Dividend investing can be a good investment strategy. Dividend stocks have historically outperformed their stock prices. S&P500 Volatility is lower. That's because dividend stocks provide two sources of income: regular income from dividends and stock price appreciation. This total return can increase over time.

Because dividend stocks have lower volatility, they are often attractive to investors looking for a lower-risk investment, especially those who are retired or nearing retirement. But dividend stocks can still be risky if you don't know what to avoid. Here we take a closer look at how to invest in high-dividend stocks.

How dividend stocks work

How dividend stocks work

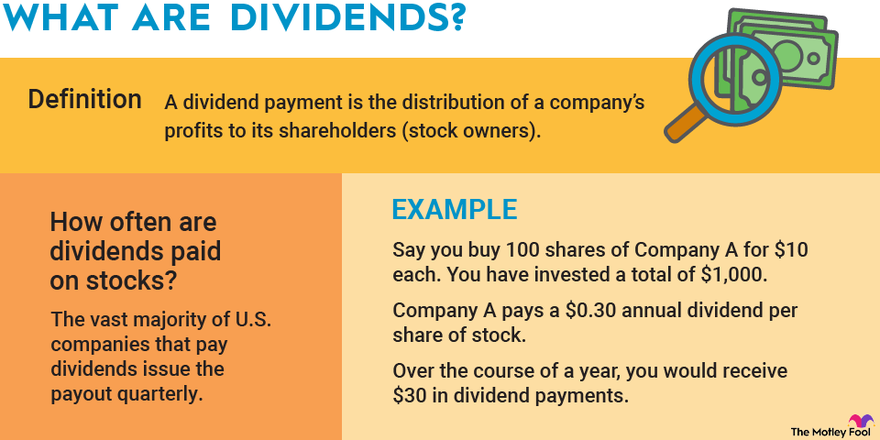

Let's look at an example. Suppose you purchase 100 shares of a company's stock at $10 each, and each share pays an annual dividend of $0.50. If he invested $1,000, he would receive $50 in dividends in one year. This equates to a 5% dividend yield, which isn't terrible.

What you do with the dividends is up to you. you can:

- DRIP — Automatically reinvest to buy more shares in a company through a dividend reinvestment plan (DRIP).

- Buy stock in another company.

- Save your cash.

- Let's spend money.

As long as the company continues to pay dividends, you will receive dividends regardless of whether the company's stock price goes up or down.

The benefit of dividend-paying stocks is that a portion of your earnings includes predictable quarterly payments. Not all companies that offer dividend stocks can maintain their dividends in every economic environment, but a diversified portfolio of dividend stocks can generate reliable income come rain or shine.

As the value of the companies you own grows, these dividends combined with capital appreciation can result in a total return that can match and even exceed broader market returns.

Image source: Motley Fool

Dividend per share

Dividends paid by a company per share and commonly used per share metrics.

example

Dividend stock example

Below are some well-known companies with a long history of paying dividends, their dividend yields at recent stock prices, and the per share amount of each dividend.

|

company |

industry |

dividend yield |

quarterly dividend |

|---|---|---|---|

|

Chevron (NYSE:CVX) |

energy |

3.99% |

$1.51 |

|

Procter & Gamble (NYSE:PG) |

consumer defense |

2.53% |

$0.94 |

|

Lowe's (NYSE:LOW) |

consumer circulation |

2.05% |

$1.10 |

Both Procter & Gamble and Lowe's have increased their stock dividends for more than 50 consecutive years, making them part of an elite group of companies known as Dividend Kings. These companies are also part of Dividend Achievers, which are S&P 500 index companies that have increased their dividends for more than 25 consecutive years. Chevron is also an aristocratic company with more than 35 years of consecutive dividend increases. Dividend stocks can occur in almost any industry, and dividend amounts and yields can vary widely from company to company.

Key indicators

Dividend yield and other key indicators

Before buying high-dividend stocks, it's important to know how to value them. These metrics can help you understand the expected dividend amount, the reliability of the dividend, and most importantly, how to spot any red flags.

- dividend yield: This is an annualized dividend expressed as a percentage of the stock price. For example, if a company pays $1 in annual dividends and the stock's price is $20 per share, the dividend yield is 5%. Yield serves as a valuation metric when comparing a stock's current yield to historical levels. All else being equal, a higher dividend yield is better, but a company's ability to maintain, and ideally increase, its dividend is even more important. An unusually high dividend yield can be a red flag.

- Dividend payout ratio: This is the ratio of dividends to a company's earnings. If a company earns a net income of $1 per share and pays a dividend of $0.50 per share, the dividend payout ratio is 50%. Generally, the lower the payout ratio, the higher the sustainability of the dividend.

