Beo88/iStock via Getty Images

Investment Thesis

My fundamental analysis indicates that Anheuser-Busch InBev SA/NV (BUD) has failed to effectively manage years of high profitability to extend the growth phase of its life cycle. The company is exhibiting a secular decline in profitability. Overall, the metrics are too low, which is a big red flag for me. While revenue growth over the past decade has been roughly in line with general inflation, trend analysis shows that costs are outpacing revenue growth. In my opinion, this means that the company's pricing power is weakening amid increased competition. Finally, my valuation analysis shows that the stock is slightly overvalued. Overall, I give the stock a “Hold” rating.

Company Information

Anheuser-Busch InBev SA/NV is the world's largest brewer by volume and one of the world's leading consumer goods companies by revenue. BUD produces, markets and distributes more than 500 varieties of beer. and other malt beverage brands.

The company's fiscal year ends on Dec. 31. BUD segments by geography, and more than 70% of its fiscal 2022 revenue was generated outside North America, according to its most recent SEC annual filing.

Finance

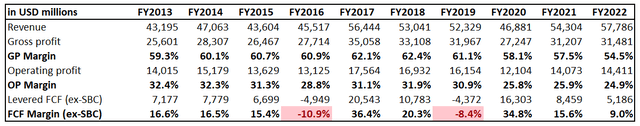

The company's financial performance over the past decade has not been stellar. Although sales CAGR was a respectable 3.3%, profitability indicators across the board have deteriorated significantly. Operating margins have fallen sharply from 32.4% a decade ago to 24.9% in FY2022. As a result, free cash flow is expected to grow at a CAGR of 3.3%. [FCF] Margin excluding stock compensation [ex-SBC] It's also worth mentioning that FCF margins have been very volatile over the past decade.

Author's calculations

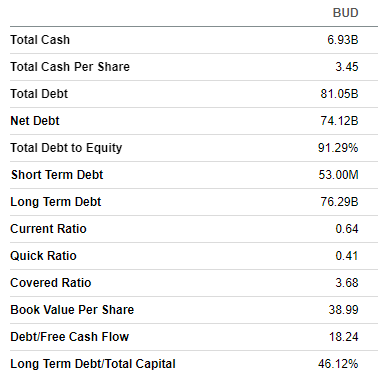

Despite a strong average FCF margin of 14.5% over the past decade, the company's balance sheet does not look robust. Outstanding debt was over $80 billion as of the last reporting date, far exceeding the outstanding cash balance. Leverage ratio is below 1, but still looks too high to me. Short-term liquidity metrics also do not look very robust. The business is capital intensive, and management has not been very efficient at allocating capital. The company maintained relatively high FCF margins for most years in the past decade. At the same time, BUD has not built a strong balance sheet or pleased shareholders, as it has rarely repurchased stock and has not delivered impressive dividend growth.

Find Alpha

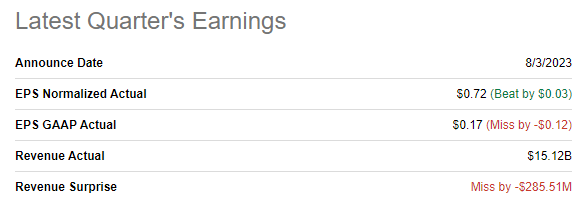

The company's latest quarterly results were released on August 3, and they missed consensus estimates. Adjusted EPS shrank from $0.75 to $0.72, even though revenues increased 2.2% year over year. The decline in profitability was due to both cost of sales and selling and administrative expenses growing faster than revenues.

Find Alpha

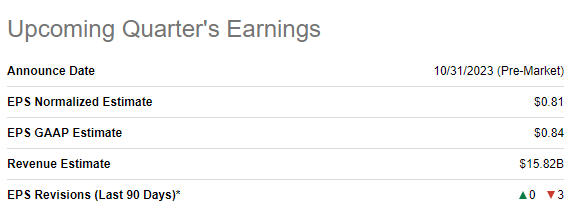

The next quarter's earnings are scheduled to be released on October 31. Consensus estimates are calling for quarterly revenue of $15.82 billion, indicating 4.8% growth year-over-year. Adjusted EPS is expected to be flat year-over-year despite the expected solid revenue growth.

