Everyone attending Climate Week NYC knows that the world is far from where we need to be in dealing with threats to our planet. However, achieving a common understanding of the situation comes with risks. Failure to take sufficient action is becoming the norm.

It's tempting to tell the sobering story that while policy is moving forward, it's still not moving fast enough. But that's a dangerous myth. There is no need to accelerate along the path you are already on. A change in trajectory is necessary.

The need for this is clear when we look at the natural state of the earth as a whole. A recent study by the World Wide Fund for Nature (WWF) shows that wild animal populations, an indicator of ecosystem health, have declined by nearly 70% over the past 50 years.1 One million species are at risk of extinction due to human activities.2

We know that the nature and climate crises are fundamentally interconnected and must be solved together. Without nature, there would be no net zero.

The question is: what can cause changes in the future that we have never seen before?

There are at least three parts to that answer.

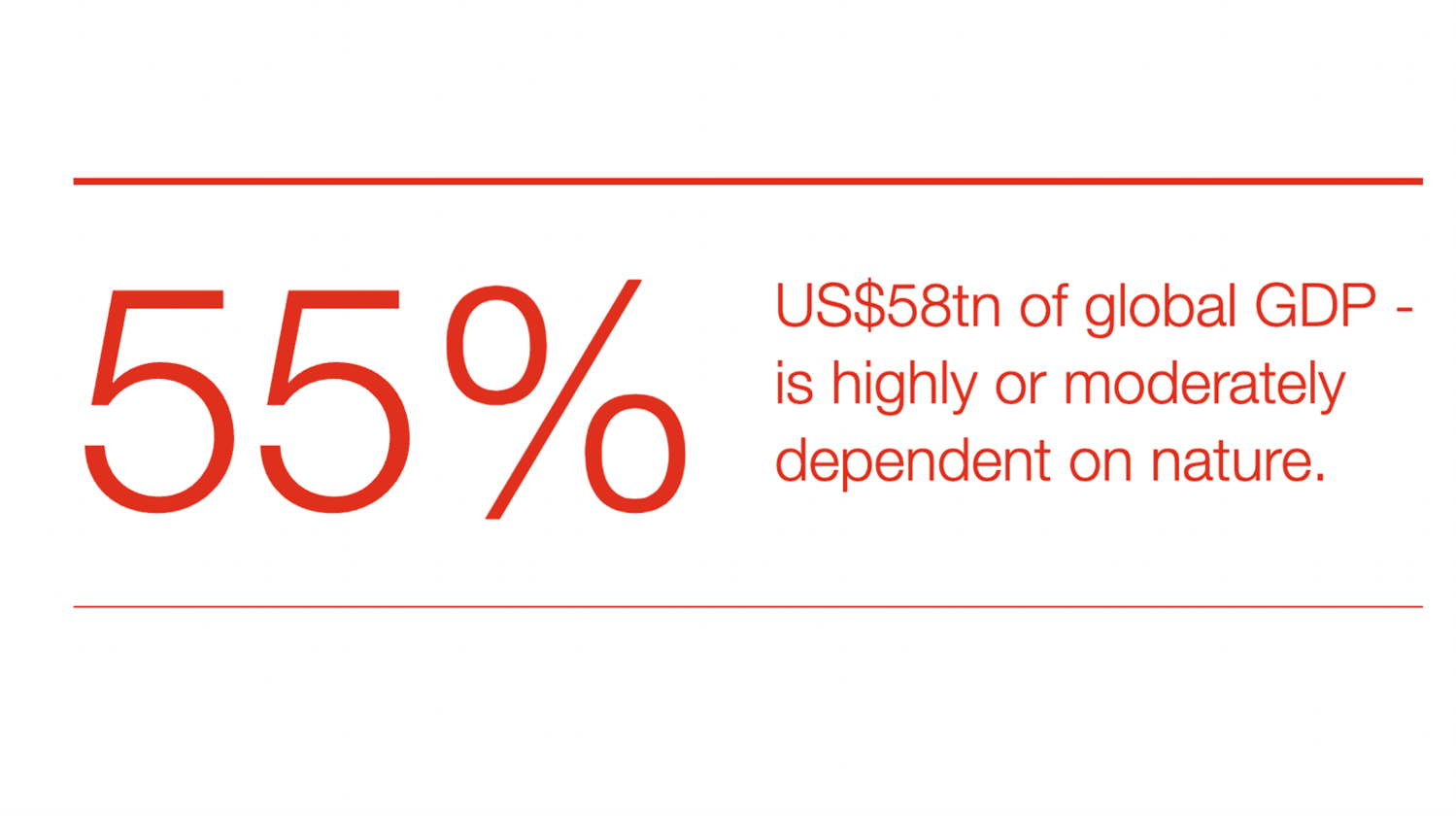

First, we need to maintain the call to do the right thing and match it with a stronger appeal to self-interest. Boardrooms need to recognize that they are vulnerable. Businesses are increasingly aware of the threat climate change poses to their operations, but natural risks remain an early topic for many. our research This indicates that USD 58 trillion (55%) of the world's GDP is highly or moderately dependent on nature. Despite mutually supporting challenges, climate change and nature loss continue to be addressed separately. There is no way to effectively manage business risk without first understanding the relationship between nature and climate. Companies that understand their relationship with nature can begin to develop dual responses and risk mitigation processes, such as incorporating nature-based solutions into their climate change plans. New frameworks, such as the Nature-Related Financial Disclosures Task Force, can help companies navigate the intersection of this complex topic with climate.

Second, systemic policies are needed to ensure that incentives in a market economy are aligned with positive outcomes for society and the planet. We need to build a framework that combines the creativity, ingenuity, and speed of markets with the authority, scale, and legitimacy of government. It's about rewiring the fundamental systems of incentives, norms, and values that drive the economy. Turning to climate, the International Energy Agency (IEA) has long described fossil fuel subsidies as an “obstacle” on the path to clean energy systems. On the other side are incentives that help accelerate positive change. Examples include the US Anti-Inflation Act, whose package of tax credits and incentives is believed to have encouraged significant investment in clean energy projects, and the EU's recent proposal for the Net Zero Industry Act. Masu.

