Editor’s note: Seeking Alpha is proud to welcome Skeptic Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

South_agency

Company Overview

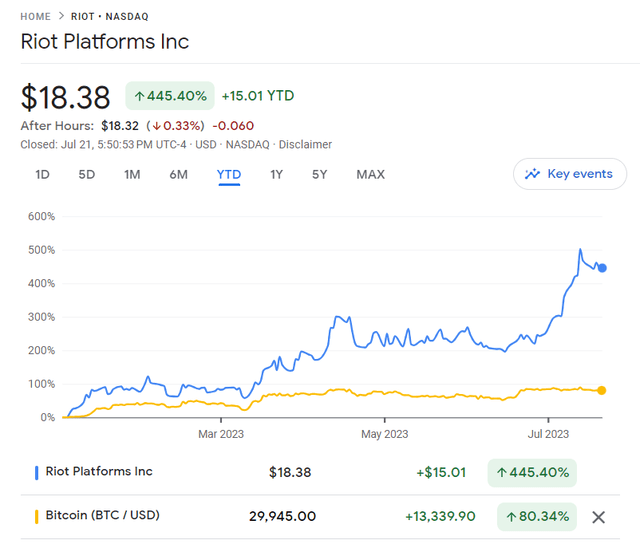

Bitcoin-mining (BTC-USD) company Riot Platforms (NASDAQ:RIOT) has seen its share price increase ~445% since the beginning of 2023. This is due to the concurrent Bitcoin rally as well as optimism around their new facility in Corsicana Texas which is expected to open later this year. Despite this, I believe there are some fundamental vulnerabilities in Riot’s business model which make me skeptical of the recent rally.

Riot Platforms share price (Google Finance)

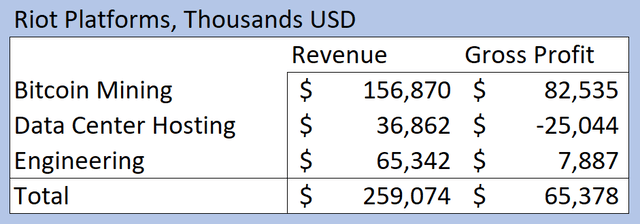

Riot Platforms is one of the largest Bitcoin-mining companies in the world with $259 million of revenue in 2022. They operate three segments: Bitcoin Mining, Data Center Hosting, and Engineering. Bitcoin mining is exactly what it sounds like, they operate mining rigs and generate revenue by selling the Bitcoin they mine. The data center hosting segment generates revenue by renting out space in their Bitcoin mining facilities to third party Bitcoin miners. The engineering segment generates revenue by selling power distribution equipment which is used in Bitcoin mining facilities. Bitcoin mining represents the majority of their revenue and more than 100% of their gross profit. Since the Bitcoin mining segment is the largest and most import segment, we’ll focus on that first. Also, understanding their Bitcoin-mining segment puts us in a better position to understand the other two segments.

Riot Platforms 2022 Revenue and Gross Profit (Company filings, compiled by author)

