3 to 15 years, with producers selling directly to utilities at prices higher than the spot market, reflecting security of supply. However, the prices specified in these contracts are often related to the spot price at the time of delivery.

In 2000, 95% of the spot market was held by major market participants: utilities and producers. This share fell to two-thirds by 2005, one-third by 2011, and has remained at around 30% to 40% since then. The remainder comes from the financial industry – traders and financiers who have entered the market and brought greater liquidity and efficiency.

The reasons for mineral price fluctuations have to do with demand and perceptions of scarcity: prices will not stay below the cost of production forever, nor will they remain at very high levels for long enough for new producers to enter the market and supply concerns to ease.

Uranium spot and long-term prices (2000-2023)

Source: Cameco, UxC, TradeTech

request

About 440 reactors with a total capacity of about 390 GWe require about 80,000 tonnes of uranium oxide enrichment containing about 67,500 tonnes of uranium (tU) from mines (or equivalent from stockpiles and secondary sources) annually. This includes the initial cores of new reactors coming online. Capacity is slowly increasing and at the same time reactors are running more productively at higher utilization rates and reactor power levels. However, these factors that increase fuel demand are offset by trends in improved efficiency, so demand is constrained. In the two decades since 1970, such improvements have reduced uranium demand per kWh of power output by 25% in Europe, a figure that continues to this day.

Every GWe of new capacity will routinely require around 150 tU of additional mine production per year, with an initial fuel load of around 300-450 tU required.

Fuel burnup is measured in units such as MW-days per tonne (MWd/tU). Increasing burnup reduces the number of new fuel assemblies that need to be loaded. Thus, increasing burnup translates into potential cost savings for utilities at both ends of the fuel cycle. However, increasing burnup may (but does not always) require increasing the enrichment of the fuel assemblies, which increases the uranium and/or enrichment required for each assembly and increases the cost of each assembly. Between 1980 and 2010, burnup increased to about 40,000 MWd/tU for most LWRs compared to the original designs, and specific uranium consumption decreased. Some utilities have continued to increase burnup further, with levels of 45-50 GWd/tU now common. However, increasing burnup beyond 40 GWd/tU increases specific enrichment requirements only slightly while decreasing specific uranium consumption slightly. For example, an increase from 40 to 50 GWd/tU would reduce uranium requirements by 4-5% while increasing enrichment requirements by about 2-3%.

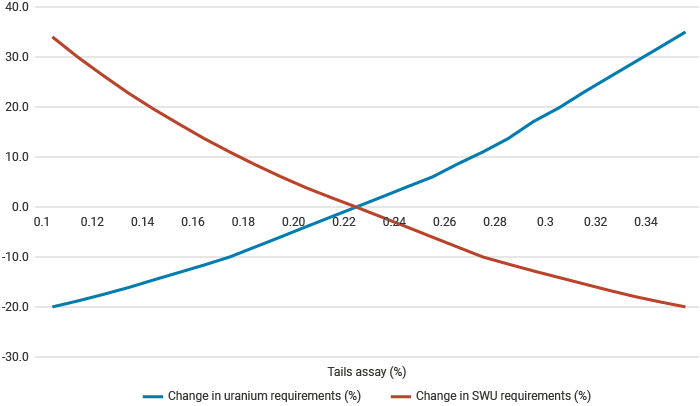

Typically, utilities pursued higher enrichment and burnup, and when uranium prices were high, they specified lower tail assays to get more fuel from enrichment, resulting in a significant reduction in the supply of natural uranium. But that then required more enrichment energy. There is a clear trade-off between the energy input to enrichment and the uranium input.

Percentage variation in uranium requirements and separation working unit (SWU) requirements due to different tail analyses

Note: Base-tail analysis is 0.22% U-235

Source: World Nuclear Association

Nuclear power's cost structure, with high capital costs and low fuel costs, makes the demand for uranium fuel perhaps much easier to predict than other mineral resources. Once reactors are built, it is very cost-effective to keep them running at high capacity and for utilities to adjust load trends by reducing fossil fuel use. Thus, uranium demand forecasts are highly dependent on installed and operational capacity, regardless of economic fluctuations. However, this situation is complicated by policies that give preferential access to the grid to subsidized wind and solar generating sources.

