Dilok Khuraisataporn

Below is an overview of the market cycle at the beginning of Q1 2024. We will focus on corporate profits, which are the core of the cycle, and work to achieve comprehensive profits. A market perspective across asset classes. This will help organize your analysis for the next quarter. However, in general, the disinflationary downcycle remains intact. This is good for Treasuries, bad for commodities, and dangerous for stocks.

Market cycle definition

First, let's briefly explain how a “market cycle” is defined here. This helps set the order in which key variables will be analyzed. Based on historical analysis, often going back 150 years, there are many important variables that tend to move in cycles and correlate with any one indicator. another (However, these correlations have relatively regular advances and lags.) Using a 16-month percentage change (or a smoother version using a percentage change compared to a 36-month moving average or similar, more complex statistical techniques) allows you to predict future trends for that particular variable. Information about changes and other cycles seems to be revealed. variable. This is explained in detail in my articles that focus on specific items. merchandise and Ministry of Finance.

Why certain variables are highly correlated with each other, or why 16-month rates of change seem to be more meaningful than others, is an interesting topic, but it remains a mystery. However, these relationships appear to be fairly consistent and somewhat predictable, so we use them when looking to the future and when thinking about how markets actually work as opposed to economic theory. It's important to keep track of it.

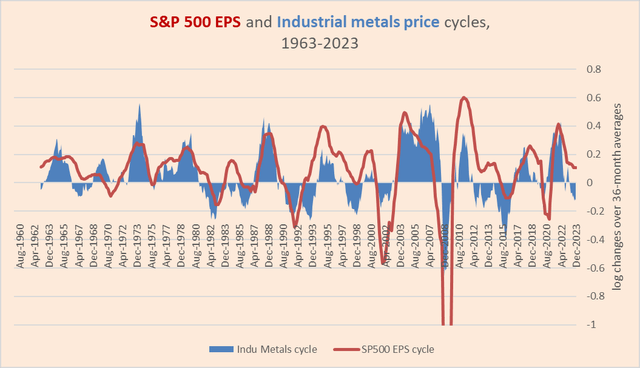

As mentioned above, corporate profits for the market as a whole seem to be the central variable. After profits, the most important thing is the price of industrial metals. Industrial metals cycles are consistently correlated with earnings cycles, but there is a lag in the release of earnings data while commodity prices are real-time. So, analyticallyIndustrial metals are as important as corporate profits in cycle analysis.

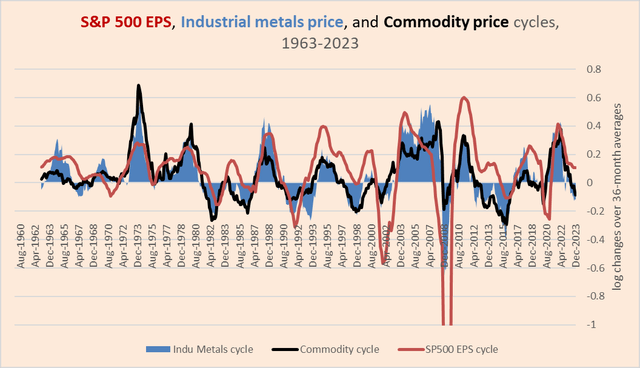

In addition to profits and industrial metal prices, there are generally commodity prices, and some commodity classes are more correlated with core cycles than others. Precious metals tend to lead this cycle. Raw materials (such as cotton) tend to move with the cycle. Particles tend to lag slightly. And energy (particularly crude oil) is lagging behind grains. Fertilizer tends to sit between grain and energy. Other food and beverage products are much more erratic (cocoa is a particularly troubling example), but over the long term they tend not to deviate significantly from the overall market cycle.

Next is long-term interest rates, which tend to lag. Short-term interest rates are less closely related to market cycles and appear to act as a bridge between market cycles and the “business cycle” (mainly the expansion and contraction of real GDP). Consumer inflation, particularly services inflation and GDP, follow the broader trajectory of market cycles. Similarly, stock prices appear to have trajectories that are primarily influenced by non-cyclical forces (this is discussed in more detail in other articles, such as this one here). In fact, when it comes to tracking; stock To account for periodicity, it is best to use trend analysis rather than momentum analysis.