Bitcoin Mining Segment

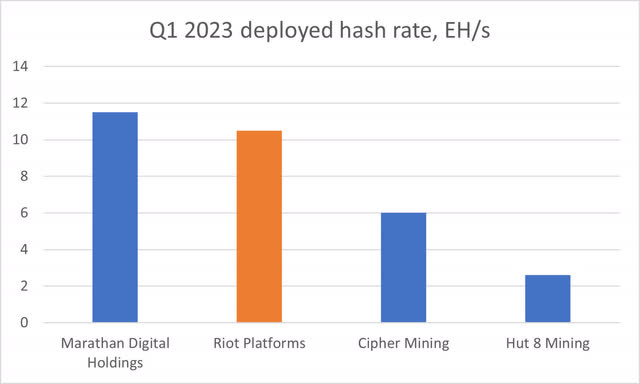

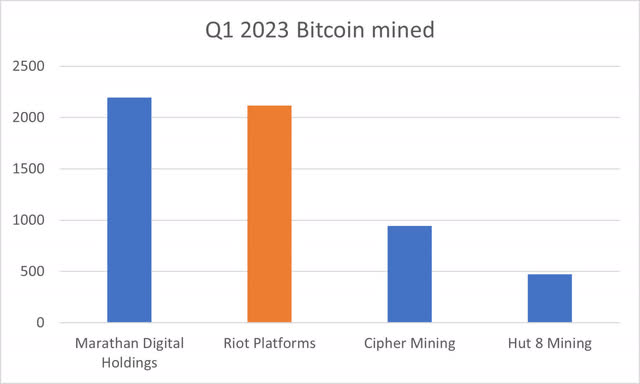

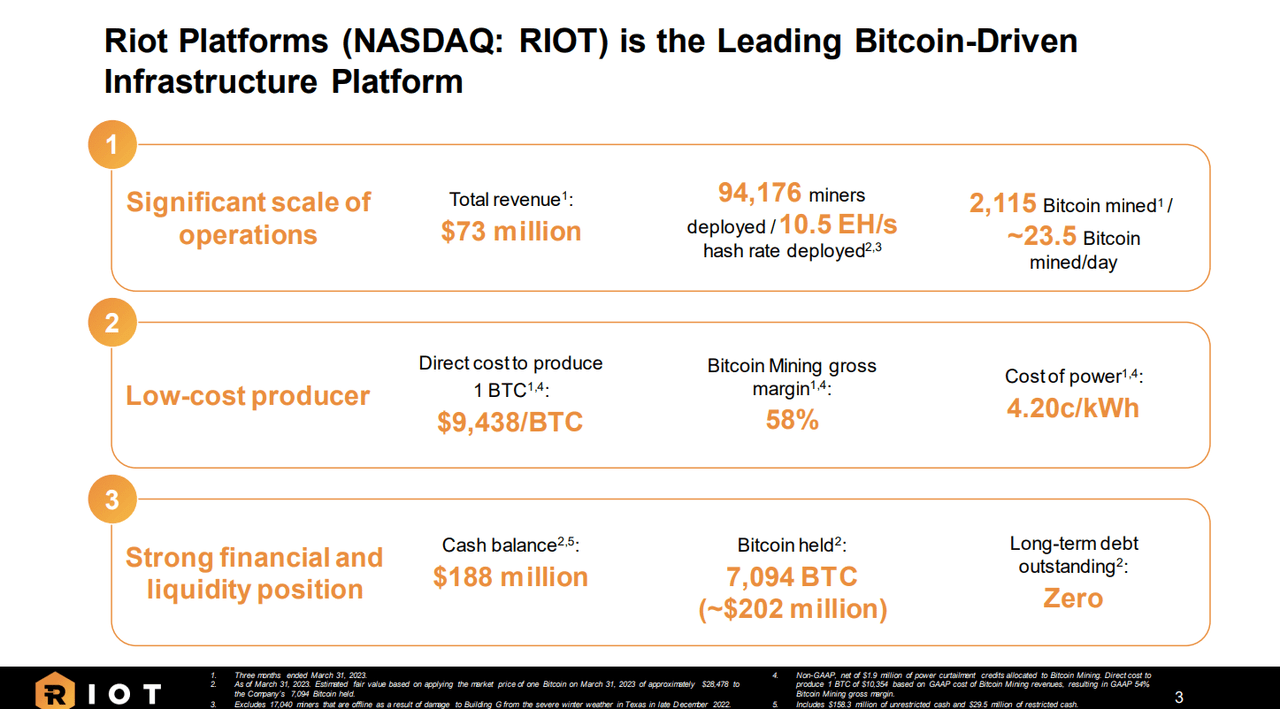

Riot Platforms owns a massive facility in Rockdale Texas, which has ~94,000 Bitcoin mining rigs representing 10.5 exahash (EH/s) of capacity. EH/s is a measure of how many computations they can do per second, which is highly correlated with how many Bitcoins they can mine. In terms of deployed EH/s, Riot is the second largest of the publicly-traded Bitcoin miners, behind only Marathon Digital Holdings (MARA). According to Coinwarz.com, there are currently 358 EH/s deployed by all Bitcoin miners globally. Thus, Riot mines approximately 3% of all Bitcoins mined globally.

Deployed hash rate of select mining companies (Company filings, compiled by author) Number of Bitcoins mined by select miners (Company filings, compiled by author)

Riot prides itself as being a low-cost producer. In their investor presentation, they show that their direct cost to produce each Bitcoin is under $10,000. With Bitcoin’s price currently sitting around $30,000, they should be highly profitable, right?

