Published as part of the ECB Economic Bulletin, Issue 3/2019.

The maturation of the technology cycle is one of the reasons for the sharp slowdown in China's trade at the beginning of the year. The technology cycle argument is based on the fact that China and other major Asian economies, including Japan, are closely integrated through supply chains that are particularly concentrated in the production of computers and other electronic equipment, i.e. in the technology sector. ing.[1]. The maturation of a technology cycle can reflect many factors. This may be related to more structural sector-specific factors, such as the potential for increased levels of saturation in the global market for smartphones and new data centers. It may be related to minicycles associated with the launch of new models of high-tech products. Or, more generally, it may signal a shift in the global business cycle. This box outlines the fundamental characteristics of Asia's technology sector and shows how it has played a key role in the recent downturn in China trade. At the same time, Box also suggests that trends in the global technology cycle due to weak Asian trade may have bottomed out.

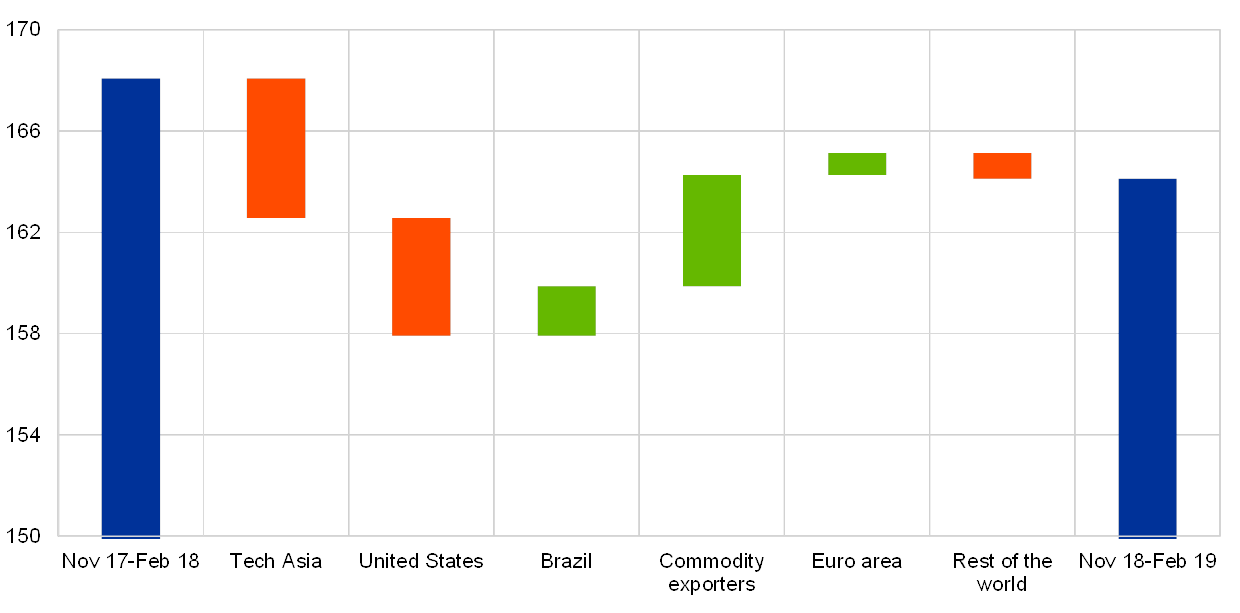

Weaker imports of goods from other major Asian economies account for a significant portion of imports from China, which have slowed in recent months (see Exhibit A). Retaliatory tariffs on soybeans have shifted China's demand for soybeans to Brazil, and imports from the United States have also decreased. At the same time, China significantly increased its imports of various products, including crude oil.

Chart A

China import volume by exporting country/region

(Billions of USD)

Source: China Customs and ECB calculations by Haver Analytics.

Note: China's total nominal imports are represented by blue bars, and exporting countries and regions are represented by red and green bars. The value of China's imports from each country/region from period 1 to period 2 is represented by red (bottom) and green (top) bars. “Tech Asia” refers to Japan, South Korea, Malaysia, Singapore, Taiwan, Thailand, and Vietnam. 'Commodity exporting countries' includes all emerging market countries that export primary products, as well as Australia, Canada, New Zealand and Norway.

