Sheila Bear talks about the New York community bank crisis on “Claman Countdown.''

The next CEO will be new york community bank (NYCB) announced Thursday that it is working on a new business plan after the beleaguered bank received a $1 billion lifeline from investors on Wednesday. He also announced a dividend cut for the second time this year and revealed that deposits had fallen by 7%.

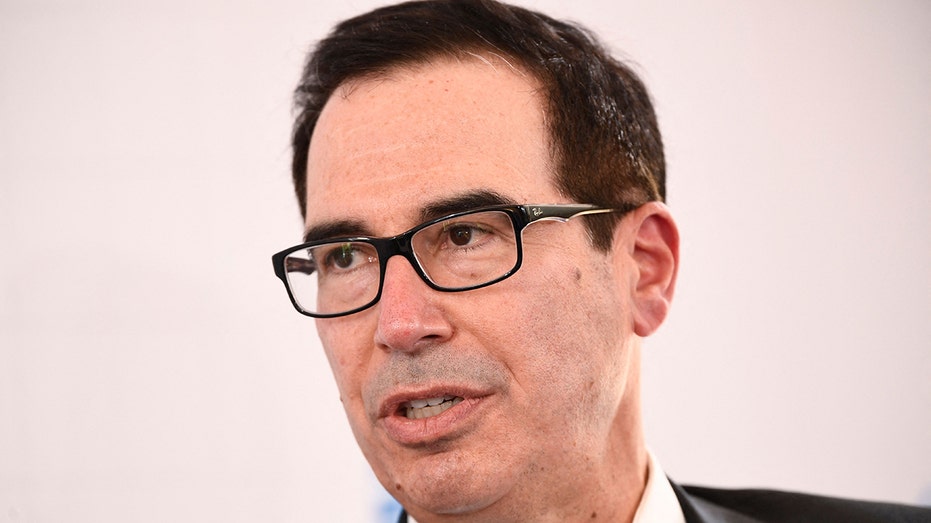

Yesterday, Joseph Otting, former Comptroller of the Currency in the Trump administration, was named CEO of NYCB as the company received a $1 billion capital infusion from a group of investors including: Former Treasury Secretary Steven Mnuchin Member of the management team of Liberty Strategic Capital and several other companies and banks.

Otting and non-executive chairman Alessandro Dinero said on a call with analysts Thursday that the bank's new business plan will be announced in late April. Mr. Otting was previously credited with helping Mnuchin turn around mortgage company IndyMac, which he and a group of investors bought into receivership of the Federal Deposit Insurance Corporation (FDIC) in 2009.

The bank reported total deposits as of March 5 at $77.2 billion, down about 7% from the previous month, when they totaled $83 billion. Approximately 19.8% of the company's deposits are uninsured, a relatively low percentage compared to peer banks, indicating that NYCB has sufficient liquidity to provide extended deposit insurance to its customers. did.

Embattled NYCB bank receives $1 billion investment from group including Mnuchin's firm

New York Community Bank announced a second dividend cut and reduced deposits, but noted it has enough liquidity to provide expanded deposit insurance. (Bing Guan/Bloomberg via Getty Images/Getty Images)

Dinero said some customers lined up to withdraw their deposits on Wednesday following media reports that the bank was seeking capital, but later in the afternoon after the company's press release. The situation is said to have stabilized.

| ticker | safety | last | change | change % |

|---|---|---|---|---|

| new york cb | NEW YORK COMMUNITY BANCORP INC. | 2.84 | -0.16 | -5.33% |

NYCB has been trying to stabilize pressure on its stock price since announcing an unexpected quarterly loss and cutting its dividend in late January in anticipation of the deadline. More stringent regulatory requirements A bank with over $100 billion in assets.

The lender exceeded that threshold last year. Obtained in 2022 the acquisition of Flagstar Bank and the acquisition of the assets of Signature Bank after its failure due to the local banking crisis;

New York Community Bank seeks cash infusion

Former US Treasury Secretary Steven Mnuchin's Liberty Strategic Capital was part of the investment group that provided NYCB with a $1 billion capital injection. (Patrick T. Fallon/AFP via Getty Images/Getty Images)

The bank also announced a further reduction in its quarterly dividend on Thursday, to 1 cent per share instead of the 5 cents announced in January.

Investors are keeping an eye on NYCB's exposure to New York's troubled commercial real estate sector and the bank's announcement last week.material weakness The Company's internal controls related to internal loan review resulted from ineffective supervision, risk assessment, and monitoring activities. ”

New York Community Bank's stock rebounded after the announcement of a $1 billion lifeline from investors. (Bing Guan/Bloomberg via Getty Images/Getty Images)

CLICK HERE TO GET FOX BUSINESS ON THE GO

NYCB stock rose as much as 12% in early trading Thursday, but the market has since pared back some of that gain. The company's stock was trading at $3.69 per share as of mid-afternoon Thursday, up 6.65% but down more than 64% year-to-date.

Reuters contributed to this report.