Riot Platforms Investor Presentation (Riot Platforms)

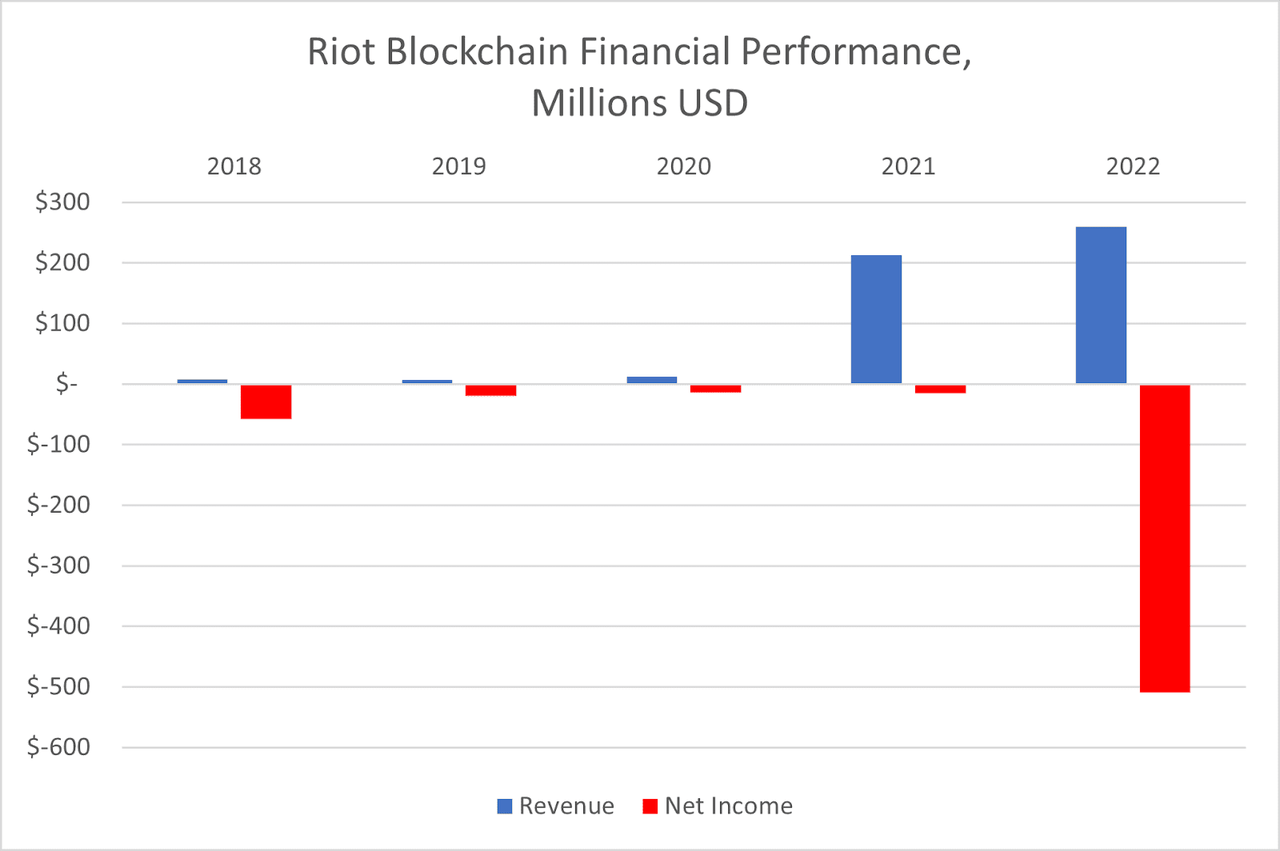

Wrong. Since Riot entered the Bitcoin-mining industry in 2018, they have never turned an annual net profit, despite impressive revenue growth.

Riot Platforms Financial Performance (Company filings, compiled by author)

There are two major costs associated with Bitcoin mining. The first is the upfront cost of buying the mining rigs. The second is the ongoing cost of electricity to power the rigs. Riot’s $9,438 of direct costs per Bitcoin mined only includes the cost of the electricity, not the cost of buying the rigs.

As technology advances, Bitcoin mining rigs become more sophisticated. There is a fixed quantity of Bitcoin that is awarded to all the miners in aggregate. So the more computing power enters the network, the more computing power you need to mine the same number of Bitcoins. Once a mining rig is too old, it won’t be worth operating anymore because the amount of Bitcoin it mines won’t be enough to cover the electricity cost. That’s why you can’t do Bitcoin mining on your laptop at home. Well, you can if you want, but you’ll lose money.

