LaylaBird/E+ via Getty Images

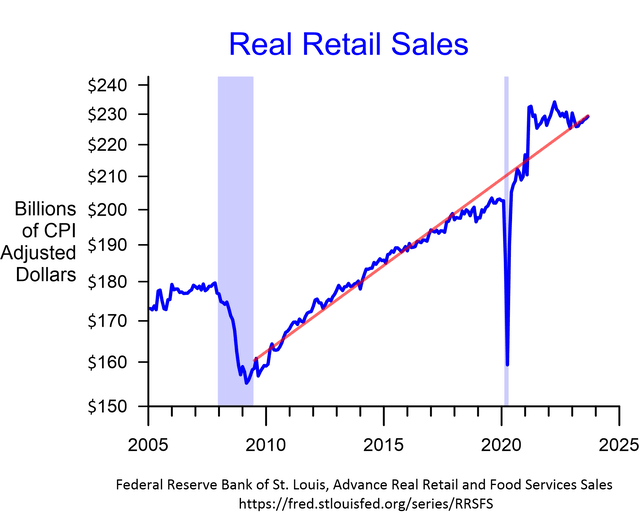

Real retail sales resume growth

The just-released real retail sales for September showed growth for the sixth consecutive month, with the year-on-year rate turning positive.Sales have returned to the growth trend of the previous economy. Magnification (red line on chart). This completes the two-and-a-half year period of historic surge from May 2020 to April 2021.

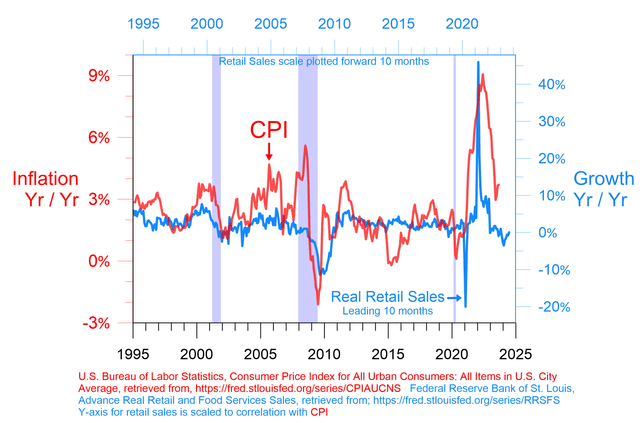

economic lead

This record surge pushed inflation to its highest level in 40 years. After two-and-a-half years of flat to declining real sales and negative year-over-year growth in 10 out of 11 months, inflation has begun a downward trend that is likely to fall below 2%.

economic lead

Profit maximizing companies typically believe that they can make a profit by raising prices when demand is strong.they will resist Raise prices when necessary to protect market share or when lower sales hurt profits more than lower prices. This dynamic appears to play out with changes in sales growth leading changes in inflation by about 10 months. Recent sales weakness suggests that inflation could fall below 2% in the next 10 months. However, based on weak CPI numbers with a decline in year-over-year CPI rates over the next three months, the headline CPI rate could trend upwards before plummeting in 2024.

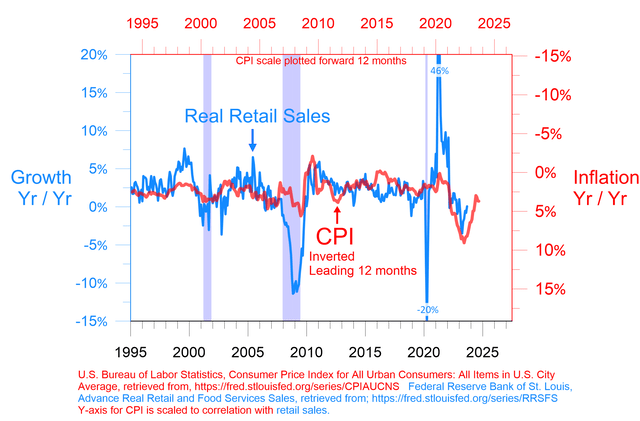

tailwind of inflation

The influence between inflation and sales is not unidirectional. Above, it is shown that a positive correlation with retail sales leads the way. There is also an inverse correlation when inflation increases. The reverse relationship has a lead time of 12 months.

economic lead

This chart shows that a spike in inflation in 2021 led to a collapse in retail sales in 2022. The rebound in inflation in 2022 is matched by an improvement in sales in 2023. Note that the inflation red line in the graph above is plotted using an inverted axis. When the red line goes up, it means inflation goes down and vice versa.

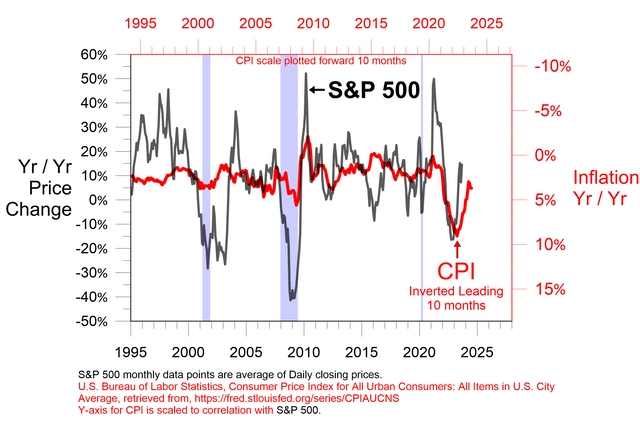

Inflation is also a tailwind for stock prices.

economic lead

The spike in inflation in 2021 corresponds to a bear market in 2022. The decline in inflation in 2022 corresponds to an upward trend in the stock market from October 2022 onwards. This correlation in the graph suggests that September's inflation rate of 3.7% is consistent with a +5% change. It will be included in the S&P500 for the 12 months ending July 2024.

Tailwind is not the cause

Inflation is one of many influences on markets. There were many factors behind the stock market's wild swings since October 2022, other than simply the decline in the inflation rate. Inflation affects the stock market and retail sales, but we cannot control them. When a recession arrives (expected to be in late 2024), inflation may be below 2% with strong tailwinds, but it doesn't matter that stock prices and retail sales will plummet in a recession.

Business cycles and stocks

Right now, we're probably in the second friendliest period in the economic cycle for stocks. We are probably in the final stages of an economic expansion in which economic growth is slow but sustained. This is the part of the cycle where stocks tend to be the most overvalued. In some cases, bull markets can last until just before a recession begins. Often a little faster. In 2007, the bull market peaked in October and the recession began in December. In some cases, he's a year early, as he was during the 2001 recession.

Of course, the beginning of a recession is the worst part of the stock cycle. When stock prices collapse at the beginning of a recession, the next period of best stock performance begins. This is what happened after the coronavirus pandemic. The best-performing part of the cycle typically ends when economic growth reaches high levels early in the expansion period. In the current economic cycle, this stock market rally ended in December 2021. 2021 was shaping up to be his year of strongest economic growth since 1984 or, by some metrics, since 1950. Stock prices often enter boom periods because economic growth is typically at its strongest rate in the business cycle. The current cycle has been a bearish one, with stock prices down about 25%. If I'm reading the cycle correctly, we're now in the stock-friendly final stage of the expansion.

If the expansion ends in late 2024, as I predict, it will be the shortest economic expansion since the 13-month expansion during consecutive recessions in the early 1980s.

In my last article, I reviewed the stock cycles that I follow. These cycles still point to an uptrend, but the shortest cycle had a 12.5 business day price increase ahead of the cycle, suggesting the possibility of a multi-day decline rather than a straight uptrend from here. ing.

If there is a dip for several days, consider it a buying opportunity.