Pigeot

RWE Ag (OTC:RWNEF) (RWEOY) is a German energy company, one of Europe's leading electricity producers, with a total installed capacity of 44.4 GW. We are working on power generation from both conventional (27.8GW) and renewable sources (16.7GW). $4.1 billion acquisition Companies in the Con Edison Clean Energy Businesses (CEB) sector, which owns 3.1 GW of installed capacity, contributed to the addition of 4.2 GW of renewable installed capacity in FY23. Rising electricity prices in Europe resulted in high operating margins and profitability, generating his OCF of €13.9 billion from FY21 to FY23. The cash on hand and debt assumption will be used to finance the company's decarbonization strategy, which aims to become one of the leading players in renewable energy power generation.

The business plan presented in the March 2024 investor presentation is very ambitious and aims to achieve adjusted EBITDA of €9 billion in adjusted net income. By 2030, we aim to have a revenue of €3 billion and an installed renewable energy capacity of over 65 GW. Although lower power prices and higher interest rates may be headwinds in the short term, with a strong balance sheet and significant cash generation, RWE appears to be on track to achieve that. They achieve their goals through both organic and inorganic growth. Considering these reasons and his DCF results, I rate RWE a Buy. I think this is a good investment opportunity to gain exposure to the European renewable energy market.

Business overview

RWE Annual Report 2023

RWE's business is divided into five segments.

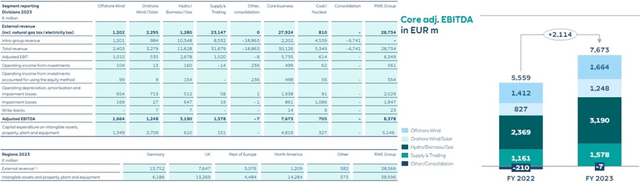

offshore wind power generation is involved in wind power generation through a network of offshore wind farms spanning the North Sea, Baltic Sea and Irish Sea, with an installed capacity of 3.5 GW. In FY23, it accounted for 4.2% of the business unit's external revenue and 19.87% of RWE's adjusted EBITDA (compared to 3.77% and 22.37% in FY22). The EBITDA margin compared to the total revenue generated by the segment in FY23 was 69.2%.

As of December 2023, Onshore wind power generation/solar power generation The installed capacity of this segment is 8.4GW for wind power (7.4GW as of December 2022) and 4.1GW for solar power (0.8GW as of December 2022). This increase was primarily due to the acquisition of CEB. This plant is distributed in Europe, the United States and Australia. In FY23, this business unit accounted for 8% of RWE's external revenue and 14.9% of adjusted EBITDA (compared to 5.81% and 13.1% in FY22). EBITDA margin compared to total business unit revenue for FY23 was 38.1%.

of Hydropower, biomass, gas The business unit has a hydropower generation capacity of 465MW, a biomass power generation capacity of 798MW and a gas power generation capacity of 15.5GW. In FY23, this business unit accounted for 4.4% of external revenue and 38% of RWE's adjusted EBITDA, compared to 4.7% and 37.5% in FY22. The EBITDA margin compared to the segment's total revenue in FY23 was 38.1%.

supply and trade sells electricity generated by other business units to third parties, resulting in 80.5% of external revenue in FY23. Nevertheless, it was characterized by low profit margins, with an EBITDA margin of 5% compared to the segment's total revenue in FY23.

Coal/Nuclear The installed capacity of this segment is 9.7 GW of coal and 146 MW of nuclear. In FY23, it accounted for 2.8% of the business unit's external revenue and 8.4% of RWE's adjusted EBITDA, compared to 2.46% and 11.9% in FY22. The EBITDA margin was 13.18% compared to the business segment's total revenue in FY23.

