Kurafura

This article focuses on business cycles and the idea that a great deal of time and human effort has been spent finding ways to accurately predict changes in the economy and, by extension, stock prices. market.

In part 1, yield curve And we'll also explain why you need to read the measurements in more detail to understand how they can be used for predictions.

This article highlights the challenges of economic forecasting. The economy is a complex system, measured primarily by data lag. As the Philadelphia Fed points out, at the beginning of the 2001 recession, a survey of professional forecasters predicted that U.S. real GDP growth would be 2.5% over the next year. Similarly, in 2007, the forecast for the following year he increased to 2.2%, but during the global financial crisis it turned out to be useless (Drautzburg, 2019).

Rather, I argue that we should take a contrarian approach to modern recession forecasting and ignore much of the mainstream media, including the NBER Dating Committee. They tend to be very late to party recession declarations.

Recession analysis dating back to 1929 – The Great Depression

If you ignore the noise and seriously study economic history going back to the 1800s, you'll find an interesting phenomenon. People have been trying to predict business cycles for centuries.

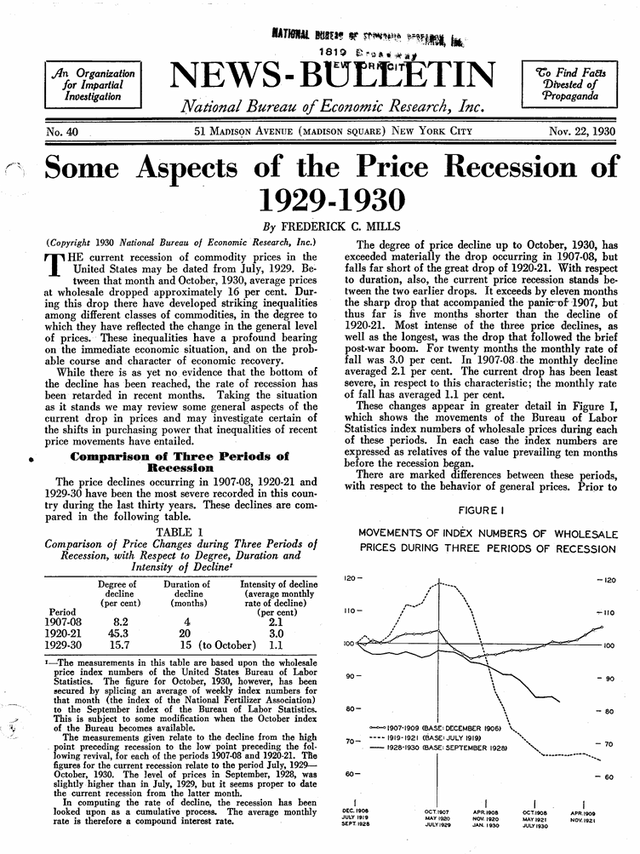

Everyone has read about the Great Depression, especially the stock market crash of 1929, so let's not focus on that. Fast forward to the middle of the Great Depression and look at a New York article published in late 1930.

NBER – Historical Record – Recession and Recovery

The first headlines describing an official recession and a National Bureau of Economic Research study hit the pages in November 1930. Of course, there were undoubtedly other references at the time, as the stock market crash of 1929 was frequently cited and documented. The important point is that it wasn't officially called a depression until the late 1930s, and even then it wasn't called the Great Depression.

There is a consistent pattern here that will be seen in future recessions. First, the stock market crashes, as happened in 1929. Then the real recession or depression begins (this can only be seen in hindsight).

Finally, agencies such as NBER make official announcements.