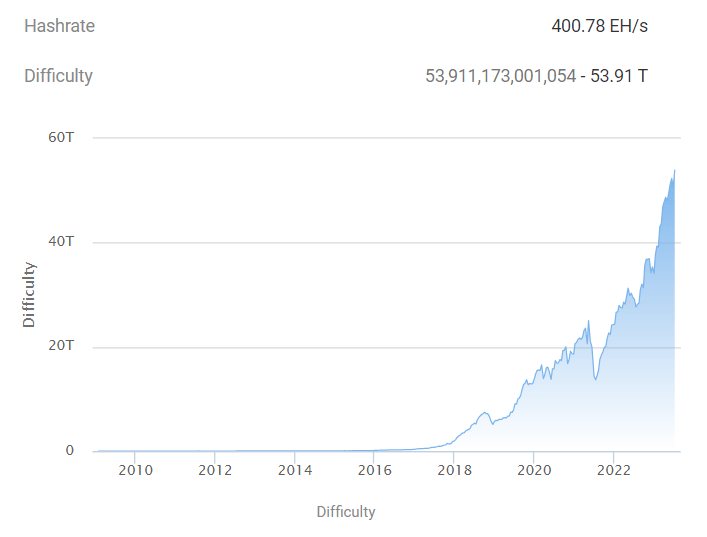

Riot buys specialized Bitcoin mining rigs which are far more efficient at mining Bitcoin than a normal computer. But with the rapid pace of innovation these rigs become obsolete very quickly. Below is a chart that shows the difficulty rate of mining Bitcoin. This measures how much computing power you need to mine a constant number of Bitcoins. As you can see the difficulty rate has been increasing exponentially over the years.

Bitcoin Difficulty Rate (btc.com)

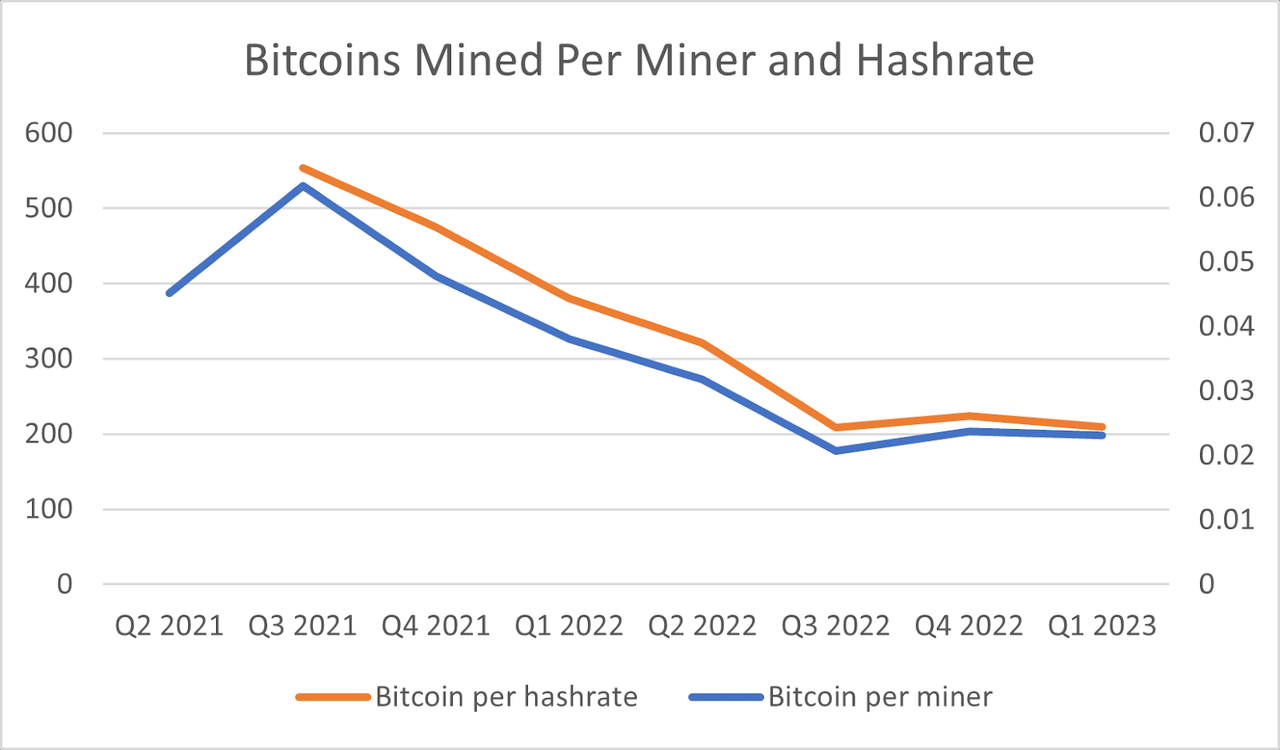

And we can see the impact of the rising difficulty rate in Riot’s performance.

Bitcoins Mined Per Miner and Deployed Hash Rate (Company filings plus author’s calculations)

From Q4 2021 through Q1 2023, Riot’s Bitcoin mined per deployed EH/s decreased by 62% from ~553 to ~209. This represents a compound annual decline rate of -48%. If the rate of difficulty continues to increase at the same pace Riot needs to double its hash rate every single year to maintain its current level of Bitcoin production.