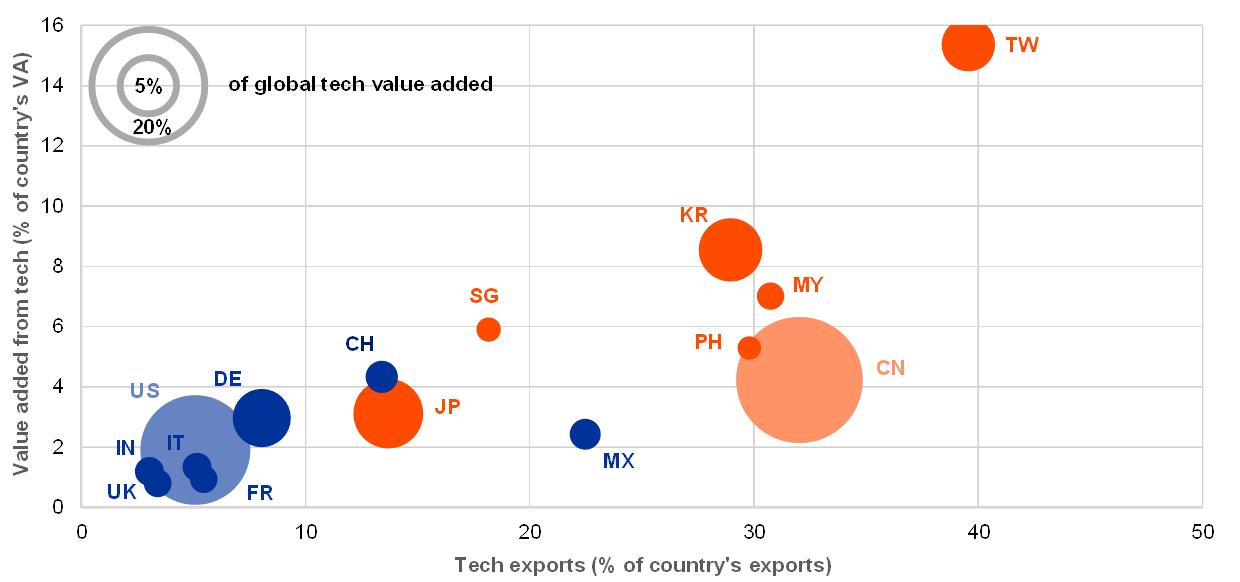

China and other Asian economies specialize in high-tech production and meet about half of the world's demand for high-tech products. China alone accounts for more than a quarter of the world's value added in this sector. With the exception of India, which specializes in IT services, the structure of Asian economies is biased toward technology production. On average, this sector accounts for about 7% of the region's total value added. The high degree of specialization in high-tech products is even more pronounced when looking at exports, with high-tech products accounting for more than a quarter of exports from the region on average (see Figure B). From a global perspective, Asia also dominates the technology sector, accounting for around half of the world's value added in this sector and more than two-thirds of global technology exports. Asia's technology exports account for 10% of total world trade.

Chart B

Specialization in technology is common across Asian economies.

(Percentage, index: 2015)

Source: OECD and ECB calculations.

Note: 'Technology sector' refers to 'Computers, electronic and electrical equipment' (D26T27) in the OECD Value-Added Trade Database. The size of the bubble on the graph indicates the relative share of a country's technological value added in the world's technological value added. Asian countries are displayed in red.

Asia's technology supply chain connects developed and emerging markets, with China being the largest producer of finished products. Japan and South Korea are located at the upper reaches of the supply chain and, together with Taiwan, specialize in the production of semiconductors and chips. Despite a significant decline in import intensity, China remains a major assembler of finished products. The import share of high-tech products that are subsequently exported fell from 40% just a decade ago to 27% in 2015, indicating a decline in dependence on intermediate goods sourced from the region. There is. A country's relative position in the supply chain determines whether domestic macroeconomic developments can also provide useful signals to global trends.