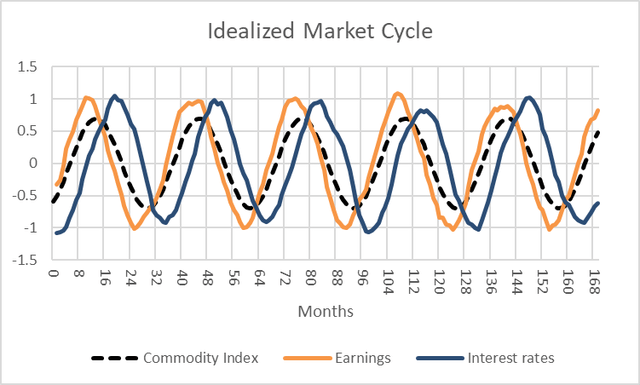

These basic and core relationships can be summarized in the following diagram. The first shows commodity volatility, his 12-month return for the S&P 500, and the ideal variation in long-term interest rates.

Chart A. Rates of change in earnings, products, and interest rates tend to move together. (author)

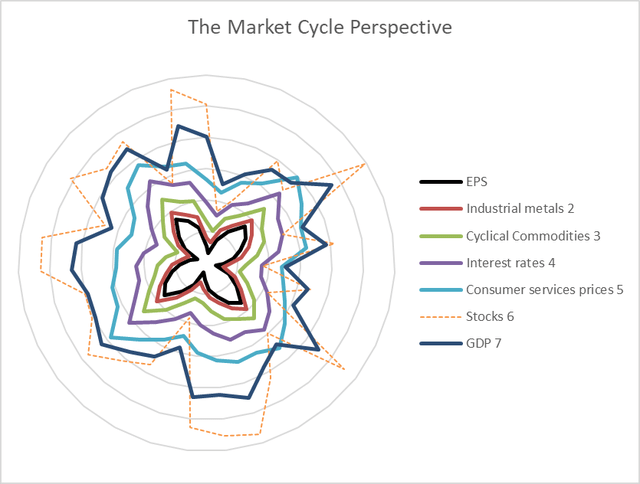

The second graph shows the ideal structure of a market cycle, with earnings at the center and GDP and stock returns most peripheral.

Exhibit B. The heart of the market cycle is earnings and industrial metals. (author)

Therefore, with the exception of stocks, we primarily use the log rate of change relative to the 36-month moving average to move from the core to the periphery.

First, there's revenue and products.

market cycle core

Industrial metals are clearly in a down cycle, as are corporate earnings, but they are at a much higher trough than metals, and this, along with high levels of services inflation (as suggested by the Gibson effect), has contributed to the resilience of stock markets. It is the cause of

Chart C. S&P 500 revenue cycles and industrial metal prices tend to be correlated. (World Bank, S&P Global, Robert Shiller, author calculations)

Next, use the same chart to add the overall product cycle.

Figure D. Overall commodity cycles tend to correlate with revenue cycles. (World Bank, S&P Global, Robert Shiller, author calculations.)

This seems to confirm the overall downward trend.

You can then zoom in and expand the world of variables.

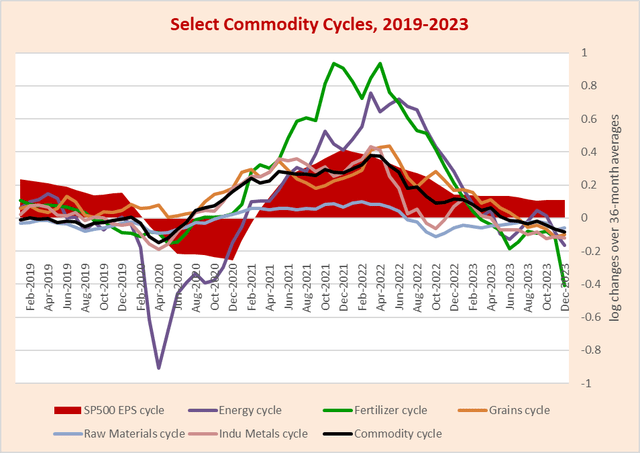

Exhibit E. All cyclical products have slowed over the past two years. (World Bank, S&P Global, Robert Shiller, author calculations)

Single variables can fluctuate, but generally they trend downward in near unison.

