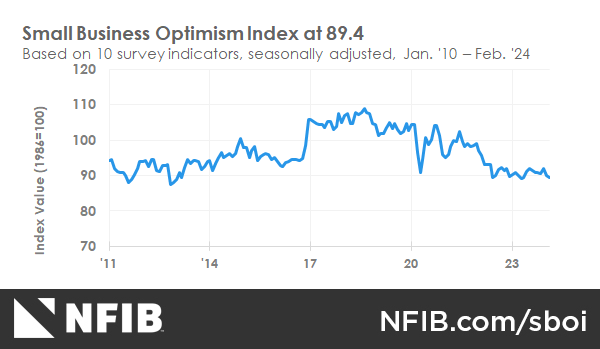

The NFIB Small Business Optimism Index fell to 89.4 in February, the 26th consecutive month below the 50-year average of 98. 23% of small business owners say inflation is the most important management issue in running their business, an increase. Labor quality replaced the top issue, up 3 points from last month.

“While inflationary pressures have eased since their peak in 2021, small business owners are still managing rising costs due to rising prices and interest rates,” he said. Bill Dunkelberg, NFIB Chief Economist. “The labor market has also eased slightly, as it has become easier for small business owners to attract and retain employees.”

Key findings include:

-

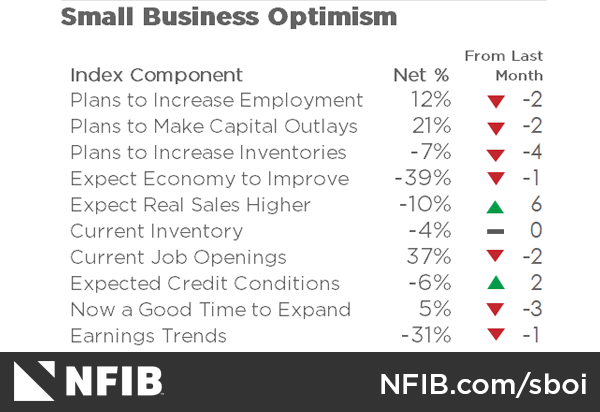

Reports on worker quality as the most important issue for employers fell five points to 16%, the lowest figure since April 2020.

-

The net percentage of owners expecting further growth in underlying sales increased by 6 points from January to a net negative 10% (seasonally adjusted), an improvement from last month.

-

Plans to fill open positions for small business owners continue to slow, with the seasonally adjusted net 12% of new jobs expected to be created over the next three months at the lowest level since May 2020.

-

37% of all business owners (seasonally adjusted) said they had jobs they were unable to fill this fiscal year, a decrease of 2 points from January and the lowest level since January 2021.

-

The net percentage of owners who increased their average sales price decreased by 1 percentage point from January to a net 21% (seasonally adjusted), the lowest level since January 2021.

As reported in NFIB's Monthly Employment Report, 56% of owners reported hiring or looking to hire in February. His 25% of owners reported that there were few qualified applicants for their open positions, and 26% reported that there were none.

54% of owners reported making capital investments in the past six months, down 5 points from January. Of those spending, 35% reported spending on new equipment, 23% acquired a vehicle, and 15% improved or expanded their equipment. 12% spent money on new fixtures and furniture, and 6% acquired new buildings or land for expansion. 21% (seasonally adjusted) plan to make capital investments in the coming months.

13% (seasonally adjusted) of all owners reported an increase in nominal sales over the past three months. The net percentage of owners expecting real sales volume growth improved by 6 points to a net negative 10% (seasonally adjusted).

The net percentage of owners reporting inventory increases decreased by 1 percentage point to a net negative 1% (seasonally adjusted). 13% reported an increase in inventory and 19% reported a decrease in inventory. As of February, owners who believed current stock inventories were “too low” had a net negative 4% (seasonally adjusted).

By industry, shortages were most frequently reported in transportation (17%), services (12%), construction (11%), and manufacturing (11%). Shortages were reported least frequently in the wholesale sector (0%) and agriculture sector (5%). Owners planning to invest in inventory in the coming months have a net negative 7% (seasonally adjusted).

The net percentage of owners who increased their average sales price decreased by 1 percentage point from January to a net 21% (seasonally adjusted), the lowest level since January 2021. 23% of owners said inflation was the single most important issue in running their business, replacing quality of labor as the top issue.

Unadjusted, 16% reported a lower average selling price and 37% reported a higher average selling price. The industries with the highest price increases were financial (up 59%, down 2%), retail (up 43%, down 13%), construction (up 42%, down 8%), and services (up 36%). , down 8%). ), professional services (36% higher, 0% lower) sector. After seasonal adjustment, the planned price increases by a net 30%.

On a seasonally adjusted basis, a net 35% reported compensation increases, down 4 percentage points from January and the lowest level since May 2021. A seasonally adjusted 19% said they would increase their pay in the next three months, down 7 percentage points from January and the lowest level since March 2021. .

11% cited labor costs as their business' biggest problem, up one point from January and just two points below the high of 13% set in December 2021. 16% said worker quality is the biggest issue for their business, the lowest figure since April 2020. .

The frequency with which positive earnings trends were reported was a net negative 31% (seasonally adjusted), which is very poor. Among owners who reported a decrease in profits, 29% cited poor sales, 15% cited increased material costs, 13% cited normal seasonal fluctuations, and 11% cited price fluctuations. Among owners who reported higher profits, 42% cited sales volume, 29% cited normal seasonal fluctuations, and 14% cited increased sales prices.

3% of owners said all of their borrowing needs were not met. 24% said all of their financing needs were met, and 61% said they were not interested in financing. A net 7% said it was harder to get a loan than their last loan.

of NFIB Research Center has been collecting data on small business economic trends through quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents were randomly selected from among NFIB members. This report is published on the second Tuesday of each month. This study was conducted in February 2024.