Looking ahead ten years, the market is expected to grow. In the World Nuclear Association's reference scenario for 2023, Nuclear Fuel Report Demand for uranium is projected to grow by 28% between 2023 and 2030 (with an 18% increase in reactor capacity requiring many new cores). Demand thereafter will depend on the construction of new plants and the rate at which older plants are retired. In the 2023 base case scenario: Nuclear Fuel Report Uranium demand is projected to grow by 51% over the decade from 2031 to 2040. Authorizations for life extension of power plants and the economic attractiveness of continuing to operate older reactors are key factors in the uranium market in the medium term. However, by 2040 electricity demand could increase by around 50% from 2022 (based on International Energy Agency projections). World Energy Outlook 2023 The report says there is plenty of room to expand nuclear power capacity in a world interested in limiting carbon emissions.

supply

In 2022, the mine will produce approximately 58,201 tonnes of uranium oxide concentrate (U3oh8) contains 49,355 tU, which is 74% of the annual requirements of the utilities (see also our information page on global uranium mining). The rest consists of secondary sources such as uranium stockpiles held by utilities, and the last few years of low prices have replenished these private stockpiles that were depleted between 1990 and 2005. As of the end of 2022, it is estimated that Europe will have around 36,000 tU, the USA 40,000 tU, China around 132,000 tU and the rest of Asia around 49,000 tU.

It's important to note that, based on the prices utilities are likely currently paying, only one-third of the cost of the fuel loaded into the reactor comes from the actual mine (or other source). The rest is primarily the cost of enrichment and fuel production, with a small component for uranium transmutation.

Since the growth in uranium demand is primarily coming from Russia and China, it is notable that the vertically integrated national nuclear industries of these countries (and possibly India) are seeking to acquire stakes in overseas uranium mines, to some extent bypassing the market. Strategic investment in uranium production, even if not the lowest cost, has become a priority while world prices are generally low. Russia's ARMZ acquired Canada-based Uranium One in 2013, and China has stakes in mines in Niger, Namibia, Kazakhstan, Uzbekistan and Canada.

Sources from elsewhere

In addition to existing mines and possibly new mines, nuclear fuel supplies could come from secondary sources such as:

- Uranium and plutonium recovered from spent fuel are reused as mixed oxide (MOX) fuel.

- Re-enriched depleted uranium residue.

- Blended with ex-military weapons-grade uranium.

- Private reserves.

- Former military weapons-grade plutonium is used as MOX fuel.

Commercial reprocessing plants are operating in France and Russia, with a combined capacity of about 2000 tonnes of heavy metals (tHM) per year. The restart of the Rokkasho plant in Japan would add 800 tHM to global reprocessing capacity. Further capacity is under construction in Russia and China, and there are many other plants with smaller reprocessing capacities around the world.

Military uranium for weapons purposes is enriched to much higher levels than for the civilian fuel cycle. Weapons-grade material is about 97% uranium-235, which can be diluted about 25:1 with depleted uranium (or 30:1 with enriched depleted uranium) to reduce it to about 4%, suitable for use in power reactors. From 1999 to 2013, approximately 9,720 tons of uranium were replaced by diluting 30 tons of such material per year.3oh8 per year of landmine production. (See also Military warheads as a source of nuclear fuel.)

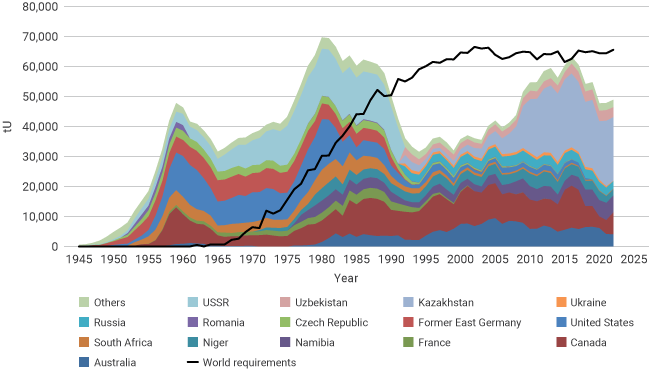

The following graph shows historically how early production went first to military reserves and then to civilian reserves in the early 1980s. Since the mid-1980s, it has been this early production that has filled the supply gap from the mines, but the gap is declining towards the level of a continuous secondary supply.

