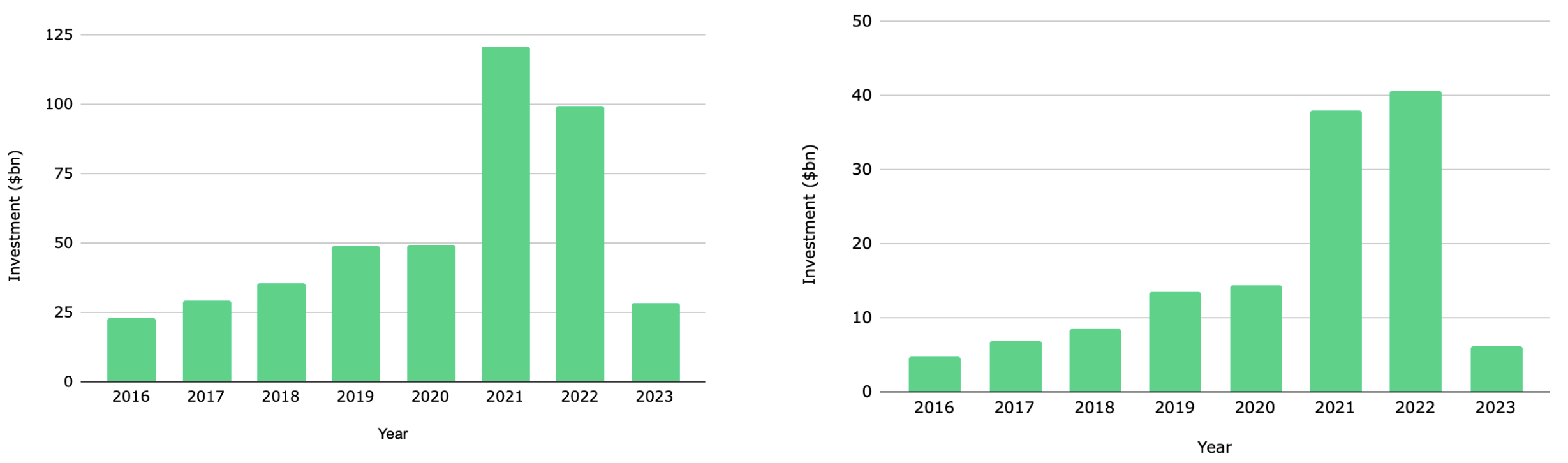

Business software companies have proven their resilience in the face of economic challenges, with investment surging by an astonishing 7.4% year-on-year in 2022, even as the tech industry as a whole faces a recession I experienced Notably, the European technology sector as a whole declined by nearly 19% over the same period.

These key findings come from a comprehensive analysis conducted by Notion Capital of Europe's dynamic business software ecosystem. According to research by a venture capital firm, start-ups and scale-ups in the business software sector have shown exceptional performance, with total sales expected to rise from $712 billion in 2021 to a staggering $1.2 trillion in 2022. It has been pushed up to a high number.

Dr. George Windsor, director of research and intelligence at Notion Capital and lead author of the report, commented:

”The trend out of recession is clear, and the business software sector is performing very well compared to other European technology sectors. This shows how these companies are maturing, coming into their own and taking a more prominent place in the broader European technology sector. ”

The business software sector has rapidly evolved from its B2BSaaS origins to now encompass startups and scaleups focused on technologies such as ubiquitous artificial intelligence, quantum computing, and blockchain. These technologies have applications across a variety of industries. The research conducted by Notion Capital leverages data from both its own resources and Dealroom to provide pioneering research into business software categories across Europe.

Business software companies will account for a larger share of the value of Europe's technology sector, claiming 30% of the total market value in 2022, or $1.1 trillion of the total technology sector's value of $3.7 trillion. It looks like this. This jump marks a notable increase from his 18% share of the total amount the previous year. In parallel, Notion's findings show that the valuation of business software startups has plummeted from $712 billion in 2021 to $1.2 trillion in 2022. By comparison, on the other side of the Atlantic, the valuation of US business software startups fell 12% from $4.2 trillion to $3.7 trillion, and has since regained lost value. Ta. 2023 value

Additionally, the study highlighted that European business software companies maintain consistent employment levels, with 2.8 million stable employees in 2022-2023. This follows a significant 27% hiring surge in 2021.

The survey also shows that European business software companies are increasingly attracting foreign investment, with US and Asian investors playing an increasing role. Notably, more than 40% of the total investments in these companies in 2021 came from US-based investors who typically engage in late-stage investment transactions.

To access the full report “European Business Software Ecosystem Update”, please visit Notion Capital.