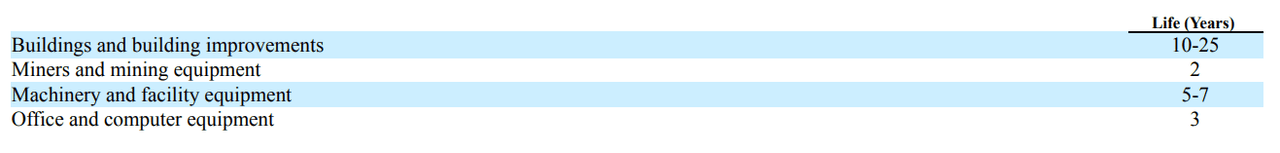

This is consistent with Riot’s own depreciation calculations. They depreciate their Bitcoin miners based on a 2-year life-span, which is an incredibly fast rate of depreciation.

Useful Life of Fixed Assets (Riot Platforms)

On June 26th 2023, Riot announced they would be acquiring 33,280 new Bitcoin miners from a company called MicroBT for $162.9 million. These miners will be placed at the company’s new Corsicana facility. The new miners will have a combined hash rate of 7.6 EH/s. This equates to $21.4 million per EH/s without even considering installation and real estate costs.

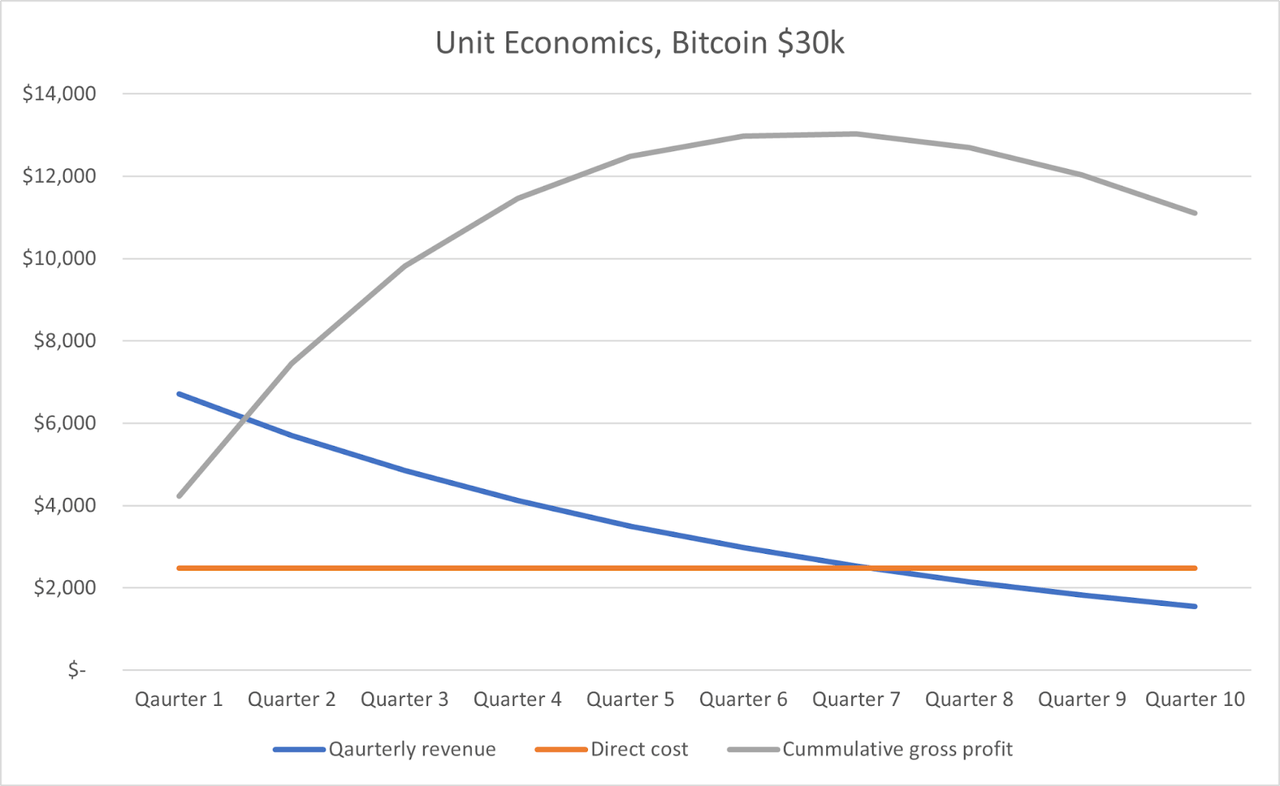

At the end of Q3 2022, Riot had a deployed hash rate of 5.6 EH/s. Throughout the quarter, they deployed more Bitcoin miners and increased their deployed hash rate to 9.7 EH/s. If we assume the new miners were deployed at a constant rate throughout the quarter, they had an average of 7.65 EH/s of deployed hash rate during Q4 2022. They incurred direct Bitcoin mining costs of revenue of $19 million or ~$2.5 million per EH/s. The vast majority of this cost is electricity. In that quarter, they mined 1,712 Bitcoins or 224 Bitcoins per EH/s.