- Dividend payout ratio: This is the ratio of a company's operating cash flow minus capital expenditures, or free cash flow. This metric is important because GAAP net income is not a cash measure and a company's earnings and free cash flow can fluctuate significantly from period to period due to various non-cash expenses. This variation can make a company's dividend payout ratio misleading. Investors can use the cash dividend payout ratio along with the simple payout ratio to better understand dividend sustainability.

- total return: This is the increase in the share price (known as capital gains) and the dividends paid. For example, if he paid $10 for a stock that increased in value by $1 and paid a dividend of $0.50, his $1.50 earned represents a total gain of 15%.

- Earnings per share (EPS): The EPS metric normalizes a company's earnings to its value per share. The best dividend stocks are companies that have shown the ability to regularly increase their earnings per share and raise their dividends over time. A history of profit growth is often evidence of a durable competitive advantage.

- PER: The price-to-earnings ratio is calculated by dividing a company's stock price by its earnings per share. P/E ratio is a metric that can be used along with dividend yield to determine whether a dividend stock is fairly valued.

High yields aren't everything

High yields aren't everything

Inexperienced dividend investors often make the mistake of buying stocks with the highest dividend yield. There's nothing wrong with high-yield stocks, but their high yields may be the result of falling stock prices due to the risk of dividend cuts. This is called the dividend yield trap.

To avoid falling into the yield trap, follow these steps:

- Avoid buying stocks based solely on dividend yield. When a company has a significantly higher yield than its peers, it's often a sign of a problem rather than an opportunity.

- We use the payout ratio to assess dividend sustainability.

- We use a company's dividend history (both dividend growth and yield) as a guide.

- Examine the balance sheet, including debt, cash, and other assets and liabilities.

- Think about the company or industry itself. Is the company's business at risk from competitors, weak demand, or other disruptions?

Sadly, yields often sound too good to be true. It's better to buy stocks with low yields and solid dividends than to chase high yields that may turn out to be illusory.Also, focus on dividends growth A company's history and ability to raise stock dividends often result in higher profitability.

tax

How are dividends taxed?

Most dividend stocks pay “qualified” dividends and are taxed at rates between 0% and 20%, depending on your tax bracket. This range is significantly lower than ordinary income tax rates of 10% to more than 37%. (Certain investment income of a high earner is subject to an additional 3.8% tax.)

Although most dividends are subject to lower tax rates, some dividends are classified as “ordinary” or non-qualified dividends and are taxed at marginal tax rates. Some types of stocks are structured to pay high dividend yields and may result in higher tax liability due to their corporate structure. The two most common are real estate investment trusts (REITs) and master limited partnerships (MLPs).

Of course, this additional tax burden does not apply if dividend stocks are held in a tax-advantaged retirement plan such as an Individual Retirement Account (IRA). However, investing in an MLP may also incur taxes on your IRA.

Dividend stock related topics

strategy

dividend investment strategy

There's a misconception that dividend stocks are only for retirees and risk-averse investors. it's not. When you start investing, you should always consider buying high-dividend stocks for long-term profits. Dividend stocks, especially those of companies that consistently increase their dividends, have historically outperformed the market with low volatility, as measured by a metric called “beta.” That's why dividend stocks are perfect for almost any investor. Helps you create a diversified asset building portfolio.

beta

A measure of the systematic risk associated with stocks or other investments.

There are several dividend strategies to consider. The first is to build a dividend portfolio as part of your overall portfolio. When building a dividend portfolio, it's important to remember that it is not mandatory for companies to pay dividends, any more than companies have to pay interest on corporate bonds. That means dividends could be at risk if companies have to cut costs.

Although you cannot completely eliminate the risk of dividend cuts, you can reduce the risk. Focus less on a company's dividend yield and more on its ability to consistently increase its dividend. Look for companies that are focused on growing industries and have healthy financials.

Another aspect of a dividend investment strategy is determining how to reinvest dividends. Some investors choose to manually reinvest their dividends, while others use a dividend reinvestment plan, also known as a DRIP. This powerful tool automatically reinvests all the dividends you earn back into that company's stock with no fees or charges. This simple set-it-and-forget tool is one of the easiest ways to use the power of time and the value of compounding to your advantage.

Another dividend investing strategy is to invest in dividend-focused exchange traded funds (ETFs) or mutual funds. These fund options allow investors to own a diversified portfolio of dividend stocks that generate passive income.

No matter which dividend strategy you use, it's beneficial to add dividend stocks to your portfolio. These can help reduce volatility and increase your total return, helping you reach your financial goals a little faster.

Jason Hall has no position in any stocks mentioned. The Motley Fool has a position in and recommends Chevron. The Motley Fool recommends his Lowe's Companies. The Motley Fool has a disclosure policy.