The table above shows the effective total revenue reported by each business unit. This is very different from external revenue due to accounting rules related to intercompany transactions. RWE generated 48.1% of its external revenues in 2023 in Germany, 26.8% in the United Kingdom, 19.6% in the rest of Europe, 4.2% in the United States and the remaining 1.3% in the rest of the world.

recent and future developments

RWE management is implementing a decarbonization strategy, reducing its exposure to coal and investing in new wind, solar and energy storage systems. In March 2023, the company completed his acquisition of CEB for $4.1 billion, or $6.8 billion, including the business unit's net debt. The deal expands its market share in the US and adds 3.1GW to its renewable energy portfolio, which includes approximately 90% of solar PV systems and a 7GW development pipeline. RWE also invested €430 million in Magnum gas-fired power plants at the end of 2022, which will maintain stable operating cash flows during the planned phase-out of coal-fired power plants by 2030. It is a useful asset for Furthermore, this acquisition is part of that effort. Part of a long-term plan to convert gas-fired power stations into blue and green hydrogen production facilities. In 2023, RWE partnered with Norwegian energy giant Equinor with the aim of producing 2GW of hydrogen by 2030. In December 2023, we completed the acquisition of a 4.2 GW offshore wind farm from Vattenfall in the UK, which is currently under development, for £963 million. It is expected to be completed by 2030. RWE added 4.2 GW of wind and solar capacity during 2023, 95% secured through Power Purchase Agreements (PPAs), Contracts for Difference (CfDs) and Feed-in Tariffs (FiT) agreements. Ta. Management aimed to reduce the volatility of revenue, which remains highly dependent on electricity prices, and increase its share of recurring revenue. Additionally, RWE has solar and wind projects amounting to 6.8GW under construction, 80% of which are already under contract and 15% (1.1GW of Toll offshore wind farm) under negotiation. A 1.1GW storage system is also under construction. The timeline laid out in a March 2024 investor presentation sets a target of a 65GW green generation portfolio by 2030, which will increase both the technology and geographic area in which new generation assets will be built. This is achieved through diversification.

Review and forecast economic performance

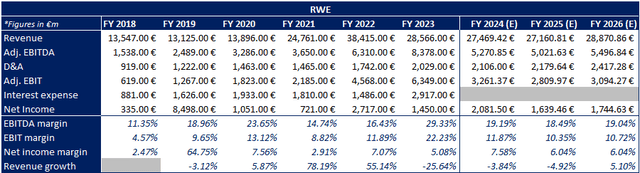

RWE Annual Report and Author Estimates

Higher electricity prices in Europe were the main driver of RWE's revenue growth, which peaked in FY22 but declined by 25.6% year-on-year to €28.5 billion in FY23. In FY23, the company achieved an adjusted EBITDA margin of 22.23% (16.4% in FY22) and an EBIT margin of 22.2% (11.9% in FY22). The improvement in margins can be attributed to increased revenue from energy trading and power plant optimization. Material costs decreased from 81.58% of revenue in FY22 to 70.55% in FY23. Revenue came out differently, falling to 1.45 billion euros due to higher taxes and higher interest expense. The company's tax income in FY22 was EUR 2.2 billion, while its tax expenditure in FY23 was EUR 2.4 billion. Management expects FY24 adjusted EBITDA margin to range from €5.2 billion to €5.8 billion and adjusted net profit from €1.9 billion to €2.4 billion (1.9 billion euros), reflecting the weaker performance in Supply & Trading and the decline in power. The company announced guidance for EPS of 2.6 euros per share. Price level for FY24. In the business plan for 2030, management has targeted EPS of 3 euros per share in 2030 and EPS of 4 euros per share by 2030, assuming his CAGR of 8% from 24 to 30. is.

