Note: The authors are collecting new data to match the original data for consistency. The site will be updated when that process is complete.

Marcel Chauvet*

(Updated Nov. 8 – see figures 1-3 and bold text)

The National Bureau of Economic Research's (NBER) Business Cycle Dating Committee has dated U.S. economic expansions and recessions for the past 60 years. Committee members reach a subjective consensus on turning points in the business cycle, and this determination is generally accepted as the official dating of the U.S. business cycle.

Although the determination of turning points is a careful deliberation, the NBER's procedures cannot be used to monitor the current business cycle. Typically, the committee meets several months after the occurrence of a turning point (i.e., the start or end of a recession) and issues a decision only when there is no doubt as to the date. This certainty can only be achieved by examining large amounts of data that have been revised ex post facto. Thus, the NBER's dating procedures cannot be used in real time. For example, the NBER announced in July 2003 that the 2001 recession ended in November 2001, 20 months after the fact.

However, some models can measure the weakness or strength of the economy and calculate business cycle dates in real time.

A formal probability model for predicting the timing of economic downturns

In recent years, analytical models that formalize the construction of economic indicators and probabilistic frameworks for defining and evaluating turning point forecasts have gained popularity. In particular, Chauvet's (1998) Dynamic Factor Markov Switching (DFMS) model has been very successful in measuring business cycles in real time and faithfully replicating the NBER measurements.

When applied to the same series used by the NBER (nonfarm employment, real personal income, real manufacturing and trade sales, and industrial production), this model produces monthly indicators of the U.S. business cycle and the probability of recessions and expansions. The estimated probabilities can be used to date the U.S. business cycle and assess the state of the economy. The resulting time series is highly correlated with ex-post and real-time NBER dates. Thus, this formal analytical model overcomes the delays in the NBER dating procedure and can be used to monitor turning points and assess the strength or weakness of the economy in real time.

What can the DFMS nonlinear stochastic model tell us about U.S. economic downturns?

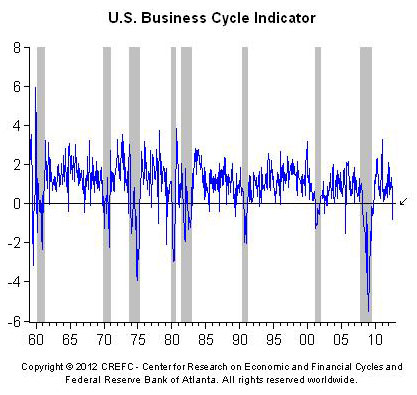

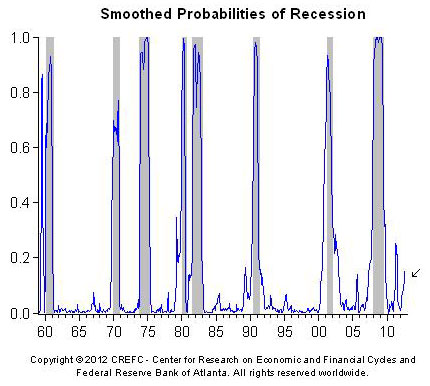

The U.S. economy has experienced eight recessions since 1959. Figure 1 shows business cycle indicators, and Figure 2 shows smoothed recession probabilities derived from the DFMS model and NBER recession dates. Probabilities are obtained using full sample information (i.e., all available information from 1959 to the present).

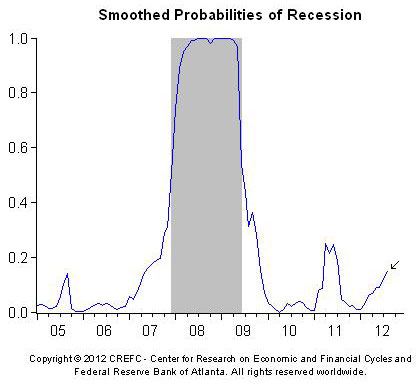

As Figure 2 shows, the probability increases significantly at the beginning of a recession (peak) and decreases at the end of the recession (trough). Recessions are generally short, lasting an average of one year, while expansions are much longer, averaging about five years. The 1990s saw the longest U.S. economic expansion (10 years) in the past 150 years, and the 2007-2009 recession was the longest in the past 50 years. (Figure 3 uses the same data as Figure 2, but focuses on the period since 2005.)

Figure 1. Smoothed probability of recession from dynamic factor model accounting for regime shifts and NBER recessions (shaded area)

Figure 2. Business cycle indicators based on the dynamic factor model that takes into account regime shifts and NBER recessions (shaded area)

Figure 3. Smoothed probability of recession since 2005 using a dynamic factor model that accounts for regime shifts and NBER recessions (shaded area)

The current possibility of a recession

Due to a two-month lag in the release of manufacturing and trade sales series data, recession probabilities are only published with a two-month lag. The Center for Economic and Financial Cycle Research provides a calendar of recession probabilities and business cycle indicator publication dates (subject to data availability).

The most recent recession probability from the DFMS model is for August 2012, using information available as of the end of October 2012. Using information as of the end of October 2012, there is a 15.2 percent probability that the U.S. economy was in a recession in August 2012. (Similarly, the model indicates an 84.8 percent probability that the economy was expanding in August 2012.)

For more information, see Real-time Recession Probabilities and The Start and End of the 2007-2009 Recession.

*Marcel Chauvet is professor of economics and research director at the Center for Research on Economic and Financial Cycles at the University of California, Riverside.

References

Chauvet, Marcel. 1998. “Econometric Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching.” International Economic Review Volume 39, Issue 4:969–96.

Chauvet, Marcel, and James Hamilton. 2006. Dating Business Cycle Turning Points. Nonlinear time series analysis of business cyclesCostas Milas, Philip Rothman, and Dick van Dijk, eds. Amsterdam: Elsevier Science Publishing.