Our 2025 Director Thinks Report – Directed by Partnerships between Corporate Board Membersdiligent laboratory and FTI consulting – reveals that improving or revising C-Suite and Board succession plans is one of the key priorities for publicly traded companies in the US this year.

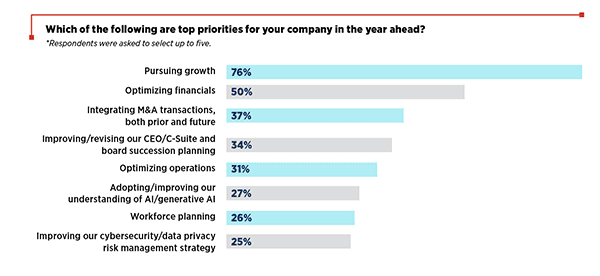

An annual survey of more than 200 public US companies directors: Over a third (34%) have identified CEO and C-Suite succession plans as a top company's priorities for 2025ahead of other pressing issues, such as AI adoption (27%), workforce planning (26%), cybersecurity enhancement (25%), and geopolitical risk navigating (10%).

Additionally, CEO succession plans ranked third in the list of topics to discuss at the next board meeting. Only M&A activities and growth strategies were ranked highly.

“It should always be the best thing in the boardroom.” says the executive director of Dottie's Siligent Institute Sindlinger, “Succession planning is a current priority as stable, focused leadership is essential for companies to implement their growth strategies.

The 2025 Succession Plan Dilemma

Succession planning is one of the core boardroom concerns for 2025, but is considered one of the most challenging. The report revealed that three in 10 directors view succession planning at the CEO and senior executive level as one of the most challenging aspects of their role.

The data represents a significant increase from the previous year. More than twice the director's percentage Compared to last year's research, we cited succession plans as a challenging issue to oversee.

Other concerns were cybersecurity and data privacy (27%), which was significantly reduced in the difficulty of oversight this year, as well as capital allocation (25%) and enterprise risk management (24%).

Executive Executives hit record highs in 2024

The report follows a massive spike of CEOs and senior executives over the past year, and considers this a significant source of risk. “They think this can completely overturn this year's strategy.” Especially in the case of unplanned departures, Sindlinger says.

In 2024, more than 2,200 CEOs resigned from their roles, up 16% the previous year, marking the highest rise in record numbers.

It could have been influenced by factors such as increased economic and political uncertainty, pressure from activist investors, and advances in technology such as AI. In the first quarter of 2024 alone there was an astounding hike of 49% compared to the same period in 2023.

Popular companies such as Boeing, Nike and Peloton have all experienced CEO departures over the past year, and this trend underscores the evolving challenges and expectations faced by corporate leaders.

Boards struggle to get succession plans right

Many directors acknowledge that the CEO's succession planning process is not scratched at all. Over half are rated as good, but only a fifth (21%) (21%) consider the succession planning process “good.”

Meanwhile, 17% admit that the current succession planning process is “poor” and is “poor” than those who have said the same thing about key aspects such as the board's understanding of long-term strategies and the ability to oversee risk management plans. Overall, the board evaluated the succession planning process lower than all other elements of the board.

So, the problem is: How does the board improve the succession planning process?

In the special 150th episode of Corporate Director PodcastDottie Schindlinger, a hardworking laboratory, spoke to Annalisa Barrett, senior advisor at KPMG about the growing importance of CEO succession planning.

First of all, that is important An overview of the process for all types of transitions. The three most common scenarios are long-term planned transitions, short-term unplanned transitions, and “I went today and tomorrow” emergency. A clear process should be outlined for each different unforeseen situation.

It is also essential Involve current CEOs in succession plans. They need to understand that the process is not a personal humiliation but a willingness to ensure that the company is in good hands when it leaves.

moreover, Tell investors and key stakeholders and succession planspromoting greater board-governance collaboration and more trust from investors.

Next, Delegating inheritance plans to the right peoplewhich allows stakeholders to successfully execute the process.

Finally, and perhaps most importantly, Understand the type of CEO your company needsconsidering future challenges and, rather than looking at the rearview mirror, define what your business needs for future success.

As investors' expectations rise and leadership sales accelerate, the board cannot afford to treat them as successors. With foresight and clear alignment, inheritance is driven by well-thinked strategies rather than scrambling. Find more insights at What the 2025 Director reports Or something hardworking A guide to CEO succession planning.