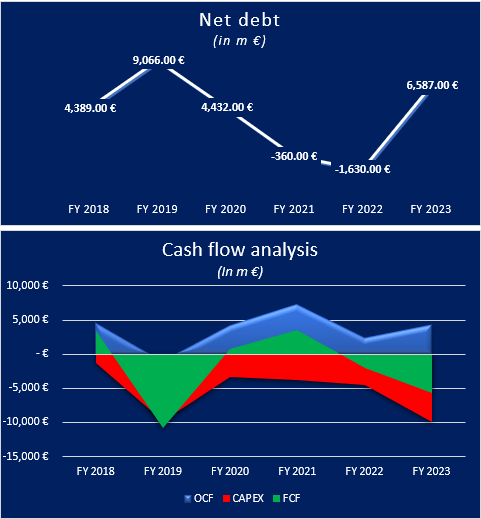

RWE Annual Report and Author Analysis March 2024 Investor Presentation

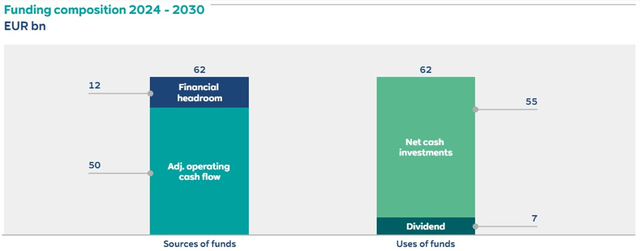

RWE's net debt was €6.5 billion as of December 2023, up from minus €1.63 billion in December 2022, due to high capital expenditures in fiscal year 2023 (€9.9 billion). The company reported negative FCF of €5.7 billion in 2023, due to the CEB acquisition, partially financed through a €2.4 billion convertible note converted in March 2023, and Qatar Holding's position rose to 9.1%, with a dilutive effect on its stake. Management expects a similar trend in fiscal 2024, with positive OCF not being able to cover the outflow of funds due to planned investments. Over the next seven years, management expects his capital expenditures of €55 billion and his dividends of €7 billion, but this is in line with his OCF of €50 billion and his debt of €12 billion. will be covered. The company's net debt/EBITDA ratio for FY2013 is 0.9x (target upper limit is 3x), and it is already set to increase in FY2024. Considering the forecast adjusted EBITDA for 2030 of €9 billion announced in the March 2024 investor presentation, an increase in debt of €12 billion would increase the net debt/EBITDA ratio by three times the baseline. It is likely to be lower. The quick ratio is 1.5x, and short-term liquidity seems secure. Dividends for FY23 are expected to be EUR 1 per share (dividend yield 3.08%), an increase of 11% compared to FY22. Management is targeting average annual dividend growth of 5-10% by fiscal 2030.

Main risks

RWE Annual Report 2023

RWE is subject to market risk. Although the proportion of ordinary revenue is increasing, it is still heavily dependent on electricity rates. Declines in electricity prices can adversely affect a company's economic and financial performance.

Like all energy sector companies, the company is highly sensitive to regulatory risks. The 2024 U.S. presidential election and European Parliamentary elections may introduce regulatory changes, which could have a negative impact on RWE's economic performance.

As of December 2023, 23% of installed capacity consists of coal-fired power plants. Closing these power plants, while accompanied by government subsidies such as the Coal Phaseout Act, would incur additional costs and could lead to lower operating margins. Additionally, €705 million of adjusted EBITDA in FY23, or 8.4% of RWE total adjusted EBITDA, was derived from coal.

The current economic environment, characterized by high interest rates, is a negative factor for capital-intensive companies like RWE, leading to higher interest expenses and reduced borrowing capacity.

RWE is subject to capital dilution risk. The number of outstanding shares increased from 614,745,000 shares in FY2019 to 743,841,000 shares in FY2023.

discounted cash flow

We performed a DCF analysis to assess RWE's intrinsic value and found a valuation of €40.51 per share, approximately 25% above the current market price.

A two-stage model was adopted, with the first stage including estimates up to 30 years. His total CAPEX from FY2024 to FY30 was set at €55 billion, in line with the estimates in his March 2024 investor presentation. The same was done for the estimation of EBIT used for terminal value. TV's calculations performed a discounting of the cash flows generated over his 30-year period (FY2031-FY60), a period consistent with the average life of a solar or wind farm. For the evaluation, the following assumptions were made:

Beta = 0.64x (retrieved from Investing.com)

MRP (5.69%) and risk-free rate (3.28%) were obtained using Fernandes data for the year 2024 and weighted by the geographic breakdown of the company's revenue. As a result, the cost of equity was 6.95%.

The cost of debt of 5.93% is obtained by dividing the interest paid by RWE by the total debt.

WACC= 6.48%, g = 2% is in line with the European inflation target.

Author's analysis and estimation

conclusion

RWE is a financially sound company with net debt/EBITDA of 0.9x and quick ratio of 1.5x in FY23. The dividend yield is over 3% and is expected to grow between 5% and 10% annually until 2030. Nevertheless, the company is primarily funded through operating cash flow and is committed to an aggressive growth strategy. If the business plan is successfully implemented, the company expects to achieve adjusted EBITDA of 9 billion euros and adjusted net profit of 3 billion euros by 2030. At the same time, this will enable the company to work on decarbonizing its operations. Additionally, a DCF analysis based on management estimates reported in the March 2024 investor presentation valued the company 25% above current market value. RWE has some risks that should not be underestimated, but they are not an undue concern. For these and other reasons explained in the article, I rate RWE a Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.