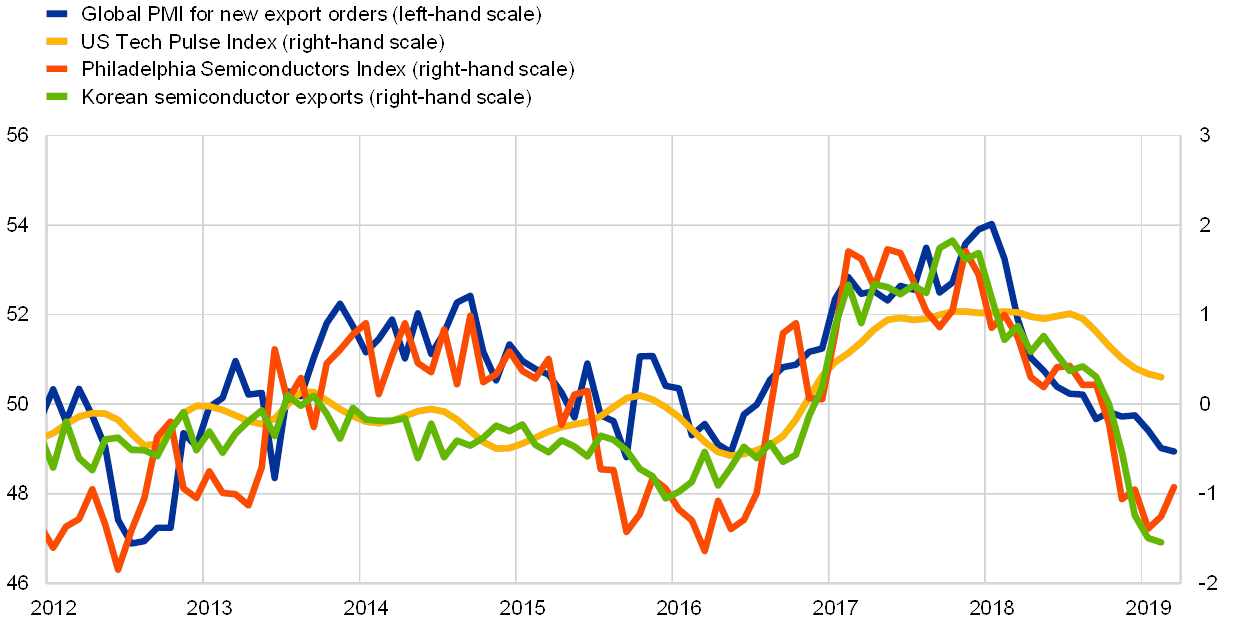

The global technology cycle changed in early 2018, and an orderly slowdown followed by some stabilization seems the most likely scenario going forward. Recent indicators of the technology cycle indicate a slowdown in the global technology cycle (see Chart C). However, there are some signs that suggest stabilization in the coming period. First, financial market expectations for sectoral development in the region, as approximated by the Philadelphia Semiconductor Index (see red line in Chart C), are likely to bottom out to some extent this year after declining in 2018. is shown. Second, while the PMI for new global export orders shows that manufacturing business confidence remains below 50, which is the benchmark for expansion and contraction, the pace of decline in recent months has been much slower than in the first half of 2018. It has become. Although this statistic covers a broader range of export products, it is highly correlated with sectoral stock prices and could therefore provide further evidence of stabilization in the global tech sector. And third, South Korea's semiconductor exports, often used as another leading indicator of technology sector activity, have recently shown signs of stabilizing. Broader activity indicators for the technology sector, including the later-released US Tech Pulse index, and global trade in electronic components also suggest limited weakening in the sector's growth momentum. Overall, therefore, the shift in the global technology cycle appears to partially reflect a rather exceptionally strong period in 2017, associated with significant investments in global data center capacity expansion. It seems to be. Despite the high degree of uncertainty, a soft landing appears to be the more likely scenario at this point.

Chart C

Tracking global “technology cycles”

(Left scale: diffusion index, right scale: annual rate of change)

Sources: Markit, Thomson Financial Datastream, FRED, KITA, ECB staff calculations.

Note: Annual percentage change in US Tech Pulse Index, Philadelphia Semiconductor Index, and Korean semiconductor exports are mean-variance adjusted. The latest observations are from March 2019 (PMI, Philadelphia Semiconductor Index) and February 2019 (US Tech Pulse Index, Korean Semiconductor Exports).