Let's add interest rate cycles to this.

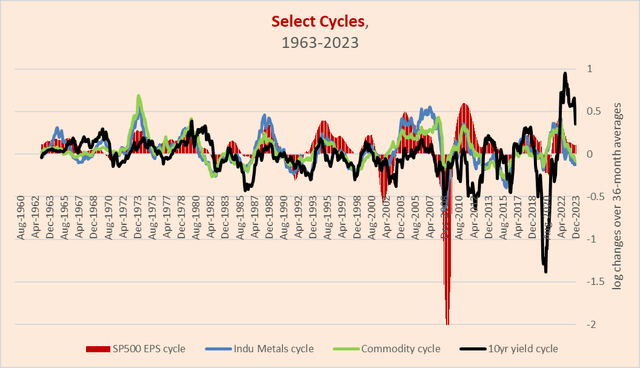

Exhibit F. The interest rate cycle has experienced its largest departure from the market cycle since the early 1980s. (World Bank; S&P Global; Robert Shiller; St. Louis Fed; Author's calculations)

So here we see that the interest rate cycle has diverged significantly from the market cycle, perhaps the most so since the early 1980s, when we last saw a disinflationary cycle in which interest rates were “higher for longer.” Masu.

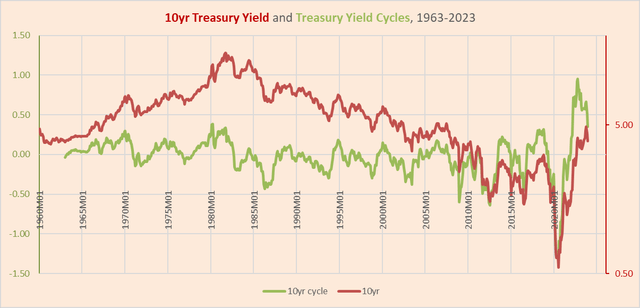

It's worth noting that even interest rates have diverged from the interest rate cycle. The cycle (as defined here) has been generally declining since late 2022, but interest rates peaked (assuming that was the peak) in late 2023.

Exhibit G. The interest rate cycle has experienced the largest deviation from interest rate levels in the past 50 years. (St. Louis Fed, author calculations.)

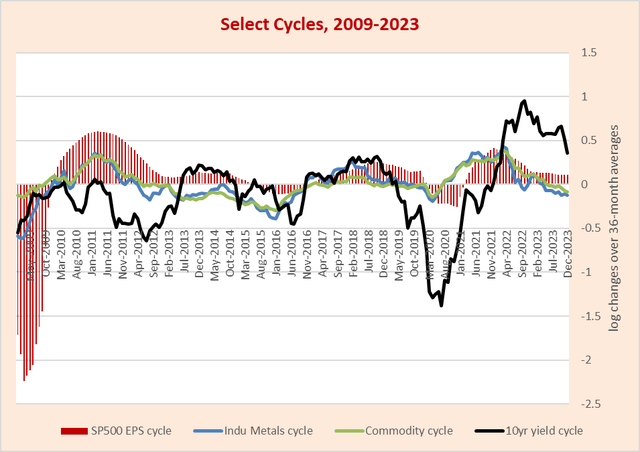

This is another enlarged view.

Exhibit H. The interest rate cycle appears to be reconverging with the market cycle. (World Bank, S&P Global, St. Louis Fed, author calculations)

Interest rates are clearly linked to core market cycles, but they do not follow them obediently.

Overall, the market cycle has been on a disinflationary downward trend, which is impacting more peripheral factors such as consumer prices and GDP.

The periphery of the market cycle

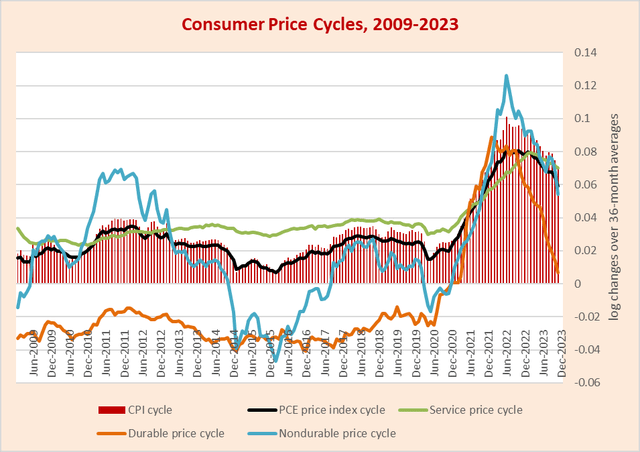

Below is a close-up of the consumer price variables.