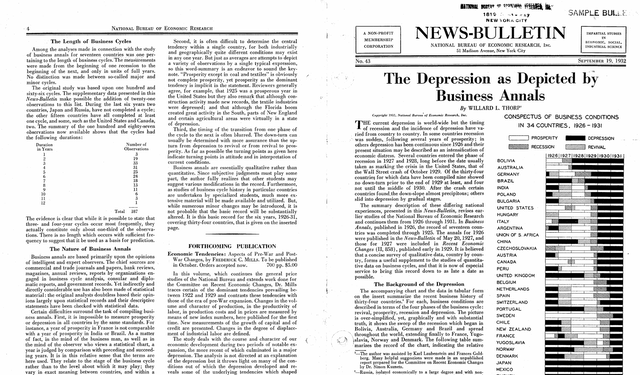

Check out this breaking news story from 1932, when the United States was waist-deep in the Great Depression. The author writes the following about the nature of business annual reports:

NBER – Historical Records – Depression and Business Records

Here's the really interesting part:

The task of compiling a business annual report presents certain challenges. The timing of transitions from one stage of the cycle to the next is often ambiguous. Recessions are usually more reliable than recession-to-recovery or recovery-to-prosperity turnarounds. Business records are qualitative rather than quantitative in nature. ”

Please try to imagine. At the depths of the worst economic disaster in history, when the U.S. stock market fell an astonishing 72.7%, results from the newly established NBER, the official breaking news and recession forecaster, were the key to the business cycle.

Even then, we realized the futility of trying to accurately time business cycles. Instead, what the general public should probably do is buy stocks and real assets to prepare for the next thriving technology-driven revolution. Instead, the nadir in economic activity was ultimately estimated to be March 1933, which was announced much later.

1973-1974 Inflation Stagflation

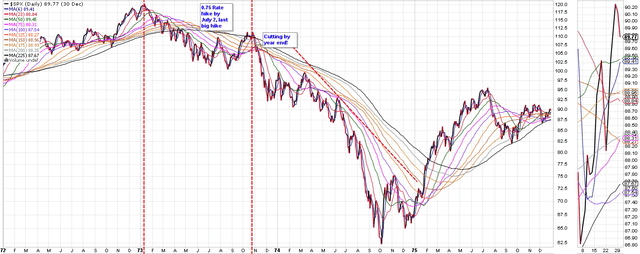

The severe bear market that occurred in 1973 is called hindsight, and the peak of economic activity was determined to be November 1973, and the trough of economic activity was determined to be March 1975. Recessions were characterized by slowing growth and there was a significant downturn in the economy. Increased output and increased unemployment. This period coincided with a period of extreme inflation, with rising costs and limited supplies of food, fuel, and raw materials.

Below is a somewhat ironic article from the New York Times on July 6, 1975.

It was like a recession. It felt like a recession. And finally, the National Bureau of Economic Research is ready to announce that it really was a recession. (…)

Jeffrey II, the bureau's chief cyclist. Moore said he pondered the data for 13 months before coming to his decision. The State Secretariat then spent several more months passing Mr. Moore's 15-page study through a cumbersome vetting process before delivering it to a printer. ”

In other words, by the time it was called a recession, the recession was already over and the stock market had corrected and rebounded in favor of more positive considerations.

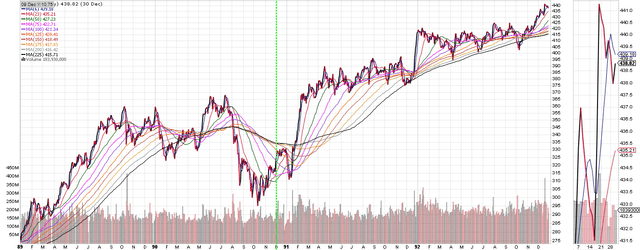

Stock Charts – David Houston

The stock market ran through all the scenarios during 1973-1974, so it quickly bottomed out and moved on before the NBER announced a recession.

