Investors are increasingly hopping on the ESG train, while the COVID-19 pandemic, climate change concerns, rising cyber incidents, global supply chain issues, economic disparities, social justice movements, and more are driving companies closer to the ESG train. This has become a catalyst for rapidly increasing the adoption rate.

Environmental, social, and governance (ESG) is a framework for sustainability management, ethical practices, and conscious consumerism that is gaining traction in the business world. But it's not a new phenomenon. Rather, it is a continuation of socially responsible investing that has gone mainstream.term ESG ESG investing officially began in 2004 with the publication of the United Nations Global Compact Initiative's first Who Wins report, and since then ESG investing has evolved and expanded.

Socially conscious investors and other stakeholders (e.g., employees, customers, regulators, suppliers, distributors, etc.) need to understand a company’s stance on socio-economic factors, sustainability efforts, and corporate governance processes. I would like to know about. According to Bloomberg Intelligence, global ESG assets under management could exceed $50 trillion by 2025, one-third of the total assets the firm predicted at the time.

Developing a successful ESG plan that passes the test of investors and stakeholders may seem difficult for any company, but a well-thought-out ESG strategy can offer a variety of business benefits. may lead to.

What is ESG strategy?

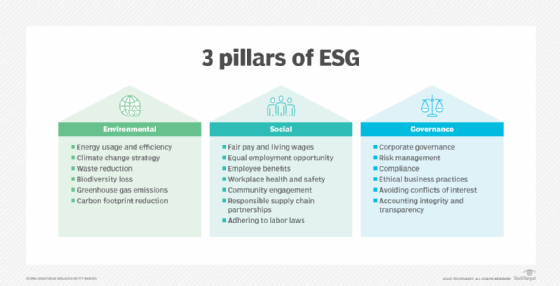

ESG strategy is an organization-wide approach that aligns a company's environmental, social, and governance practices to improve business sustainability. The success and growth of the business is now more directly tied to his ESG strategy, which is stronger than ever. This includes operating our business in a way that provides long-term value without negatively impacting the environment or society. At least it's effective.

A good ESG strategy includes a variety of sustainability elements, such as a company's commitment to reducing its carbon footprint, caring for the environment, promoting diversity, and implementing employee wellness programs. . We also focus on the initiatives that are most important to your business and the easiest to implement. ESG strategies thus pave the way for companies to gain investor confidence, gain customer loyalty, reduce operating costs, and improve both asset management and financial performance.

5 ESG benefits for companies

Using an ESG framework can deliver tangible benefits to both companies and investors. For companies, it opens up access to larger pools of capital, fosters stronger brand identities, and allows investors to demonstrate their value through investments associated with ESG-focused brands that are comparable to or better than traditional approaches. You can get more returns.

Here are five benefits of ESG for companies:

1. Provides a competitive advantage

Companies that participate in ESG initiatives often gain a competitive advantage over their business rivals. For example, a 2022 survey of 1,062 U.S. residents by Greenprint, a sustainability tools provider now owned by PDI Technologies, found that 66% of respondents I found myself willing to spend the extra money. Similarly, in his 2022 survey conducted by TechTarget's Enterprise Strategy Group, 70% of 400 IT professionals said their company preferred their IT products from vendors with good ESG practices. respondents said they expected to pay a price premium of 5% or more.

The various ESG metrics tracked and reported by companies are also important to consumers, employees, lenders, and regulators. Company leaders who strive to improve working conditions, promote diversity, give back to their communities, and address socio-economic issues play a major role in strengthening their company brand.

2. Attract investors and lenders

There is a trend among companies to include ESG reports in their earnings reports and separate disclosures. Investors and lenders are becoming highly attracted to organizations that invest in ESG and leverage ESG disclosures to demonstrate their sustainability efforts. A Gallup survey published in 2022 found that 48% of investors are interested in sustainable investment funds, and a Dow survey of 200 investment professionals also conducted in 2022 found that 48% of investors are interested in sustainable investment funds. Jones Research predicts that ESG investing will more than double over the next three years.

Social concerns caused by the pandemic, climate change and the misuse of natural resources have led investors to turn to sustainable businesses, including unfair wages, fossil fuel investments, unsustainable farming practices and manufacturing. is designed to eliminate outdated practices. Products that cannot be recycled. Companies that engage in ESG initiatives can influence investment decisions by providing a comprehensive view of their practices, allowing investors to choose companies that offer a low-risk, sustainable future.

3. Improving financial performance

ESG can not only make your business better for investors, but it can also improve the overall financial performance of your business. Even small steps toward sustainability, such as going paperless, recycling, and energy-efficient upgrades, can improve a company's bottom line and its ROI.

To address ESG programs, companies need to track key metrics such as energy consumption, raw material usage, and waste disposal, which can ultimately lead to lower energy bills and cost savings. there is. Companies that remain compliant with ESG-related regulations are also less exposed to fines, penalties, and other business risks, positively impacting their bottom line.

For example, in 2020 food and beverage company Nestlé announced it would invest up to $2.1 billion by 2025 to transition from traditional plastics to food-grade recycled plastics. The move is expected to help Nestlé reduce its carbon footprint and lower compliance costs, especially in regions where laws against the use of plastic packaging have become stricter.

4. Build customer loyalty

A 2021 Accenture survey of more than 25,000 consumers across 22 countries found that 50% have changed their product purchasing priorities due to the COVID-19 pandemic. Reported that it has been readjusted. These consumers are willing to pay extra for brands that align with their values and are more loyal to organizations that treat people well. Today's socially conscious consumers want to know what the companies they support are doing for the greater good.

Companies that adhere to ESG principles can attract and retain more customers by being transparent and effectively communicating their ESG efforts to customers.

5. Make business operations sustainable

Companies that invest in ESG initiatives can sustain and adapt to an ever-changing landscape. For example, companies that properly integrate ESG principles into their core operations better identify cost reduction opportunities and enjoy lower energy consumption, less resource waste, and lower overall operating costs. can.

For now, ESG reporting is only mandatory for publicly traded companies in some jurisdictions, but the rest of the corporate world appears to be moving in that direction. Companies that ignore ESG policies now may have to deal with them later in the form of legal, regulatory, reputational, and compliance issues.

Does ESG apply to companies of all sizes?

Small and medium-sized enterprises may believe that a lack of resources may hinder ESG implementation and that ESG efforts will not pay off in the long term. But even on a small scale, ESG investments can always have a positive impact on your business.

While larger organizations may have additional resources to develop ESG policies or form high-level sustainability partnerships, smaller companies may Attract socially conscious investors without the bureaucracy and red tape. Small and medium-sized businesses are often closer to their customers and have more opportunities to share their sustainability stories and connect on a deeper level.

long-term ESG

An effective ESG plan demonstrates a company's commitment to risk management, cost reduction, and environmental stewardship. It also means that companies have strong stances on socio-economic issues such as customer satisfaction, labor standards, social injustice and sustainable investing, and are willing to evolve as the market changes. is showing.

Despite all the positives of ESG investing, critics, including many U.S. Republican politicians, argue that ESG investing fails to deliver the kind of results it promises in the real world, and that market and political It is also facing significant backlash. However, this does not seem to slow down companies' ESG adoption rates, and in fact, ESG investing can generate solid returns overall. ESG and sustainability funds offer lower volatility and often outperform traditional funds in 2020 and 2021, with similar returns in 2022, according to Morningstar Index data.