Figure I. Consumer inflation has been steadily declining. (St. Louis Fed, author calculations)

Goods inflation has declined significantly since 2021, and services inflation has peaked in the second half of 2022.

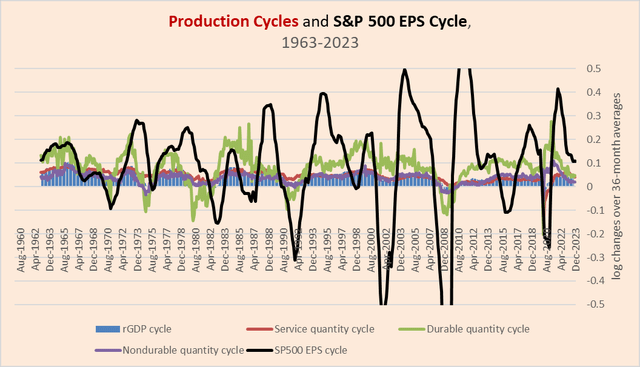

The production cycle is more loosely tied to the revenue cycle, but again with a downward trend.

Chart J. Revenue cycles and production cycles tend to be correlated only in times of crisis. (St. Louis Fed, S&P Global, Robert Shiller, author calculations)

It's finally time to turn your attention to stocks.

stock market cycle

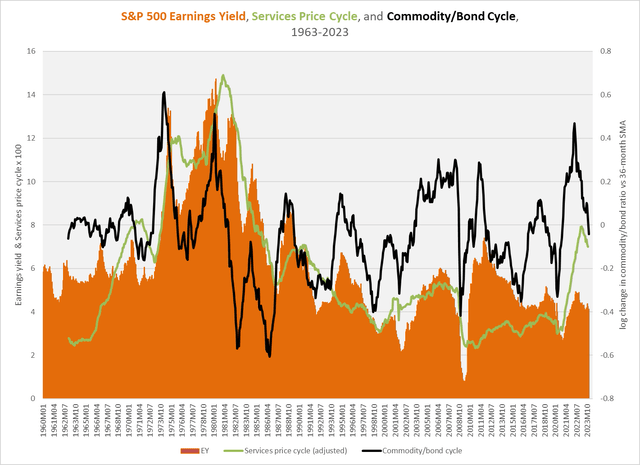

Cyclical movements in earnings yields (the reciprocal of the price-to-earnings ratio) tend to be driven by changes in earnings rather than changes in stock prices, whereas hypercyclical movements in earnings yields tend to be driven by changes in stock prices. . Therefore, over cyclical periods, earnings yields, like commodities, tend to fluctuate with market cycles.

The graph below shows the absolute level of S&P 500 earnings yields, the cyclical changes in the commodity/treasury bond ratio, and the cyclical changes in consumer service prices, the main components of consumer prices. It is highly unusual for consumer prices to lead market cycles; they usually lag.

However, the level of earnings yields and commodity/treasury bond cyclical momentum tend to be linked.

Chart K. Earnings yields tend to correlate with market cycles, while service inflation tends to lag. (World Bank, St. Louis Fed, S&P Global, Robert Shiller, author calculations)

Stock prices can be very sensitive to market cycles (as in 2008-2009), but they can also behave counter-cyclically, with stock prices rising as inflation and earnings momentum declines. (e.g. 1984-1986).