Based on Bitcoin’s current price of $30,000 and extrapolating the previously observed decline rate of 48% per year, we can see Riot’s unit economics. Every quarter the number of Bitcoins mined decreases while the cost of electricity remains constant. By the 8th quarter, the revenue generated is less than the electricity cost. So the optimal strategy is to operate the miners for 7 quarters after which they need to be replaced. In the first 7 quarters, 1 EH/s of deployed hash rate will have generated a cumulative gross profit of ~$13 million. This is substantially less than the $21.4 million it costs Riot to deploy 1 EH/s of hash rate. Thus, at current Bitcoin prices Riot’s operations are unprofitable.

Unit Economics at Bitcoin $30k (Company filings plus author’s calculations)

Of course, it’s possible that the price of Bitcoin increases. Based on the same estimated decline rate, Riot’s unit economics would become breakeven if Bitcoin reaches $38,000. But they also had $67 million of SG&A costs in 2022. If we allocate SG&A according to revenue contribution, the Bitcoin mining segment would have SG&A of ~$41 million. Based on their current deployed capacity of 10.5 EH/s, the price of Bitcoin would have to rise to ~$42,000 to cover their SG&A. It’s also important to note that if the price of Bitcoin did rise to $42,000, this will cause more Bitcoin miners to enter the market causing the mining difficulty rate to accelerate further. Thus, the decline rate would likely be even worse than what I assumed above.

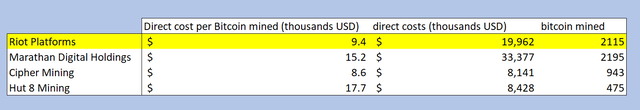

The core problem is that the Bitcoin mining industry is highly competitive. Riot buys its Bitcoin miners from third party manufacturers. Anybody with capital and an empty warehouse could buy these miners as well. Thus, the only way Riot could achieve a competitive advantage is by having lower electricity costs than their competitors. Unfortunately, this does not appear to be the case. In the first quarter of 2023, Riot had direct costs of ~$9,400 per Bitcoin. While this is better than Marathon and Hut 8 Mining (HUT), it is worse than Cipher Mining (CIFR). Riot is basically in the middle of the pack.

Bitcoin mining direct cost, selected miners (Company filings, author’s calculations)

At current Bitcoin prices, Riot’s unit economics are unprofitable. But things will likely get even worse in 2024 due to the expected Bitcoin halving event. About every 4 years, Bitcoin has a halving event where the number of Bitcoins awarded to a miner for completing a block is cut in half. When Bitcoin was first launched in 2009, miners were rewarded 50 Bitcoins per block. Today, that is decreased to 6.25 Bitcoins and next year it will decrease again to 3.125 Bitcoins. This means that all else equal, a miner will earn half the Bitcoin for a given amount of computing power. Halving events are generally viewed as bullish for the price of Bitcoin as it slows down the rate of supply growth. However, the 2024 halving event is well known by Bitcoin investors and should already be factored into Bitcoin’s current trading price. Thus, I view the halving event as very negative for Riot and all Bitcoin miners for that matter.

New Corsicana Facility

Riot is currently constructing a new Bitcoin mining facility in Corsicana Texas. They expect the first phase of the facility to consume 400 megawatts of electricity and begin operations in the fourth quarter of 2023. This will increase Riot’s total deployed capacity by about 60%. This first phase of development will cost $333 million of which $70 million had already been spent as of Q1 2023. This facility will come online at almost the worst possible time as it will only be able to operate for a few months before the 2024 Bitcoin halving event.

Site of Riot’s construction site in Corsicana, Texas (Riot Platforms website)

Data Center Hosting Segment

In addition to mining Bitcoin on their own, Riot also rents out space in its Rockdale facility to third-party Bitcoin miners. The customers pay a fee and Riot has to cover their electricity consumption. In 2022, the data center hosting segment generated $37 million of revenue but incurred $62 million of direct costs. Thus, it generated gross profit of negative $25 million. The customers who rent space in the Rockdale facility face the same problems that Riot does; the Bitcoin mining industry is highly competitive and it is very difficult to make a profit. Thus, they are not willing to pay Riot enough for Riot to cover its own costs.

