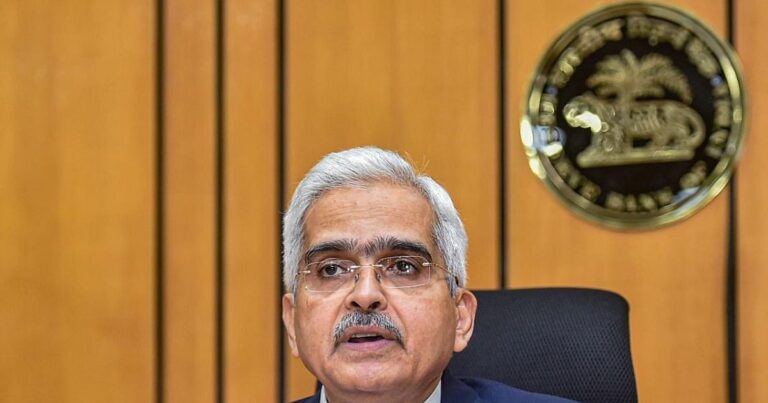

MUMBAI: Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday said banks will have to rethink their business strategies to address the persistent gap in credit and deposit growth.

He also said further measures could be taken to curb the growth of unsecured loans if necessary.

In November last year, the RBI had expressed certain concerns over excessive growth in unsecured retail lending and NBFCs' over-reliance on bank funds.

“Recent data indicates some easing in such loans and advances. We are closely monitoring the incoming data to assess whether further measures are required,” he said while announcing the bimonthly policy.

“This sends a message that the RBI is closely monitoring all aspects of the financial sector, particularly the banking sector. We will be agile, cautious and take further action if required,” he said while talking to reporters.

The Reserve Bank increased the risk weights of unsecured consumer credit and bank credit to non-banking financial companies on November 16, 2023 to forestall potential build-up of risks in these segments.

As a result, credit growth for unsecured personal loans such as 'outstanding credit cards' declined from 34.2% in November '23 to 23% in April '24, while bank credit growth to NBFCs declined from 18.5% in November '23 to 14.4% in April '24.

Das said the board and management of regulated companies should ensure that the risk limits and risk exposures of each business unit are kept well within their respective risk tolerance frameworks.

“The continuing gap in credit and deposit growth rates will require bank boards to rethink their business plans and realign their strategies. They will need to maintain a careful balance between assets and liabilities,” he said.

Stressing that customer protection remains the central bank's top priority, he said that while the RBI has ensured that the guidelines in the Key Facts Statement (KFS) are generally followed, some regulated entities (REs) continue to charge fees and other charges that are not specified or disclosed in the KFS.

It has also been observed that some microfinance institutions and non-banking finance companies are charging high interest rates on small loans, making them appear like loan sharks, he said.

He said the regulatory freedom that real estate companies enjoy with regard to interest rates and fees should be used judiciously to ensure fairness and transparency in pricing of products and services.

He added that the central bank will continue to maintain constructive relations with these financial institutions to protect the interests of their clients and ensure overall financial stability.

Published June 7, 2024 11:25 IST