The 2024 presidential election will take center stage next year, and of course we'll all be keeping a close eye on the polls for any signs of leadership change in Washington, D.C., but for now we can't speculate on a potential winner. It's too early to tell, but polls and oddsmakers are pointing to a rematch between Biden and Trump.

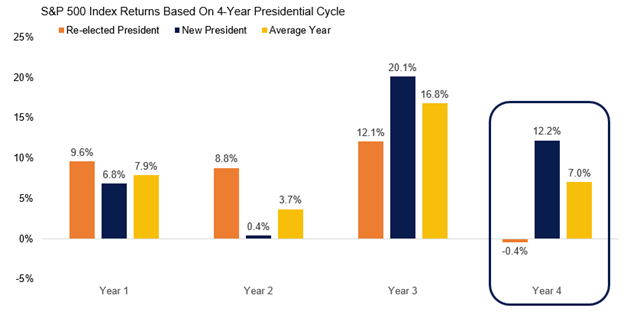

Regardless of who is in the White House in 2025, we know that since the 1952 election, the S&P 500 has risen an average of 7% during presidential campaign periods. That's a far cry from the average three-year gain of nearly 17%, but it could help allay fears that the election could derail the bull market.

Stock prices have historically been strong in election years.

Source: LPL Research, FactSet 12/05/23 (1950–2022)

Disclosure: All indices are unmanaged and cannot be invested in directly. Past performance does not guarantee future results.

The modern design of the S&P 500 index was first launched in 1957. Prior performance incorporates the performance of its predecessor, the S&P 90 Index.

pump priming

Another perspective worth noting is that in a redistricting year like 2024, the S&P 500's average gain jumps to 12.2%. We argue that this pattern is partly due to incumbents stimulating the economy with fiscal spending and pro-growth regulatory policies ahead of elections to head off a potential recession and promote job growth. is thinking. All presidents who avoided recessions in the two years before reelection went on to win, and all presidents who fell into recession within two years before reelection went on to lose.

This is a high hurdle for Biden, given that many leading indicators point to some economic contraction next year. As LPL Research reveals, 2024 Outlook: Tipping Point (ETA 12/12/23), LPL Research predicts a mild, short-term recession at some point next year, although it expects a relatively mild market reaction. , the needle could be pointing toward the Republican Party.

Limited pump priming opportunities

With Republicans in control of the House of Representatives, Biden has limited opportunities to stimulate the economy next year. But keep in mind that the stimulus passed in 2022 will still continue to flow into the economy through 2024. This is one reason why most economists underestimate growth this year. In fact, most of the spending from the Anti-Inflation Act passed in August 2022 will be applied during fiscal years 2024-2026, supporting the economy next year and boosting Democrats' chances.

Still, we may see some actions that don't require Congressional approval, such as expanded student loan forgiveness or regulatory maneuvers that could lead to pre-election economic relief, but their size and scope will be limited. There is a high possibility that it will be done.

For those who think this view of the stock market is a conspiracy theory, consider that the three-month pre-election returns predicted 20 of the past 24 elections. In other words, if the stock price has increased three months before election day, the incumbent usually wins. Conversely, an incumbent tends to lose if stock prices decline in his three months leading up to election day. It's too early to start thinking about it, but don't worry, everything will be resolved in August.

The bottom line is that history suggests that despite the policy uncertainty surrounding the election, stock prices are likely to rise next year. LPL Research expects inflation, interest rates and corporate fundamentals to also be supportive, as seen in LPL Research's report. 2024 Outlook: Tipping Point next week. That being said, it would not be surprising and consistent with history to see increased market volatility in the run-up to the election in late summer and early fall.