Engineering Segment

In December of 2021, Riot acquired a small company called ESS Metron for $50 million. ESS Metron forms the foundation of their engineering segment. The engineering segment manufactures and sells power distribution equipment which can be used in the operation of Bitcoin mining facilities. In 2022, the engineering segment generated $65 million of revenue and $8 million of gross profit. Riot does not disclose operating profit by segment, so we have no way of knowing if the segment is profitable. Given that Riot currently has a market capitalization in excess of $3 billion, the $8 million of gross profit from the engineering segment is frankly too small to matter.

Hyperinflationary Share Count

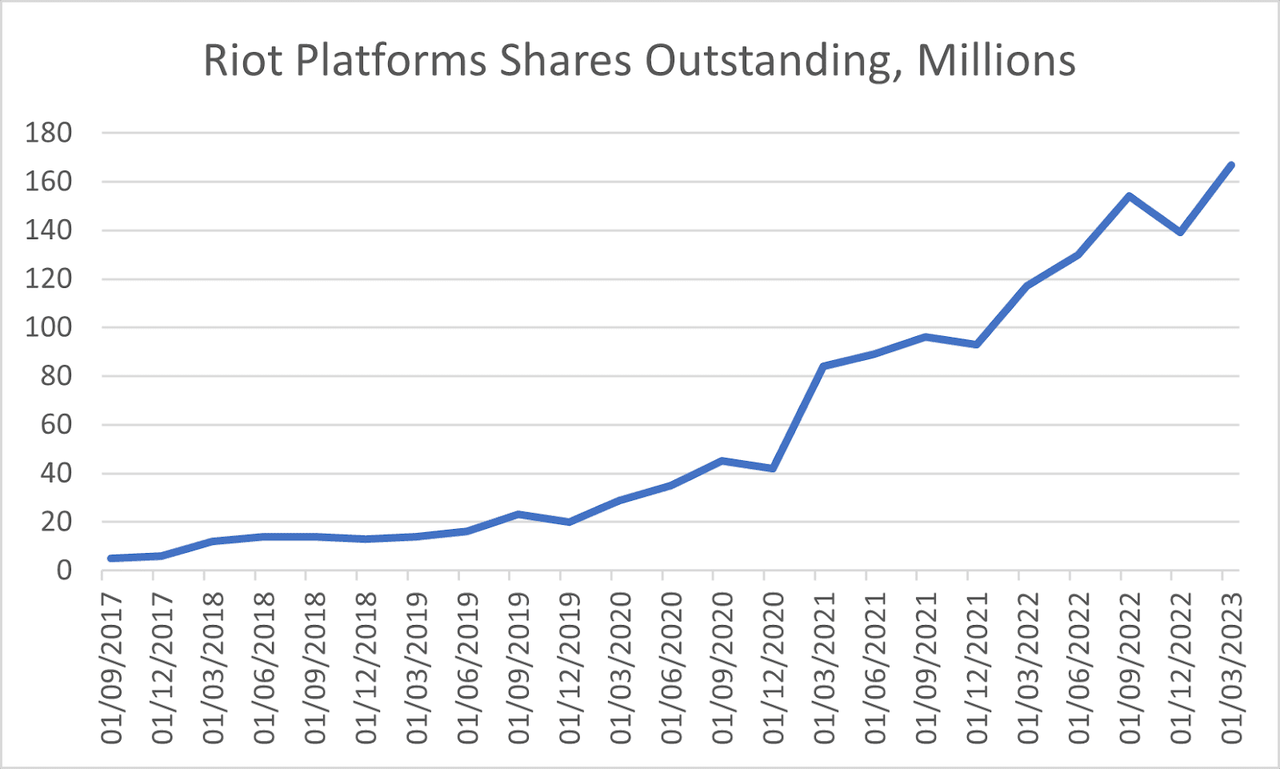

A lot of the challenges Riot is facing apply to other Bitcoin miners as well. The reason I’m particularly bearish on Riot is their insistence to continue growing even as their current operations are unprofitable. They have funded this growth by issuing massive amounts of new equity.

On the bright side, their reliance on equity financing means they haven’t had to issue any debt and they currently have zero debt on their balance sheet. The downside is that shareholders have seen their ownership stake massively diluted and this dilution will continue going forward. Since Riot entered the Bitcoin mining industry in Q4 2017, they have raised billions of dollars by issuing new shares. This has caused their share count to balloon more than 30-fold from 5 million to 167 million.

Riot Platforms Share Count (Company filings)

They recently filed paperwork which would allow them to double their share count again to 340 million.

