(Bloomberg) — Thames Water board members will hold final talks this week to update its business plan after shareholders branded the previous one “uninvestable” is.

The heavily indebted utility's board will meet Thursday and the plan will be announced Friday, said a person familiar with the plan, who asked not to be identified discussing a private matter.

The River Thames, which supplies a quarter of England's water and wastewater services, including London, is facing an investment of at least £2.5 billion after parent company Kemble Water Holdings last month refused to inject further funding into the river. The company is rushing to secure capital of $3.1 billion. work.

The River Thames needs cash to rebuild, repair chronic leaks and sewage spills and develop new supply in the face of worsening droughts caused by climate change. But investors said overly restrictive regulations by industry watchdog Ofwat made funding impossible.

Kemble, which derives all of its income from Thames Water dividends, defaulted a week after refusing to make further payments.

When Thames announced its new five-year business plan in October, the utility said it wanted to increase bills by 40% to fund an investment program totaling £18.7bn. These figures may be revised upwards as the River Thames seeks to meet new rules set by the government to improve its environment.

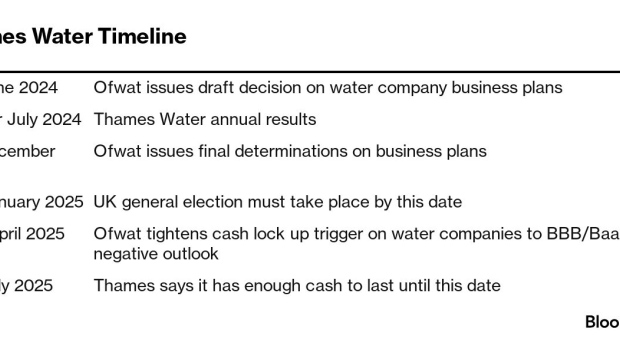

The plans are currently being scrutinized by Ofwat as part of a regulatory process known as PR24. A draft decision from the regulator is expected to be published on June 12th.

So far, other water companies, in consultation with Ofwat and the government, have increased their expected capital expenditure and further increased bills ahead of the June decision.

Southern Water Services, one of the industry's worst-performing companies along with Thames, revised its spending forecast upward by 8.5% in March, predicting average annual customer bills of £727 by 2030. announced that it would be raised from the October forecast. 681. Its customers will face the biggest bill increase across the UK.

Another power company, Severn Trent, also raised its spending plans slightly, saying customers' annual bills would average £547.10 by 2030, 75p more than it planned in October.

However, not all companies have revised their spending forecasts upwards, suggesting Thames' next move will not be easy. Yorkshire Water has lowered its capital expenditure forecasts from plans set out in October, as well as lowered its customer bill forecasts. United Utilities revised its spending upward, but said the bill would be 3p lower than originally expected.

A spokeswoman for Thames Water declined to comment.

©2024 Bloomberg LP