While much attention is focused on government policies, just as important and susceptible are the policies that businesses manage themselves. Earlier this year, PwC UK worked together London Business School investigates the link between executive pay and carbon reduction targets at 50 of Europe's top listed companies. This is a mixed photo. Good news. Nearly 4 out of 5 people are related to him in some way. Even more surprising news is that the payout rate in 2022 averaged 86%, with more than half of his payouts being 100%. Given the limited progress toward setting emissions on a trajectory consistent with the Paris Agreement, one wonders whether these targets are as far along as they should be.

Third, we need to be honest about the importance of simply setting limits beyond which the market must not exceed. Markets only work within boundaries. There are already limitations in areas such as competition policy, labor markets and food standards. Now we need boundaries that reflect the limits of our planet. Setting science-based targets for nature, using emerging frameworks such as the Science-based Targets Network (SBTN), will help businesses understand their limits and the potential impact of exceeding them. will help you. When I talk to business leaders, many say they would welcome well-designed regulations that give them the freedom to act in the best interests of the planet without paying penalties. This became clear ahead of last year's United Nations biodiversity summit, COP15, when more than 300 companies from 52 countries called on their leaders to make nature assessments and information disclosure mandatory.

Managing this change requires close collaboration.

Neither climate change nor nature loss can be managed solely at the level of individual companies or organizations. When a factory floods, so do the roads surrounding the factory, the homes of its employees, and the schools of their children. Building a private wall doesn't work. We need collective action and robust information systems to help stakeholders make good decisions.

And, of course, we need funding.

A recent United Nations Environment Program report estimates that the world spends US$154 billion annually on “nature-based solutions,” half of the projected funding needed by the middle of this decade. , and less than one-third of the funds needed in 2030.

In economically challenging times, relying on the public sector to fill this gap is unrealistic – public funding already accounts for 83%3 Of natural expenditure. That is why the market mechanism I have described is so important in introducing private finance, and at the same time Scale your project Therefore, they are attractive to providers of capital.

footnote:

1. Living Planet Report 2022

2. Overview of the Global Assessment Report on Biodiversity and Ecosystem Services for Policy Makers

3. Finances for natureUnited Nations Environment Programme, 2022.