Pareto

After an unforgettable 2023 in which Ørsted (OTCPK:DNNGY) (OTCPK:DOGEF) plunged into a net loss and lost 52% of its value on the stock market, the Danish wind energy company is looking to become more focused and efficient. It seems like they are determined to move forward.towards this Finally, we developed a plan and provided an encouraging outlook. But, as always, the key question is whether that's enough to change that assessment. from hold buy.

The story so far

The Hold rating was prompted by the company's major challenge last August, when it canceled two Ocean Wind projects in the United States. This announcement caused the company's ADR prices to fall by 25%. It then reported a partially recoverable impairment loss of DKK 28.4 billion, leading to an even bigger price decline of 26%, leading to a third-period operating loss. Quarterly (Q3 2023).

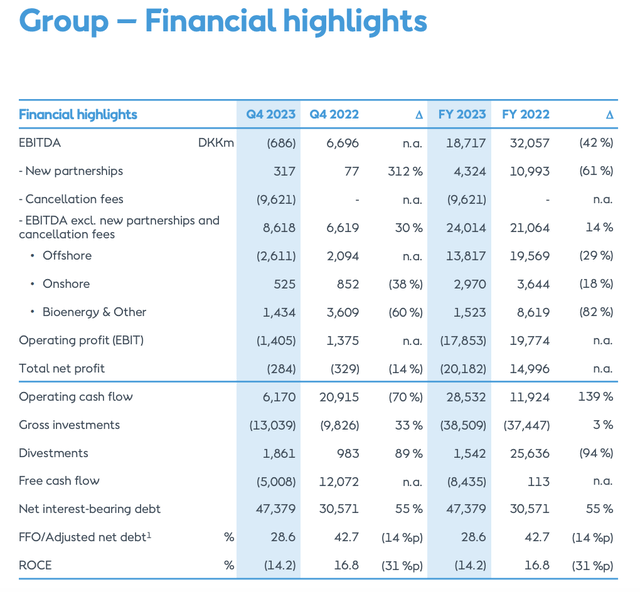

Financials continued to be hampered in the fourth quarter of 2023 by the project's huge cancellation fee of DKK 9.6 billion. EBITDA numbers, which were unaffected by project terminations, were also impacted by these fees in the latest quarter. Ørsted reported that his EBITDA loss for the quarter was DKK 686 million, compared to his profit of DKK 6.7 billion in the same period last year (see table below).

The company also reported a 42% decline in EBITDA for the year, with a net loss of DKK 20.1 billion, compared to a profit of approximately DKK 15 billion in 2022. Orsted faced a decline in power, which was also exacerbated by the harsh and widespread environment. These include prices, supply chain delays, and cost inflation.

Source: Ørsted

Business plan update

To get its act together, Ørsted released its updated business plan along with its annual results earlier this month, which is both good news and bad news for investors at this point. The bad news is that no dividends will be paid for the next three years.subsequent 12 months [TTM] The dividend yield is 3.5%, which isn't the highest, but it's not bad either. It has also been paying dividends consistently for the past six years, so there is some predictability. And finally, dividends have kept investors' capital from being eroded over the past decade, especially as prices have fallen dramatically over the last year (see chart below).

Source: In Search of Alpha

However, the positive news is that the company has a renewed focus, which is expected to result in positive EBITDA growth, which we discuss in the next section. It aims to achieve it in the following steps.

- Narrow your project focus: The company is now focusing on “value over quantity” in its project portfolio, which involves exiting markets such as Norway, Spain and Portugal, and deprioritizing Japan. It is also accelerating divestitures and promoting leaner offshore wind projects. Ørsted expects to raise DKK 15 billion from an accelerated partnership and divestiture program between 2024 and 2026, with total revenues of DKK 70 billion to DKK 80 billion.

