No product provides perpetual profitability. Ever-changing consumer desires, limited resources, and unpredictable industry events ensure all products that rise also eventually fall. This cycle from rise to fall is the product life cycle.

Successful businesses employ strategic analysis on the life cycles of all of their products and act on that analysis to ensure relevance and maximize earnings.

Read on to learn what exactly the product life cycle is, what comprises its stages, and strategies to extend the life cycle to bring in more returns.

Overview: What is the product life cycle?

The product life cycle describes the journey all products take from their development to eventual decline. It’s critical for businesses to understand this product journey and how to apply it to all their products in order to make more informed decisions to maximize returns.

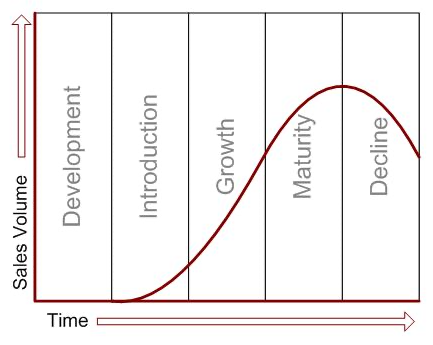

The five product life cycle stages and an example life cycle curve displaying sales volume and time in the market. (image via Image source: Author

brighthub.com)

For example, what if Blockbuster had the foresight to develop a platform for the tidal wave of streaming media that eliminated their business? Or what if Ford haphazardly decided to introduce a new line of diesel-fueled cars to the marketplace in 2020?

All major decision-makers in an organization need to be aware of the product life cycle. Marketing, sales, product, support, and operations must all work together to optimally analyze current product stages and define strategies to maximize growth in each stage.

What are the product life cycle stages?

The same five stages make up every product life cycle, but the varying durations of each stage give every product its unique product life cycle curve.

It’s important that businesses recognize which stages of the cycle their products presently occupy to employ the proper strategies for prolonging and gracefully moving into the next.

Many similar write-ups on product life cycle theory assert only four stages, omitting the critical product development stage as a precursor to the product life cycle. That’s a mistake.

It’s certainly warranted to say there’s a separate product development life cycle or innovation pipeline that takes place before a product is released to the market. We simply believe the culmination of that development life cycle is the first step in the greater product life cycle.

Stage 1: Product development

The product development stage is a combination of researching, ideating, testing, analyzing, and optimizing a product into existence.

A current example of a product in development is the self-driving car. Tesla has dipped into the waters with its Autopilot capabilities, but it has tons of room for further development. All other automakers are still deeply in the product development stage.

Unlike the other four product life cycle stages, development is an ongoing process. Businesses must constantly develop and test new products to ensure future growth and sustained success.

A key focus for businesses in this stage is failing fast and knowing when to cut losses and move on. Development is inevitably marred by failed products that eat resources, provide no return, and never see the light of day. Difficult, disciplined decisions will need to be made to do what’s best for the business rather than individual products.

When considering products during this stage, scalability is a critical attribute for determining immediate and long-term viability.

Businesses must determine the cost and the time needed to produce the product at various volumes, mapping to sales projections. If there’s no way to lower costs or production time, the product may still be viable to bring to market; it would just have naturally low cap on growth because of its subpar production life cycle.

Stage 2: Introduction to market

Products that make it out of development are next introduced to the marketplace. This stage kicks off the product life cycle marketing strategy.

A current example of the market introduction stage is this next round of subscription streaming services. NBC’s Peacock and AT&T’s HBO Max will both enter the introduction stage when they hit the market in the first half of 2020. Disney Plus and Apple TV Plus have landed and moved on to their growth stages as they compete for market share with Netflix, Hulu, and Amazon.

It’s critical that businesses launch coherent brand messaging and targeted marketing and advertising. This is especially true for small businesses that must do more with less when establishing sets of early adopters for their product.

This stage gives businesses an opportunity to test core systems and components like e-commerce solutions or marketing automation tools. These systems must be in place and operating soundly before moving out of the introduction stage.

Just like failing fast during the development stage, the market introduction requires discipline and agility since costs are almost always higher than revenue. It’s important to have the discipline to push forward or pull back the product based on initial reception. And agility is required to optimize the positioning of the product if one customer segment is more receptive and profitable than another.

Stage 3: Growth in market

Products that cross a sustainable customer base threshold then move into the growth stage. This is where companies boost their products from niche to national. The marketing plan kicks into overdrive here.

A great growth stage example is Tesla’s electric vehicles (EV). While many major automotive players are still developing, tweaking, and slowly introducing their products to the market, Tesla is dominating the growing EV auto market.

Expanding the customer base as well as the market at large is the core objective here. And with the growth stage typically being hugely profitable, expanding and prolonging this stage with a healthy growth strategy is a critical objective.