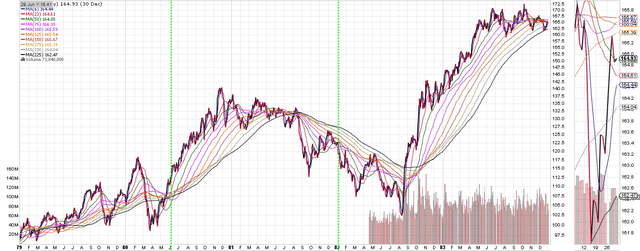

Business cycle 1979-1982

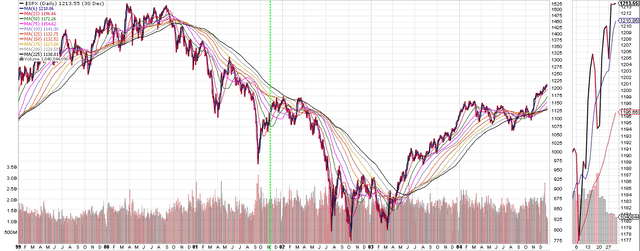

Stock Charts – David Houston

The era of 1980-1982 may prove to have some similarities with today. There were two waves and a recession that began in January 1980 and lasted until July 1980. The culmination of the cycle was called in May 1980, near the end. You can see it marked by the first green line.

The second wave arrived in July 1981 and lasted until November 1982. The NBER announced earlier than usual that it had reached the top of the cycle in January 1982.

1990 Recession and Gulf War

Are you starting to see a pattern here? Every time there's a call for a recession, it's either the end of a bear market in stocks or a complete afterthought. The recession of the 1990s followed the same pattern.

Stock Charts – David Houston

The recession began in July 1990 and ended in March 1991. He was called by the NBER in December 1990, just after the cycle's peak and stock price trough.

2000 dot-com crash and recession, 9/11

Stock Charts – David Houston

The dot-com bust of 2000 was unusual, given that the recession began in March 2001 and lasted until November 2001. However, the NBER said he called November the peak of the business cycle (when the economy bottomed out!) and did not announce a bottom. While it turned out to be prescient for the stock market, it was quite a distance from what was happening in the real economy.

This should really impress upon you the fragile nature of predicting what's going on beneath the surface of the economy.

2007-2009 global financial crisis

I'm sure everyone has watched The Big Short and imagined themselves as the bosses of Scion Capital, an upstart company that could be called the top of America's housing bubble. But when the market soared in 2007, Barry almost lost his nerve. Business cycles didn't help either in that bear market.

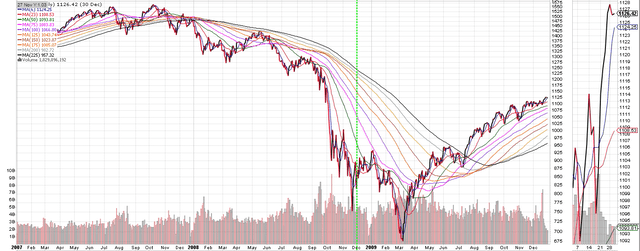

Stock Charts – David Houston

The official recession began in December 2007 and lasted until June 2009. The NBER marks December 2008 as the top of the economic cycle and very close to the bottom of the cycle. They did not point out the bottom in economic activity until September 2010, which was very slow due to the slow recovery. By that time the market had almost fully recovered.

Overview of recession calls

Based on historical records dating back to the Great Depression, it's far better to keep your cool and ignore official recession declarations. By the time it becomes a mainstream concept, by the time we are actively discussing it in the news and dating committees are calling it the apex of the cycle, the cycle is often over for good. Most of the damage has been done to the stock market.

The NBER Dating Committee is also not very good at pointing out gaps in economic activity. Remember that the recession dates mentioned here, i.e. the specific month of the recession, can only be determined consequentially.

Where does that leave us?

Recognize that the simple story of the yield curve, like the one we saw in Part 1, or the simple story of exiting the stock market when a recession hits, is not a reliable way to time investment decisions. . People have been trying it for hundreds of years, but as 2022 showed us (again!), it's simply not easy and forecasters are often wrong.

There is one thing that is historically much more useful and correlates better with the market. It's pure liquidity. This will be covered in the third part of the series.