On November 21, 2022, the Company filed an amendment with the Secretary of State of Nevada increasing its number of authorized shares of common stock, no par value, from 170 million shares to 340 million shares.

Source: 2022 10-K

Valuation

It’s very difficult to come up with a fair valuation for Riot’s stock price. Traditional valuation metrics like Price / Earnings don’t work because the company is losing money. They are growing very fast, but this growth is highly capital intensive and I’m not convinced that their investments will generate returns in excess of their cost of capital. Given the fact that they have never turned an annual profit, their mining rigs are non-proprietary, and they are not the lowest cost producer (Cipher Mining has lower direct costs per Bitcoin), I can’t justify giving Riot a valuation in excess of book value.

As of March 31st 2023 Riot reported shareholders’ equity of $1.09 billion which includes $122 million worth of Bitcoin held on their balance sheet. They held 7,094 Bitcoins which at the current price of $30,000 each are now worth about $213 million. If we adjust their Bitcoin holdings to market value we get shareholders’ equity of a little less than $1.2 billion or about $6.85 per share. This represents almost 2/3rds downside from the current share price of $18.38 per share.

Risks To Bear Thesis

Obviously, the biggest risk to my bearish thesis is the price of Bitcoin. I have no idea where the price of Bitcoin will be 6 months from now. But for the sake of argument, let’s assume Bitcoin goes back to its all-time high of $69,000 and stays there for the foreseeable future. Riot currently has 10.5 EH/s of deployed hash rate and they are targeting for this to grow to 20.1 EH/s by the middle of 2024. This growth in hash rate will cost them about $260 million of capex primarily consisting of buying the new mining rigs and finishing construction on the Corsicana facility.

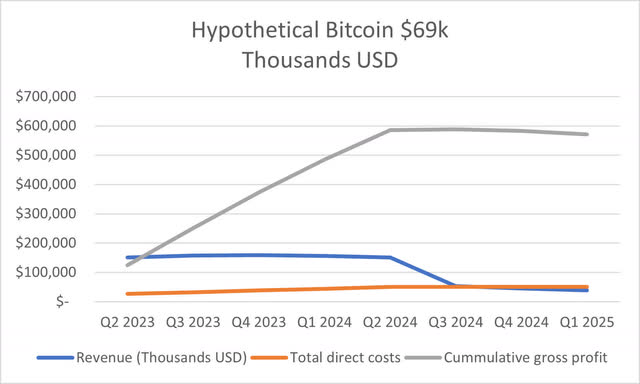

The 2024 Bitcoin halving event is expected to happen in the 2nd quarter of 2024. For simplicity, let’s say it happens at the tail-end of Q2. Riot currently mines about 209 Bitcoins per quarter per deployed EH/s. Let’s assume the difficulty rate continues to increase at the previously observed 48% per year. As Riot deploys more capacity, this will offset the increasing difficulty rate and their revenue will stay constant at ~$150 million per quarter, which is more than enough to cover their direct costs. But this changes once the Bitcoin halving event occurs. This causes Riot’s Bitcoin mining revenue to be cut in half almost overnight and soon thereafter the revenue will fall below their direct costs. Based on my calculations they will make a cumulative gross profit of ~$590 million.

Riot Platforms estimated performance assuming Bitcoin $69k (Company filings plus author’s calculations)

Of course, if the price of Bitcoin really does rise to $69,000, their data center hosting and engineering segment will also benefit, although this is much harder to quantify. These two smaller segments currently represent ~2/3rds the revenue of the Bitcoin mining segment. Let’s assume they achieve the same revenue growth and gross margins as the Bitcoin mining segment and thus generate ~$390 million of gross profit in this same period. I understand that this is a crude estimate but let’s roll with it as a mental exercise. Based on all of these assumptions, Riot would generate a little under $1 billion of gross profit between today and the Bitcoin halving event. Also, the value of their current Bitcoin holdings would increase to $490 million. Their current cash balance will be completely wiped out by the remaining capex for the Corsicana facility.

So in this bull case scenario of Bitcoin re-achieving its all-time high price of $69,000, Riot will generate ~$1.5 billion in gross profit + Bitcoin appreciation between now and the halving event. This represents about half of their current market cap. For them to remain profitable after the Bitcoin halving event, they would need the price of Bitcoin to increase substantially above $69,000. So in my opinion, the only way Riot Platforms will be a good investment in the long run is if the price of Bitcoin more than doubles and reaches new all-time highs. Given that Bitcoin is sitting at ~$30k today, I view Riot’s risk-reward profile as unfavorable. Of course, if the price of Bitcoin increases dramatically, I will have to re-evaluate my bearish view.