Marketing analytics capabilities are a critical tool for determining which messaging and campaigns are resonating. And business intelligence tools empower decision-makers to conduct tests and identify the most valuable customer segmentation strategies to implement for sustained growth.

The increase in profits is twofold during the growth stage. Not only are sales of the product increasing, but scaling production drives down costs and boosts margins. Put simply, you sell more products while simultaneously making more profit per product.

The growth stage isn’t all roses though. Sustainable growth of a product will attract competitors. Competitors not only impact market share, but they can also drive down prices and shrink profit margins. It’s critical that companies differentiate their product outside of price alone. Marketing should shift resources from strictly acquisition to more relational, loyalty-building goals.

Stage 4: Maturity in market saturation

Growth begins to halt as the product reaches maturity. This is a critical stage for management and operations as they’ve now picked all the low-hanging fruit.

A great example of market saturation is Netflix. While new streaming services are in the introduction and growth stages, the market originator has reached its saturation point.

Maturity and saturation is the peak of competition for a product, often resulting in battles on prices. Businesses may be forced to lower prices and lose margin in order to grow or even maintain their customer base. Though beneficial throughout, sales analytics tools and pricing strategy models propel businesses to sustained success during this saturation stage.

Products at maturity have reached peak production and thus provide the lowest costs of the cycle to the business. Additionally, products and businesses built to last stand to gain market share through competitive consolidation as struggling players in the space are eliminated.

There’s one critical differentiator between this maturity stage and the prior stages. Products moving out of the first three stages of the life cycle and onto the next face challenging but plentiful opportunity. That’s no longer the case in maturity; up next is the decline. That’s why businesses must, and so often do, dig in on maturity, optimizing and innovating across the board to protect their market share and sustain margins.

Stage 5: Product decline

The decline: alas, all great, and hopefully profitable, things must come to an end. All products face an eventual decline. This is one reason why you read that the development stage must be an ongoing process.

A current example of a product in decline is the landline phone. The advent of personal phones and then smartphones has signaled the inevitable death of home phones with separate phone numbers. Landline phone sets still have a place in the business world, but they’re declining there as well.

As products decline, it’s common to see mergers and acquisitions as businesses cash out on whatever value they see left in the product.

It’s critical that businesses understand what’s driving their product’s decline in order to optimally move forward. Maybe it was a good run and that’s that. Or maybe, just maybe, there is smooth water, even a blue ocean, just over the horizon that can turn back time to maturity.

As in every other stage, informed and disciplined decision making is critical to squeeze the most value out of the waning days of the product’s demand. All of the same software and tools listed above will play a critical role in navigating the quest for achieving maximum value.

Product life cycle example

Let’s run through the full life cycle of an actual product to highlight the progression through the various stages. Few product life cycle examples provide as robust analysis as Apple’s iPod.

Collage of different iPod variations throughout its 15 years in the marketplace. Image source: Author

Take a look at the path the iPod took through the product life cycle: the rise to ubiquity and the demise through internal cannibalization.

Development

The iPod, like many great products, is an iterative design built on existing products. The first actual MP3 player brought to market was by South Korean company SaeHan. And the origins of all MP3 players go back to a patent filed in 1981.

The origins of the iPod within Apple actually begin with their FireWire, a shelved technology that allows data to be transferred at unprecedented speeds compared to existing industry standards. Combine that data transfer capability with compact, sleek design aesthetics, a revolutionary interface — the wheel — and an impeccably effective marketing plan, and the development of the original iPod is complete.

Introduction

Apple had the great benefit of being late to the game with the iPod. They didn’t have to define the already existing MP3 market space, and they were able to leverage the shortcomings of the existing products to introduce and differentiate the iPod.

Apple initially introduced the iPod to their hardcore Apple customer base. In addition, the iPod was strategically targeted to tech savvy music lovers. This top-down approach ensured the iPod would stick upon introduction with a small but influential consumer base and then hopefully trickle down overtime to a more novice general public.

Growth

Running concurrent to the growth of the iPod was the complete overhaul of personal music consumption. This digital music disruption was inevitable, but the iPod’s leading design and compelling branding positioned itself to both fuel the MP3 engine and sit behind the wheel.

Given the astronomical rise of the MP3 player space, Apple made it a point to expand their product line to encourage repeat buyers and prolong the growth stage. They introduced product variants like the Shuffle, Nano, and Touch to stave off competitors like Microsoft’s Zune and Samsung’s YP-P2, whose product names have all but fallen off the pages of history.

Maturity

The iPod glided into the maturity stage of the product life cycle on golden wings. Its massive but effective ad budget, multiple product lines, and cohesive brand ecosystem propelled the iPod to a 72% market share in 2007.