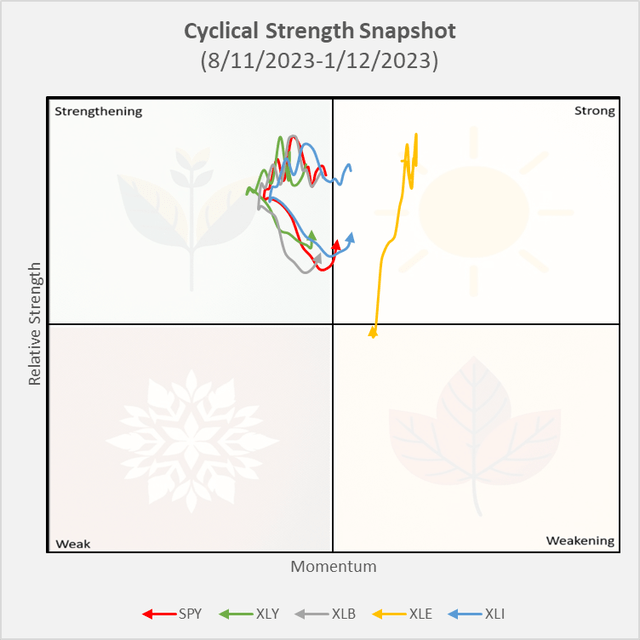

Their peculiar properties mean that their periodic momentum must be measured in a different way. This chart captures the total returns of SPY and some of the most cyclical sectors (XLY, XLB, XLI, XLE) to create a composite measure of their momentum and strength relative to long-term Treasuries. Masu.

Chart L. Stocks continue to perform well. (Tiingo.com; author's calculations)

As shown above the horizontal line in the center of the chart, stocks have consistently outperformed Treasuries over long periods of time, with the exception of the recent decline in XLE's position. Similar to the situation in fall 2022, it lost some momentum late last year, but this turned out to be primarily a buying opportunity.

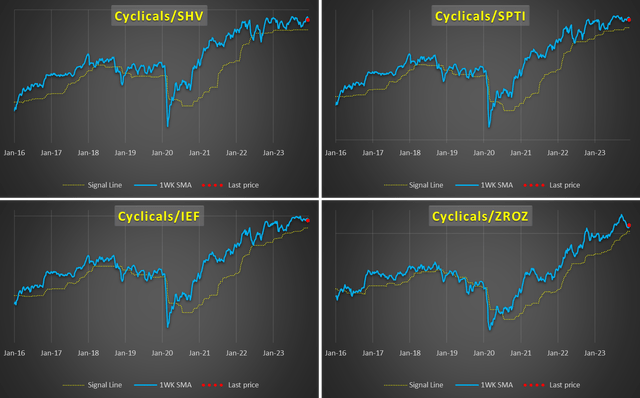

The following graph tells almost the same story in a slightly different way. Here, we created an equally weighted index of XLB, XLI, and XLE (or “cyclical”) and the ratio of that index to four government bond ETFs (SHV, SPTI, IEF, and ZROZ). Behind that ratio, I calculated a value that I think is a good moving average for such a ratio.

Chart M. Cyclical Sectors Continue to Outperform US Treasuries (Tiingo.com; author's calculations)

As you can see, cyclical sectors have lost some momentum compared to short-term Treasury ETFs like SHV and SPTI, and longer-term Treasury ETFs like IEF and ZROZ, but the trend remains the same.

In summary, the downcycle that began in early 2022 in commodities and corporate earnings appears to be here to stay, followed by a continued slowdown in long-term Treasury yields, not to mention the consumer inflation cycle. Only in recent months have we started to see US Treasury yields begin to “catch up” with not only the momentum of the market cycle, but also the momentum of Treasury yields themselves.

conclusion

In a future article, I will say that we are likely to see a sustained and significant decline in U.S. Treasury yields this year, and that this next phase of decline could begin within the next few months, if not weeks. I'm going to argue that it's expensive. However, the question remains how stock prices will react, both in absolute and relative terms. Recent history (particularly over the past 20 years) has shown that stock-to-bond ratios tend to follow market cycles. In other words, as yields and commodities decline, the stock/bond ratio also declines, as they did in 2018 and 2019 leading up to the coronavirus crash.

The most unusual thing about the current cycle, especially since the peak of commodity and earnings momentum two years ago, is the extent to which interest rates have refused to follow suit, even as momentum has been building. This contributes to the large disconnect between the core of one market cycle (earnings growth and commodity inflation) and the periphery of the other (interest rates and stock prices).

Expectations remain that yields will fall decisively and that stock prices will rise accordingly. Therefore, long-term government bonds are considered to be the most suitable. However, it will be important to monitor the state of the cycle across all asset classes and related macro variables.