Find Alpha

In conclusion, I do not like the trends in the company's financial performance. There is little evidence that the company is making strong strategic moves to drive revenue growth or improve BUD's profitability. The lack of expansion in profitability metrics indicates weak pricing power, despite the company having a solid and large portfolio of well-known beer brands, as the company struggles to pass on the impact of inflation to customers. The inability to align prices with cost inflation indicates increased competition as the company competes not only with other brewers but all soft drink makers. The company's below-average balance sheet also suggests that it does not have many resources to drive significant revenue growth in the near future. Overall, I believe the company is in the later stages of its business life cycle.

evaluation

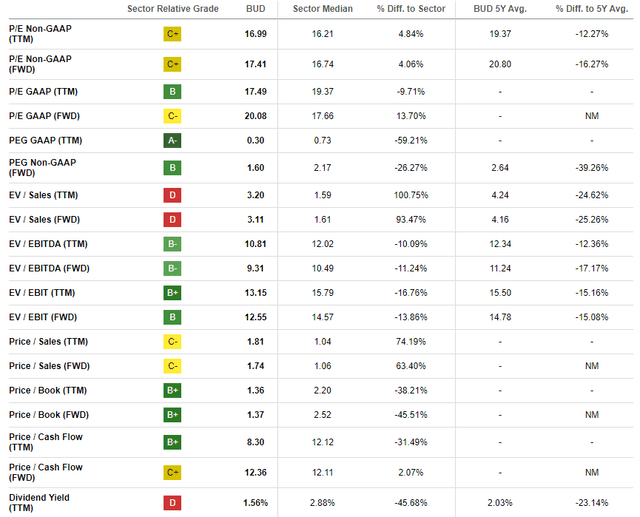

The stock is down about 10% year to date, significantly underperforming the overall U.S. market. Seeking Alpha Quant gives the stock a low “D+” rating, meaning the stock is likely overvalued based on ratio analysis. Meanwhile, current multiples are significantly lower than historical averages across the board. For a company the size of BUD, I think it's more appropriate to compare current multiples to historical averages.

Find Alpha

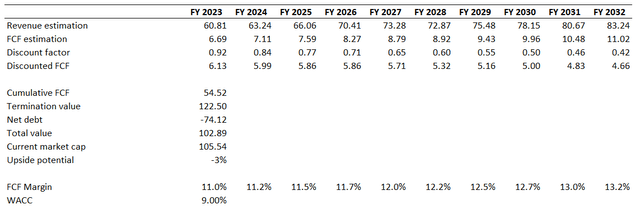

Even though BUD is a dividend stock, it has not been very consistent in its dividends. Therefore, its discounted cash flow is [DCF] Better to go ahead and do a simulation. I'll use a 9% WACC for discounting. TTM FCF ex SBC margin is 11%, which I'll build into the base year and expand by another 25 basis points per year. Consensus forecasts for earnings project a 4% CAGR over the next 10 years, which I think is reasonable to use in the DCF.

Author's calculations

According to my DCF simulation, the stock is about fairly valued when the outstanding net debt is factored into the calculation. That said, the current share price is close to fair value and I don't see any upside potential from current levels.

Risks to consider

A major long-term risk to the company's business is the growing proportion of people who are becoming more health conscious. And, generally speaking, it's well-known that drinking alcohol is bad for your health. That said, trends in beer consumption are likely to worsen in the long term. Sluggish sales growth and shrinking profitability suggest the company is too reliant on traditional beer brands and lacking innovation in non-alcoholic drinks.

Another significant risk relates to the company's global expansion. Selling its products around the world means that BUD faces significant international trade risks, including possible changes in regulations and tariffs. Failure to comply with the complex web of international rules and laws could lead to significant financial damage and reputational loss. With over 70% of its sales generated outside North America, the company faces significant foreign exchange risks.

Conclusion

In conclusion, BUD is a HOLD. The company's financial performance has been declining over time due to management's over-reliance on legacy brands and lack of initiatives to drive growth or improve operational efficiencies. The company has not demonstrated solid efficiency to absorb high FCF margins over the years. It has not been able to build a strong balance sheet to be well-positioned to extend the growth phase of its life cycle. Additionally, the valuation is unattractive.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.