World uranium production and reactor needs, 1945-2022, tU

Source: OECD-NEA, IAEA, World Nuclear Association

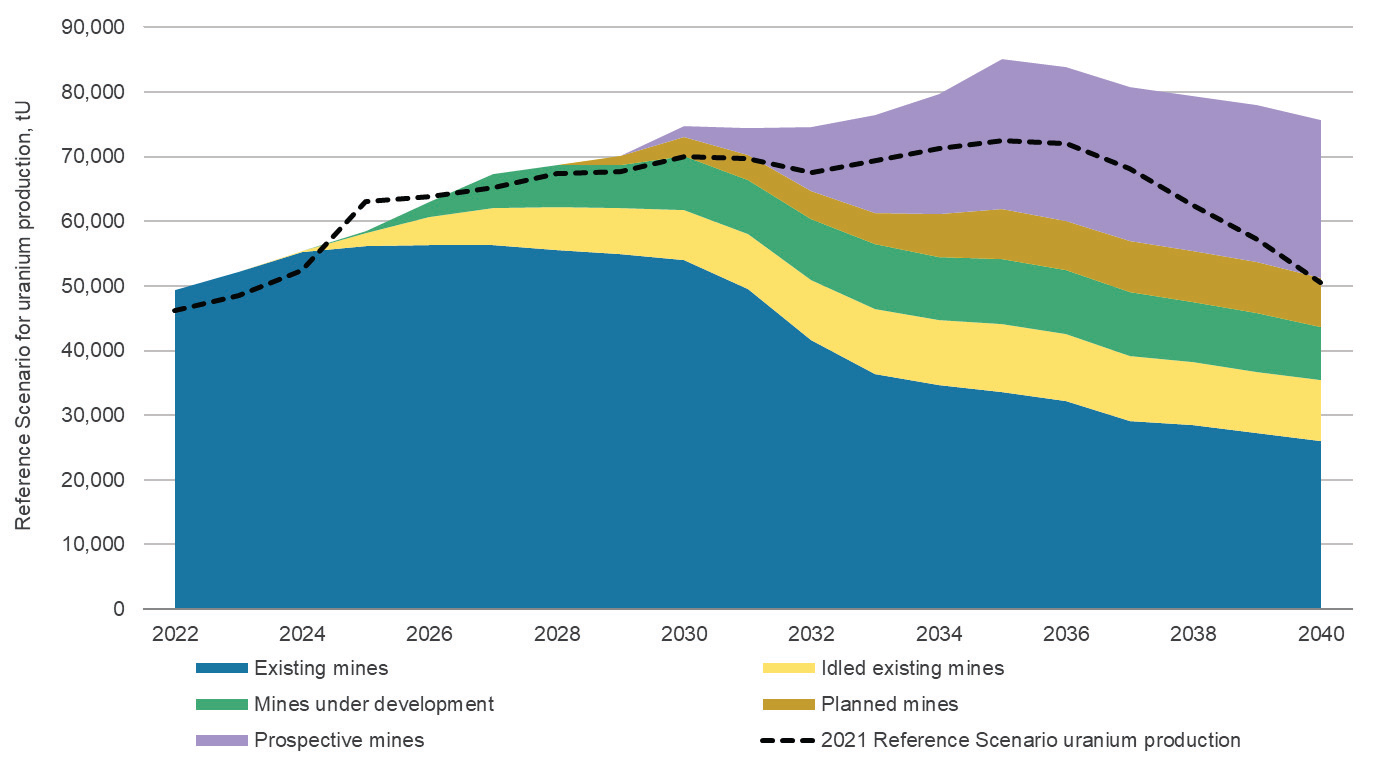

The following graph shows what these different sources could look like over the coming decades. The graph shows a breakdown of the World Nuclear Association's 2023 reference scenario. Nuclear Fuel Report It is broken down into current mining capacity (separately including idled capacity), and capacity that is under development, planned or prospective. The black line shows the reference scenario for the 2021 edition. Nuclear Fuel Report For comparison, meeting the requirements of the Reference Scenario from the beginning of the next decade will require reopening idled mines, developing, planned, and promising mines, as well as bringing other new projects into production. Converting these resources into refined uranium suitable for nuclear fuel production within this timeframe will require significant exploration, innovative technologies, and timely investments.

Reference scenario for uranium production, tU

Source: Nuclear Fuel Report, World Nuclear Association

Notes and References

source

World Nuclear Association, Nuclear Fuel Report

International Energy Agency, World Energy Outlook

Uranium Production

Military warheads as a source of nuclear fuel

Nuclear power plants and uranium demand around the world