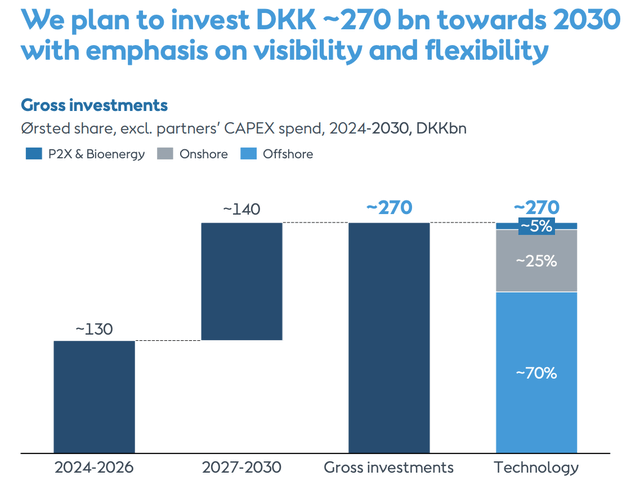

- Capital investment: It also aims to reduce capital expenditure by DKK 35 billion between 2024 and 2026, and expects to invest DKK 130 billion by 2026. That number is expected to nearly double by 2030, mainly due to investment in offshore wind power (see graph below). We also balance capital expenditures with project maturity, ensure permitting is obtained before making large capital expenditures, conduct frequent project reviews, and obtain independent external reviews. We aim to improve capital investment management.

- Cost reduction and control: It also plans to reduce fixed costs by DKK 1 billion by 2026. Considering that the company's cost of goods sold in 2023 was DKK 46.6 billion, this is not a huge reduction, but it is certainly a step in the right direction after the recession. last year. It is also taking steps to prevent supply chain blockages and inflation, such as those seen last year. Among the measures to ensure a smoother supply chain is monitoring of suppliers to track manufacturing progress. Inflation protection will be built into future project arrangements to prevent cost inflation.

Source: Ørsted

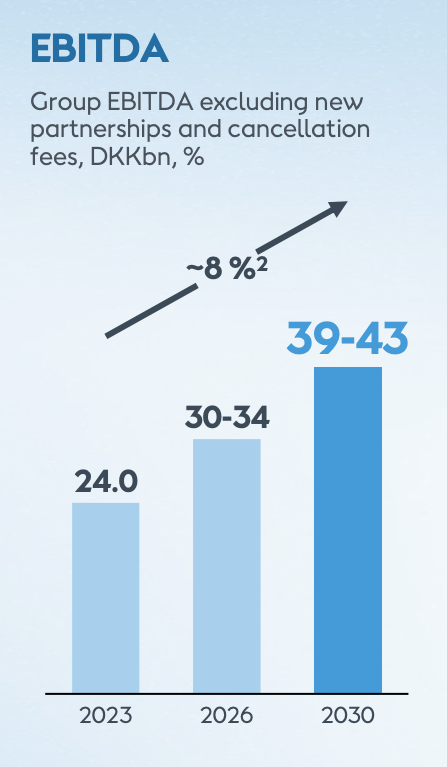

EBITDA growth is expected

As a result of these measures, the company expects to achieve EBITDA excluding growth from new alliances with “high degree of certainty heading into 2026.” His EBITDA in 2026 he expects to be between DKK 30 billion and DKK 34 billion. At the midpoint of the range, this equates to a compound annual growth rate of 10%. [CAGR] From the 2023 level of DKK 24 billion. By 2030, EBITDA is expected to be in the range of DKK 39-43 billion.

Source: Ørsted

To estimate what the EBITDA level means for net income in 2024, we have assumed that the ratio of net income attributable to shareholders excluding new partnerships to EBITDA remains at 69%. The company reported a net loss in 2023, so this would be at 2022 levels. A 10% increase in EBITDA in 2024 would amount to DKK 26.4 billion, slightly above the company's forecast range of DKK 23 to DKK 26. a billion. However, given that we still exceeded our target in 2023, our forecast holds true. This results in a net profit of DKK 18.25 billion (USD 2.74 billion). This represents a 25.5% increase in net profit compared to 2022.

market multiple

Estimating net income, the forward price-to-earnings ratio (P/E) is 8.15x. However, it's worth noting here that this is much more optimistic than analyst expectations on Seeking Alpha (18.2x). Although TTM P/E is not available due to losses in 2023, we also note the favorable EV/EBITDA multiple here. TTM EV/EBITDA is 9.5x, with a 5-year average of 19.2x. Similarly, forward EV/EBITDA is 7.9x compared to the historical average of 15.4x.

What's next?

Slowing market multiples and a positive outlook for 2024 favor stocks. I especially like the soul-searching the company has done to become more focused and effective following last year's difficult development. The short planning time is also impressive.

But making a plan and successfully executing it are two different things. Since the dividend has been suspended and the share price has limited momentum at the moment, I think it would be prudent to see how the plan plays out in practice. It's getting more and more interesting and I'm getting closer to “buy it now”. But just in case, I'll hold off on Ørsted for now.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.