This total market dominance matched with consumer saturation signaled the maturity of the iPod. Its success likely expedited the path from growth into maturity, as that market share forced many competitors to remove their MP3 players from the market.

Apple maintained their favorable saturation and maturity for as long as it made sense. They would have dominated the space for years to come, but their own technology innovations brought about the iPod’s decline.

Decline

The iPod’s decline is the rare, fortuitous decline brought about by a business graduating to an even more innovative and dominant product. Unsurprisingly, the iPod’s sales peaked in 2008, the same year the iPhone debuted. The advent of the iPhone led to such a demise for the iPod that Apple uncharacteristically dropped prices to move its final inventory.

Apple innovated consumers away from the once-ubiquitous iPod and to the now-ubiquitous iPhone. This cannibalization is the best way to sunset a product. From its introduction in 2001 to its peak in 2008 and huge decline by 2013 and on, the iPod is a testament to the rapid product life cycle businesses must manage in these times.

How can you extend the product life cycle?

The product life cycle of the iPod is a unique one given Apple’s incentive not to extend the life cycle once the iPhone came about. Most businesses never have the luxury of sunsetting one revolutionary product to shift focus to an even more revolutionary product.

There are plenty of lessons about extending product life cycles we can learn from the early iPod days as well as from other iconic businesses and products. Here are a couple of strategies for extending your product life cycle:

1. Progressive iterations

The iPod kept getting better every year, so much so that consumers with iPods would purchase another so they could enjoy the latest upgrades. A product can always be improved. And depending on the scale of the improvement, some products warrant being reintroduced with wholly new form i.e., iPod Mini, Nano, Touch. This is intuitive for the technology space, but it doesn’t have to stop there.

This progressive iteration is a great strategy for businesses to extend a product’s growth and maturity stages and maximize returns. But it’s critical that the tweaking and new product variants aren’t conducted in a vacuum. New iterations must take into consideration consumer sentiments and address shortcomings with the existing product as well as the market at large to truly extend growth and carve out more space in a saturated market.

2. Value-Added services

Offering additional services to help consumers learn about, maintain, or repair their product is a proven extension strategy. This strategy empowers businesses to engage directly with consumers and provides consumers a path to address issues and can even reduce friction for repeat or add-on purchases.

Businesses that truly understand their products, their consumers, and what drives and prevents purchases can add value for nearly no cost. Take Nestle’s Nespresso coffee and espresso pods for example.

Nespresso provides a quality, convenient means of coffee consumption. But they know many consumers are concerned about the extensive waste that comes with the non-reusable product. So Nespresso made sure to build a recycling platform into their brand.

At its most convenient, all Nespresso’s customers have to do is fill a durable, pre-addressed bag with their used pods and then put it in the mail. That’s it. Crisis averted, recycling achieved, and the environmentally-conscious consumer base can feel good trying out and sticking with Nespresso as their personal coffee supply. Growth extended and maturity sustained in the marketplace of a product that’s been around since the 15th century, coffee.

3. Reached the end?

The end of the road exists for all products. Every combination of product life cycle extension tactics won’t save a product from eventually moving beyond decline.

Unfortunately, all good things, no matter how profitable, must come to an end. Image source: Author

This is why successful businesses are constantly looking to develop new and profitable products for their portfolio. But alas, once you’ve tweaked and iterated and pivoted and re-re-re-released, here’s what to do when the life cycle can’t be extended any more:

- Start by reconsidering one more time. Analyze recent sales performance and then zoom out to see just how drastically declined the long-term sales curve is. If at least some sales are still coming in, consider what the cost to the business is to keep the product in the market. Could production or product support be scaled back or simplified? Or would resources provide greater value to more profitable products? Numbers don’t lie, so answer these questions with analytics and make the best decision based on the numbers.

- Once it’s truly time for the end, get the word out to all your stakeholders. This varies based on product and business. Customers must be alerted, whether they are retailers or actual consumers. Sales and marketing teams should be altered and prepped to handle any incoming communications about the product sunsetting.

- Finally, it’s time to move on and redistribute those resources to the next great product.

Seeing the forest for the trees

The product life cycle is an interchangeable big picture. Businesses must familiarize themselves with the stages of the product life cycle and be able to step back from the day-to-day and see their products through this lens.

Keep in mind that the progression from stage to stage is natural. There’s no failure in that. What’s critical is that businesses maximize the value they take from all stages of the life cycle and across all their products. By purposefully stepping back from time to time and seeing the forest for the trees, you can ensure maximized values are being achieved.

This high-level insight empowers decision-makers to optimally conduct business and make the critical choices required across all products to sustain business success with an eye on the future.